The ETF Advantage Diversify Your Portfolio with these MarketBeating ETFs

Post on: 16 Март, 2015 No Comment

The ETF Advantage

On March 21, 1924 three Boston businessmen pooled together $50,000 to form a company called the Massachusetts Investor’s Trust. The purpose of the company — to invest in the roaring 1920s stock market boom.

These three men unwittingly gave birth to a financial revolution. In fact, in the ensuing 80 years their invention, the mutual fund, has come to dominate the retail investing landscape.

By 2006, U.S. mutual fund assets had grown from that $50,000 seed invested in a single fund into $9.2 trillion invested across 8,606 funds. Over 50 million American households now own mutual funds, making them by far the most popular and common means of participating in the stock market.

So with all that success, why then are mutual fund executives so nervous? After years of unfettered and unchallenged dominance of the retail investing landscape, there’s a new kid on the block, a new asset class that threatens to challenge the mutual fund’s pre-eminence.

And the mutual fund industry is vulnerable to that competition. One reason funds have become so popular is that they’ve been the only game in town for millions of Americans. Many retirement funds mandate investments into hand-selected funds. In addition, mutual funds have been, until recently, the easiest way to diversify a portfolio among a broad selection of different stocks.

Mutual funds have taken full advantage of this near monopoly. Fees charged for managing that $9 trillion pie have been creeping up. This has been true even since the advent of no-load funds in the 1970s. From 1990 to 2002, for example, the Investment Company Institute reports that the average mutual fund expense ratio jumped from 1.47% to 1.64%.

And most investors are keenly aware of several other drawbacks of traditional mutual funds. For one, they’re only priced once per day so you can’t buy and sell them as freely as you would a regular stock. In addition, most mutual funds also have minimum investment requirements, making them impractical for some investors.

A New Kind of Fund

So, what exactly is this revolutionary new investment that’s challenging the mutual fund industry’s dominance? It’s called an exchange-traded fund (ETF). For those of you unfamiliar with ETFs, these unique financial instruments are essentially passive mutual funds — similar to traditional index funds — that allow investors to purchase a basket of securities in a single transaction. They’re traded on the NYSE, AMEX, and Nasdaq just like common stocks.

According to AMG Data Services, in the 2005 calendar year over $50 billion flowed into U.S. ETFs. That’s over a third of the $147 billion or so that flowed into U.S. equity mutual funds during the year. Particularly amazing is how quickly this industry has grown. After all, the first ETFs hit the investment scene only a little over a decade ago.

ETFs address some of the problems inherent with mutual funds, but that’s not the only reason we’re so excited about this investment class. Instead, we’ve become more and more interested in ETFs in recent years because they are starting to open up an exciting new avenue of growth for U.S. investors, an avenue that until recently has been all but closed — investing abroad.

TABLE OF CONTENTS:

Available Exclusively to Paying Customers:

Throughout the remainder of this report, we provide an in-depth look at our four favorite individual ETFs. This includes ETFs that offer ways to invest in foreign countries and even one ETF perfect for income investors.

(1.) The Many Advantages of ETFs

ETFs boast several major advantages over mutual funds and common stocks. Here’s a brief review:

Diversification — Each ETF represents an interest in an underlying basket of common stocks. This allows investors to gain broad exposure to a large group of companies in one fell swoop. This diversification also makes ETFs much less volatile than common stocks.

Low Cost — Unlike traditional mutual and index funds, you can purchase ETFs with no front- or back-end loads. In addition, because they are not actively managed, most ETFs charge minimal annual expenses of under 1%, making them much more affordable than most other diversified investment vehicles.

Liquidity — Unlike traditional funds, ETFs can be bought and sold throughout the trading day, and many trade hundreds of thousands (and in some cases millions) of shares per day.

Dividends — Many ETFs pass through the accumulated dividends paid by the stocks held in their basket. StreetTRACKS Wilshire REIT Fund (RWR), for example, pays a healthy 3% dividend.

Choices — The American Stock Exchange alone lists well over 100 different ETFs. Some of these funds track broad U.S. equity market indices. Meanwhile, others track specific sectors or industry groups. Still others represent an interest in baskets of foreign stocks. And finally, others invest exclusively in the bond market. With so many options to choose from, you’re certain to benefit from ETFs no matter what your investing/trading style.

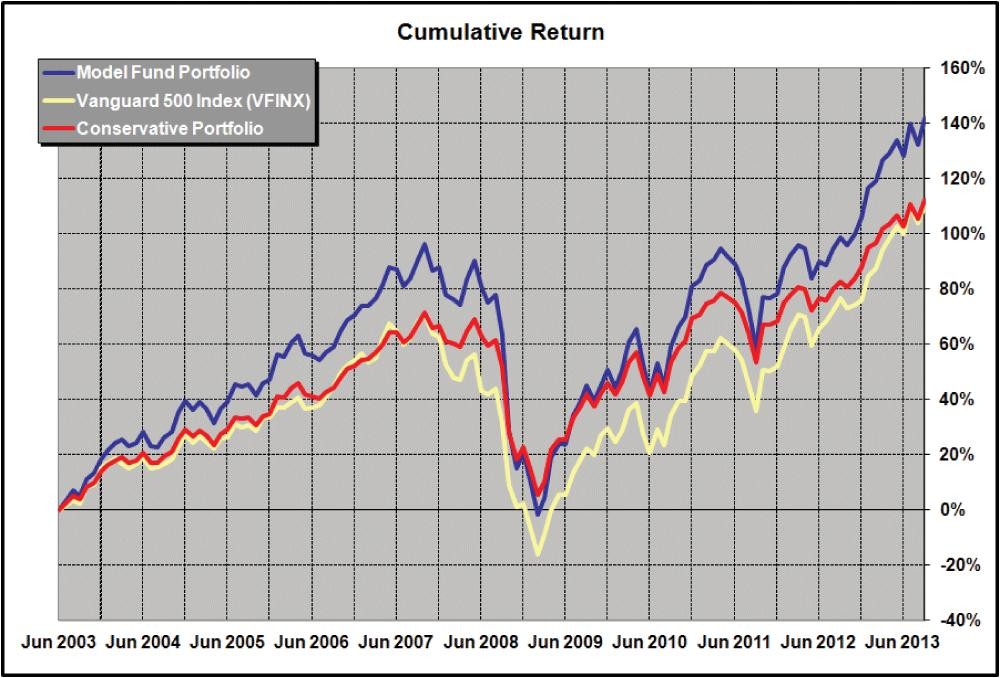

Returns — Many ETFs have handily outperformed the broader market over the past few years. As such, they deserve strong consideration for a place in your portfolio.

International Exposure — Thanks to the introduction of dozens of foreign ETFs in recent years, investors can now quickly and easily diversify their assets abroad to take advantage of tremendous growth in nations like China.

With all of these benefits in mind, nearly every investor could benefit by holding a position in one or more of today’s leading ETFs. The main question is, which ETFs are worth your consideration? In today’s report you’ll find an extensive list of many of today’s most popular U.S.-traded ETFs. And in the analysis that follows, we will then bring you an in-depth look at a few of our favorite funds.

(2.) Extensive List of Available ETFs