The Economics of the Scrap Copper Market

Post on: 16 Март, 2015 No Comment

The Economics of the Scrap Copper Market

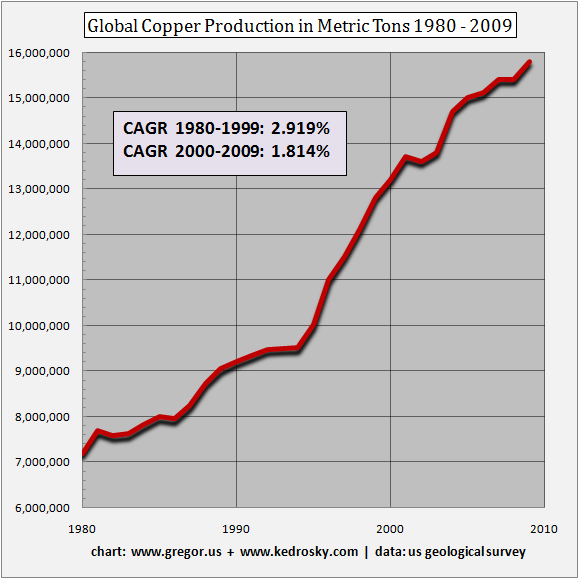

Scrap copper is an important source of the red metal. The use of scrap copper expected to rise in the coming years as a necessary means to compensate for declining supplies of mined copper. This sentiment was echoed by J.P. Morgan Chase & Co.s (NYSE:JPM ) head of metals research Michael Jansen at the recent Metal Bulletin Global Copper Markets Forum in New York. The urban mine is the future of the copper industry, Jansen said, referring to the copper industrys increasing reliance on recycled metal as a copper supply. Every year we will be disappointed by primary mine supply, and production disruptions will remain a source of concern for copper consumers.”

The scrap copper business has witnessed its fair share of boom and bust cycles. The price of scrap copper is directly correlated to the demand and supply of primary (mined) copper. Traditionally, scrap copper sells at a discount to refined copper on the LME, with current scrap copper prices about half that of refined copper, however, the gap between refined and scrap prices has been closing, and this trend is expected to continue as the use of scrap as a source for copper increases. Just like mined copper, the price of scrap copper is influenced by macroeconomics. The overall tight supply fundamentals of the copper market are spilling over into the scrap market, and therefore industry experts such as Jansen are projecting that the scrap copper market is on track for another boom.

A global business

The scrap copper market is a global business. Currently, the United States is the worlds largest exporter of scrap copper in the world, and accounted for 20 percent of the world‘s total copper-based scrap exports in 2010. China is the world’s largest importer of scrap copper. In 2008, the country imported an astonishing 68 percent of world’s scrap copper. The demand for scrap copper has flourished over the last few decades, with copper consumed by world trade (imports) tripling between 1989 and 2009. This skyrocketing demand is being fueled by rapid industrial growth in both Asia and Europe. During this this time period of rapid growth, copper recovered from all scrap, as a percent of total world copper produced, has ranged between the low of 30 percent in 2009 to as high as 40 percent during 1995, Of all the countries in the world, China has had the most significant growth in scrap imports.

Current climate

The scrap copper market has had a volatile few years, as the recession and subsequent changes to the global economy impacted the scrap market. In the US, the current climate is for tight copper scrap supplies, as a lingering slump in industrial demolition has made copper scrap hard to come by. High-grade metals are the most impacted by the recent shortage, whereas the lesser grades are fairly plentiful. The majority of the lower-grade scrap material is being shipped to Asia. In addition, there is sentiment that the condition of tight supplies is being exacerbated by suppliers hoarding their material. Demand for scrap within America has been on a downward trajectory for years, however, demand for scrap outside of America, namely in Asia, is more than compensating for America’s falling demand.

Right now, China is increasing its imports of scrap copper. According to the most recent data, in June shipments of copper scrap into China climbed to 420,000 tonnes, their highest level this year. “Chinese companies will continue madly buying scrap copper in overseas markets for the next five years, with industrialization and urbanization spurring demand,” said Tao Yonghe, a senior executive at Yunnan Copper Group.

While the increase in imports is partially due to the country’s growing demand, in the future, governmental initiatives to encourage recycling will add extra impetus to demand growth. Currently, the Chinese government restricts investment in copper smelting projects, but encourages recycling and reusing of metal scraps to develop its local recycling economy. Earlier this year, the Ministry of Industry and Information Technology announced that Beijing has set a goal to nearly double its production of recycled metals including copper, aluminum and lead to a total of 12 million tonnes by 2015, compared with 7.75 million tonnes last year. Under the plan, recycled copper is to account for about 40 percent of total copper output. Current rates are around 35 percent.

China’s demand for scrap copper should experience an upward sloping growth curve over the course of the foreseen future. The government is taking a key step by supporting the development of domestic recycling operations (it has not always been amenable to this industry, in efforts to curb pollution), but it will take time before the country will build up local production of recycled copper.

Get the latest Copper Investing News articles delivered to your email inbox. Learn more