The Coming Bull Market in Gold Stocks by Frank Barbera Financial Sense Archive

Post on: 13 Июль, 2015 No Comment

by Frank Barbera, CMT. Gold Stock Technician. April 14, 2005

For as long as investors have sought to make money in capital markets, there has been the ongoing quest to identify trading systems to beat the market. As market historian, Richard Dana Skinner once noted,

More zeal and energy, more fanatical hope and more intense anguish have been expended over the past century in efforts to forecast the stock market than in any other single line of human action.

Yet throughout history, few trading systems have stood the test of time. While technology may change the times, and much of the circumstances surrounding daily life, throughout history markets have been driven by human psychology, which through the years has changed very little. Investors today, as a class, are still as emotionally driven as they were 10, 20 or even 50 years ago.

In this vein, one approach to markets analysis is Elliott Wave Theory, which is largely predicated on the concept that markets are a reflection of mass psychology in motion. Developed in the 1930s by Ralph Nelson Elliott, Elliott Wave Analysis has been practiced successfully for decades by great market timers such as A. Hamilton Bolton of Bank Credit Analyst in the 1950s and 1960s, A. J. Frost in the 1960s and 1970s, Robert Beckman in the 1970s and in the early 1980s by Robert Prechter. To be sure, Elliott Wave Theory is arcane and is best used as an adjunct to more conventional forms of quantitative analysis such as analysis of market breadth, momentum, volume and sentiment. In his 1978 book, Super Timing. Robert Beckman stated,

Anyone who seeks absolute perfection will find Elliott Wave Theory quite unsatisfactory. But, equally, those who seek absolutes will find all stock market methods unsatisfactory, simply because absolutes do not exist in the stock market.

An Elliott Wave Point of View to Markets

With the understanding that Elliott Wave Analysis is but one element of a larger technical tool kit, there are nonetheless at times potentially huge dividends to be accrued by looking markets from an Elliott point of view. In it simplest form, Elliott Theory argues that bull markets are characterized by a five wave impulsive rhythm, while bear markets are characterized by a three wave corrective rhythm. The five wave bull market sequence involves 3 upward thrusts (Waves 1, 3 and 5 ) known as Impulse Waves , which are separated by two intervening downward thrusts (Waves 2 and 4 ) known as Corrective Waves .

In a bull market, each impulse wave will consist of a smaller five-wave advance and each corrective wave will unfold as a three-wave decline (labeled as A-B-C). In a bear market, the wave structure unfolds as a three step decline, with an initial decline labeled Wave A. followed by a counter-trend rally labeled Wave B. B-Waves are then followed by a second, more severe decline labeled as Wave C. This basic Elliott sequence is shown in the diagram Figure 1. While a comprehensive primer on Elliott is not possible within the confines of a small article like this, Robert Beckman’s Super Timing and Robert Prechter’s and A. J. Frost’s Elliott Wave Principle are both still in print and offer all the details necessary to understand the Elliott Framework in detail. Suffice it to say that a look through almost any set of historical data for markets will reveal fairly intelligible Elliott Wave Patterns.

Elliott Wave Pattern In U.S. Stock Market

Figure 1 — The Basic Elliott Wave Sequence

One example would be the U.S. Stock Market where, for instance, the entire 9-year bull market of the Roaring 1920s saw stock prices trace out a large five wave advance, which was then subsequently retraced by an even larger Bear Market coinciding with the Great Depression. This Great Bear Market plumbed the depths of negative human psychology and was then followed by a resumption of mankinds’ longer-term march toward progress with the Bull Market from 1932 to 1937. This bull market traced out another clean 5 wave advance and was followed by yet another three wave bear market pattern from the late 1930s thru World Wave 2.

DJIA — 1920 to 1933

DJIA — 1932 to 1944

In fact, looking back at the very long term history of stock prices, between 1788 and the mid 1800s in England, stock prices advanced in a nearly 50-year bull market. This bull market yielded to economic turmoil in the 1860s and 1870s associated with the depression aftermath of the U.S. Civil War. This nearly 25-year bear market was then followed by another powerful bull market in both English stock prices and U.S. Stock prices, which peaked in 1929 and was accompanied by huge technological advancement, the Industrial Revolution and a greatly increased quality of life. U.S. Stock prices joined English stock prices in the last phases of this advance as the U.S. emerged as an Industrial Power at the turn of the 19 th century with speculation centered on American stocks.

The Bull Market Advance 1920 to Present

In what Elliott Wave Analysts call a Super Cycle, the advance in English Stock prices from 1788 to the mid-1800s would be Wave One of the Super Cycle, which was then followed by the nearly 25-year Civil War Bear Market which comprised Wave 2 (not shown). From there, the Bull Market advance from the late 1860s to the 1929 high comprised Wave 3 (see above), which was then followed by the Bear Market collapse of the Great Depression constituting Wave 4 of the Super Cycle. Since the 1932 low, it can be argued that a Super Cycle Degree Bull Market made up of five large advancing waves was in force until the major top of 2000.

The argument under Elliott Analysis would now be that the stocks are due for a regression to the mean and a long period where total returns for U.S. Equities, which were so high in the 1980s, will need to regress to more historically normal levels. This suggests that U.S. Stock prices are headed for a long running bear cycle wherein prices will no longer trend higher, but will instead trace out a large trading range over the next ten to twenty years in what could be a larger, more volatile version of the pattern seen between 1966 and 1982.

At present, the Elliott view of events is far from alone. Today many forms of analysis show stock prices to be at high valuations and facing significant fundamental headwinds in the years to come. In recent years notable proponents of the U.S. stock market in the 1980s including Warren Buffett, Sir John Templeton, George Soros, Jeremy Grantham and others have all turned generally bearish on the future outlook for the U.S. Market. In the immediate years ahead, I believe the second major leg down in the developing secular bear market for stocks will be accompanied by a financial crisis and a severe global economic contraction, which was outlined in my previous piece entitled, The Day After Tomorrow: Stagflationary Collapse: Prelude to The Greater Inflation. On the economic front, the U.S. standard of living is headed for a fall, caught between a falling dollar, rising long-term interest rates, and rising unemployment associated with the widespread outsourcing of jobs.

DJIA 1914 to 2005 and U.S. Gold Stocks 1914-2005

Thriving in the Developing Global Slowdown

In this environment it will be difficult to make money and near impossible using conventional investments. To this end, it is important to understand that there are non-correlated investments, which can truly thrive during these periods of adversity which we now face in the U.S. Equity market. The recent reports from General Motors, Ford Motor, and Retail Sales are but early signs of a developing global slowdown. Historically, these difficult periods for the U.S. stock market have seen Gold shine as an asset class, as Gold tends to be the investment of choice when higher levels of uncertainty prevail. In the chart above, we see the DJIA from 1914 to Present aligned with an Index of U.S. Gold Stocks over the same period of time.

While the Gold Stocks do not move in exact inverse proportion to the U.S. equity market, down through the years the inverse correlation between the two markets has been striking. As an example, during the Bull Market in U.S. Stocks and the DJIA in the 1920s, Gold Stocks did not participate, but instead spent 8 years in a sustained downtrend. Prior to the 1920s, Gold Stocks were in a sustained 43-year bear market, which began from a peak in 1887 and lasted through the major lows of the late 1920s, early 1930s. The evidence of a bear market in Gold Stocks before 1930 is derived from records of early South African Mining companies tracked by, what later came to be known as The Financial Times Gold Index. This trading pre-dated the advent of trading in leading U.S. Mining companies such as Homestake and Dome.

The Financial Times Gold Index 1887 to 1937

An historical chart of the Financial Times Gold Index comprised of South African Mining Companies between 1887 and 1937 .

As the Great Depression took hold, Gold Stocks roared to life. They benefited from an increased purchasing power in bullion. A flight to cash during the Depression dramatically boosted their earnings and sent the stocks through the roof. From the crash low in 1929, the share price of Homestake Mining advanced from a low of $7.00 to a final bull market peak in January 1936 just above $68.00. That advance in Homestake measured 871% in just over 5 years and was accompanied by a roaring bull market in other Gold Stocks such as Dome Mines, which advanced nearly 1,000% over the same period of time.

From the mid-1930s to the early 1950s, Gold Stocks then faded back into a long bear market as the overall U.S. Stock market surged in a secular bull market spanning nearly 24 years. From its high in early 1936, the S&P Gold Index moved sideways into a major low seen in early 1954 comprising a bear market of 18 years. Thus, like the Roaring 1920’s, the Golden Era of the Fab-Fifty’s saw Gold Stocks stagnate while the U.S. market enjoyed a period of robust growth and high confidence.

By the mid 1960s, an investment mania had taken hold in U.S. equities in what became known as the Go-Go Era of Mutual Funds. Like the Roaring Twenties mania of the late 1920’s, this time period was characterized by widespread public participation in markets and the use of high levels of leverage for speculation. By the late 1960s, the bubble found its inevitable pin as the U.S. economic landscape began to deteriorate. War broke out in Viet-Nam, the U.S. government began running big budget deficits, and inflation and interest rates began a steady rise. Confidence began to break down and the U.S. Stock Market succumbed to the first of several cyclical bear markets.

Homestake Mining Company

Dome Mines

Above: the chart of Dome Mines by M. C. Horsey, which exploded from 1930 to 1936. Quarterly Dividends were accompanied by several huge special annual dividends the entire bull run as mining company earnings exploded during the Depression as the purchasing power of Gold advanced during the deflation of the 1930s. Below: the S&P Gold Mining Index, which peaked in early 1936 and corrected a Bear Market between 1936 and early 1954.

S&P Gold Mining Index 1933 to 1954

Not surprisingly as the U.S. Stock Market began to founder, the Gold Stocks began a strident advance, which accelerated throughout the hard times of the late 1960s and turbulent 1970s. As inflation soared and the Dollar weakened, the price of Gold exploded peaking at $850 in early 1980. As the price of Gold moved higher and higher, Gold Stocks advanced nearly 6,750% in 26 years with the Bull Market crescendo coming in 1980 as Oil prices soared above $40 per barrel. On an Elliott Wave basis, it is clear that Gold Stocks have all been tracing out a Super Cycle advance over the last 100 years.

Waves One and Two of the Super Cycle in Gold Stocks

In the case of Mining shares, the Super Cycle is counter-cyclical to the primary trend of the U.S. Equity market. As a result looking back, we note that the great Gold bull market of the 1930s was driven by the deflationary collapse of the Great Depression and gave way to the reflationary bear market of late 1930s — early 1940s spawned by World War II. This sequence of a dramatic bull market peaking in 1936 followed by a 24-year bear market troughing in 1954 constitutes Waves One and Two of the Super Cycle in Gold Stocks . From there, the great tumult of the 1970s Inflation where stagflation produced rising unemployment, rising interest rates soaring above 15%, rising inflation rates above 15% created the next huge bull market in Gold Stocks. Amid the building uncertainty of the 1970s, Gold Stocks traced out a perfect 5 wave advance that culminated in a climactic run in early 1980 just as interest rates and inflation were peaking.

On an Elliott Wave basis, this secular bull market in Gold Stocks in the 60’s and 70’s, traced out a clean 5-Wave advance, which formed what Elliott referred to as an extended Third Wave. By early 1980, Gold Stocks and Energy Stocks dominated the most active pages of the NYSE led by a plethora of South African and North American mining shares, and Oil and Oil Service shares. On one financial television station in Southern California, Channel 22 — KWHY where I worked for many years, quote pages on gold stocks appeared every 30 minutes showing the most active South African mining companies. Why? Because at the time, that’s where a great deal of trading action took place. Inflation was spiraling upward and with it, panic buying of mining shares. Almost every day, Domes Mines (now Placer Dome) held a place on the Top 10 Most Actives for the Big Board (between 1979 and 1980). Other major movers at the time were Callahan Mining (silver), Campbell Red Lake Mines, Giant Yellowknife Mines, Homestake Mines, Campbell Resources, Hecla Mining, Coeur D’Alene, Hemlo Mines, Battle-Mountain, Echo Bay, Pegasus Gold, Equinox Resources, Noranda, Sunshine Mining, Kloof, Vaal Reefs, Durban Deep, Western Deep Levels and ASA Ltd.

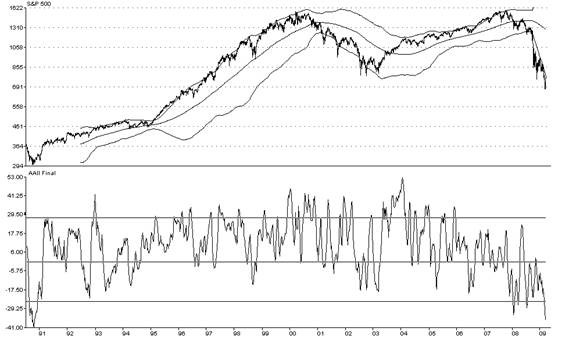

Gold Stock Index & 10-yr Bond Yields 1960 to Present

With the arrival of Fed Chairman Paul Volcker in 1978, new financial medicine was administered as the Federal Reserve fought Inflation by tightening monetary policy and restraining money supply growth. The result was the Era of Disinflation. which has seen long term interest rates decline steadily since there 1980s. Along with the Bull Market in Bonds, stocks once again revived and gave rise to one of their longest and greatest bull markets ever seen. As can be seen below, as interest rates declined and stock prices soared from the major lows in 1982, Gold Stocks began a long 20-year period of sideways behavior, producing nothing but negative returns.

Gold Stock Index & S&P 500 1960 to Present

Thus, we see the continuation of the long term negative correlation between Gold Stocks and U.S. Equities as a the Great Bull Market of the 1980s for stocks translated into a 20-year bear market for both Gold and Gold Stocks. On an Elliott Wave basis, the 20-Year bear market for Gold stocks from 1980 to 2000 comprises Wave 4 of the Gold Stock Super Cycle. Since 2000 and the bust of the Technology Mania surrounding Internet Stocks and NASDAQ, Gold Stocks have once again embarked on a brand new bull market, outpacing most sectors since 2001.

Wave 5 of the Gold Stock Super Cycle Developing

In my view, we are now embarking the beginning of another multi-year secular bull market in Gold Stocks, which will develop as Wave 5 of the Gold Stock Super Cycle . This will correlate to the multi-year bear market in U.S. Stocks in which total returns for U.S. Equities are likely to be negative over the next 5, 10 and 15 years.

So What’s Next From Here?

Over the next two to three years, I believe Gold Stocks will explode once again, as rising long-term interest rates will result from a further collapse of the U.S. Dollar and the abandonment of the Dollar centric Reserve Currency regime. As long-term interest rates rise sharply, the U.S. economy will undergo signs of both inflation and recession at the same time and a Perfect Storm will unfold. On the one hand, a lower dollar, especially against Asian Currencies, will result in higher import price inflation raising prices on a host of retail goods from electronics (i.e. stereos, DVDs, cameras, printers, PCs, photocopiers) to clothing.

In addition, dis-hoarding of U.S. Treasury Bonds and re-allocation of Asian Central Bank reserves is very likely to force up long-term U.S. interest rates. Given that the U.S. Economy has just gone through the greatest credit bubble ever seen, with zero-down payment available on everything from Auto’s to Houses to Big Screen TVs, a steady rise in long term interest rates will crush large elements of the U.S. economy. Auto companies, which are highly leveraged to cheap credit, will be among the first victims of the rising rate environment as once again, the recent earnings warnings at both GM and Ford now affirm. Rising long term interest rates combined with rising prices of imported goods, will act as a one-two punch on consumer spending, which is long overdue for a slow down and could soon lead to severe recession like conditions.

As for Gold, gold prices will not only continue to advance against the U.S. Dollar, but will likely begin advancing against all other forms of paper money as well. Why? Simply put, for many central banks around the world, Dollar reserves ARE the key asset standing behind the backing of their particular currency. A lower dollar will imply reserve right downs for all central banks, which will then seek to remonetize their balance sheets by spending those dollars and exchanging them for a currency, which cannot lose intrinsic value. That currency is gold.

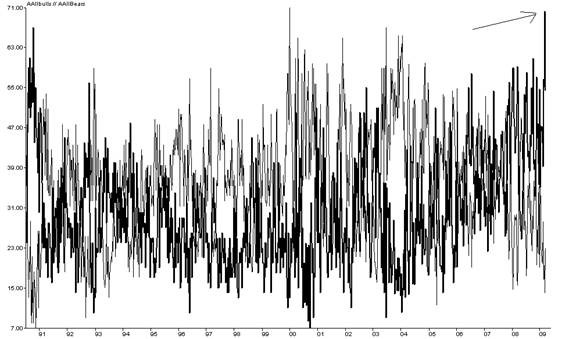

Unweighted Gold Index 1971 to Present

As a result, to date, I believe we have only seen part of Wave One of the long term Super Cycle Wave Five for Gold Stocks. More specifically, over the next 10 to 15 years, we are likely to see a Super Cycle Degree Wave 5 advance in Gold Stocks, which itself will be subdivided into 5 waves of Cycle Degree. Within that pattern, we have currently completed Waves One. Very soon over the next few weeks we will complete the bottom of Wave Two of Primary Degree.

In the chart above, I plot my Unweighted Gold Index over the last 35 years. Between November 2000 and May 2002, this index traced out a clean five-wave advance signaling the start of a new secular bull market. The May 2002 peak stands as the high of Primary Wave One of Cycle Wave One of Super Cycle Wave 5. For the balance of the last 18 months, the index has been in corrective mode tracing out a large A-B-C Primary Wave Two correction. Wave Two is now in its final stage of completion. Once complete, Primary Wave Two will be followed by a tremendous and likely manic advance, which will drive Gold Stocks vertical as Primary Wave 3 unfolds. I expect that the beginning of this renewed bull market advance is now but weeks away and will produce excellent returns in Gold Stocks during the second half of 2005.

Over the last two years, I have been trading Gold Stocks quite actively. Looking back, I was correctly bearish in late 2003, bullish in June-July 2004 and out of the market entirely since the November 2004 peak in the mining stocks. In late November 2004, I wrote that the Gold Stocks were giving strong technical warnings that a serious medium term peak was at hand topping out Wave B of Primary Wave 2. As Gold bullion advanced strongly in late November 2004, I noted that gold shares were not performing in the face of higher gold prices. I wrote, What point is there in owning Gold Stocks right now, if they don’t go up when Gold goes up? Answer: Very Little. Since November 23 rd. I have been standing aside on Gold shares having noted the completion of a five wave advancing pattern on the hourly chart of the XAU back on November 223 2004. At the time, a huge bearish divergence between Gold prices and Gold Stocks had developed with Gold prices making new highs, while Gold Stocks were unable to advance.