The Best ETFs For Your 401k Yahoo India Finance

Post on: 3 Май, 2015 No Comment

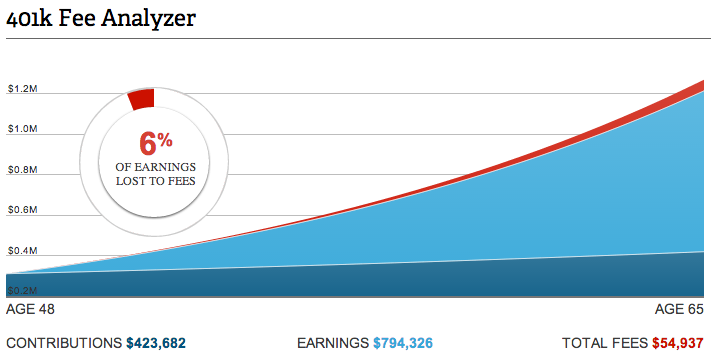

Although many employers offer 401(k) plans to their employees as part of their compensation, a large percentage of these plans offer investment alternatives with high fees and mediocre performance. Traditional managed mutual funds usually come with high fees. including annual management fees, sales charges and other expenses, making sense as to why some mutual funds have expense fees as high as 2% (if not higher).

Variable annuity subaccounts come with even more fees, such as mortality and expense risk charges, surrender charges and other insurance-related expenses. However, many plan participants have no real idea of what they are paying the way of fees in their plans or what they are even really getting in return.

Buying company stock can be a good idea in some cases but it can also cause plan participants to become under diversified. Exchange traded funds (ETFs) can therefore be a good alternative to these options because of their low cost, superior performance and liquidity (the annual expenses of a typical iShares ETF are in the 0.4% neighborhood).

The pool of ETFs from which to choose are growing rapidly, and the experts at TheStreet.com have provided analysis of many of the newer funds and have ranked them as well. Some of the highest-ranking funds include:

Equity Income Funds

- Proshares Ultra Consumer Goods (ARCA:UGE ) – This equity income fund seeks to benchmark and generate an ongoing return equal to twice that of the Dow Jones U.S. Consumer Goods Index. Although the fund has only been around since 2007, it has outperformed its peers thus far.

- PowerShares KBW Bank (ARCA:KBWB ) – Another equity income fund that seeks to match the performance of an index, this time the KBW Bank Index. This fund is also relatively new and has outperformed its peers over the past year. PowerShares also offers KBW Insurance and Capital Markets ETFs that have done well.

Domestic Growth

- Guggenheim S&P Midcap 400 Equal Weight Index Fund (ARCA:EWMD ) – This domesticgrowth fund attempts to match the performance of the S&P Midcap 400 Equal Weight Index. It has also outperformed its peers during its brief tenure. Guggenheim’s S&P Small Cap 600 Equal Weight fund is also worth considering.

Growth and Income

- IndexIQ: US Real Estate Small Cap (ARCA:ROOF ) – Some analysts feel that this fund is in an ideal position to capitalize on the rebounding real estate market in the U.S. and could outperform its large-cap peers for the year. Small-cap real estate funds are typically not as affected by trends in the international markets (such as the current real estate crisis in Europe) and may also produce higher dividends.

Sector ETFs

- SPDR S&P Health Care Services ETF (ARCA:XHS ) – This fund follows the S&P Health Care Services Select Industry Index and has either matched or beaten its peers since its inception.

- ProShares Ultra Utilities (ARCA:UPW ) – This fund attempts to double the performance of the Dow Jones U.S. Utility Index. It has substantially outperformed its peers since its inception in 2007.

- PowerShares Dynamic Energy Fund (ARCA:PXE ) – This fund seeks to mirror the performance of the Dynamic Energy Exploration & Production Intellidex Index. It has nearly doubled the performance of its peers since its inception in 2005.

The Bottom Line

Although ETFs offer many advantages over traditional mutual funds and variable annuity subaccounts, the low costs and liquidity of ETFs can also entice novice investors into overtrading them, which may end up churning their accounts in an effort to time the markets. Less experienced investors may also shy away from ETFs because they appear to be higher-risk instruments than traditional funds. Plan sponsors who offer these vehicles will need to make certain that participants get a thorough education in what they are and how they work. For more information on ETFs, consult your retirement plan sponsor or financial advisor.

More From Investopedia