The Average Annual Return on Mutual Funds

Post on: 10 Июнь, 2015 No Comment

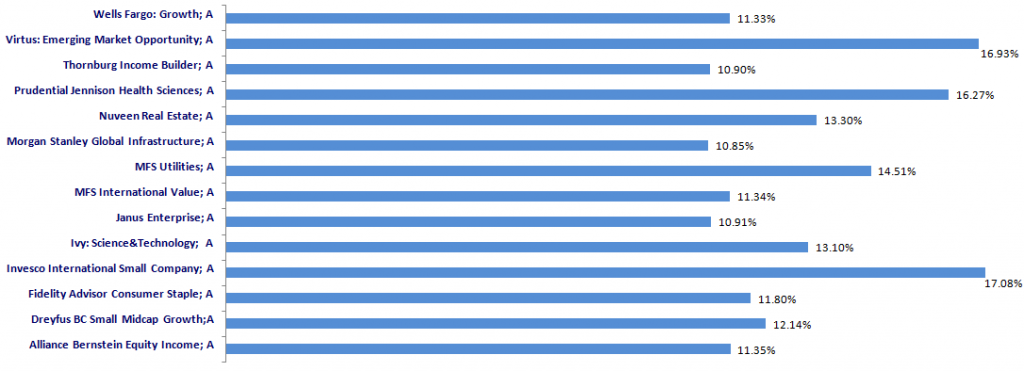

According to Yahoo! Finance, stocks have earned investors an average annual rate of return of just over 10 percent since 1926. Over time, mutual funds invested in stocks should earn something close to this average, even if some years are better than others. Investors, however, have the ability to increase or decrease their average fund performance, based on decisions they make when choosing the right fund to own.

Other People Are Reading

Managed Funds and Index Funds

Some mutual funds are actively managed by a professional analyst who researches the markets and makes decisions about the fund designed to earn investors the best possible rate of return. An index fund, on the other hand, is not managed. Index funds own the same stocks that major market indices, such as the S&P 500 own. According to a study performed by Motley Fool, on average, index funds have outperformed managed funds by 2 percent per year. Thus, investors are likely better off choosing an index fund.

Stock Funds Versus Income Funds

Fund Fees

References

More Like This

The Average Earning of a Mutual Fund in a Year

The Average Rate of Return on Mutual Funds

The Average Mutual Fund Returns

You May Also Like

Mutual funds provide a way for the average investor to diversify their holdings into many different types of investments chosen by professional.

A mutual fund is a portfolio of stocks, bonds or other investments. When you buy shares in a fund, you become a.

In the search for safety and returns, some investors turn to either a money market mutual fund or a fixed income fund.

Investing in mutual funds incurs fees and expenses. Fess are commonly referred to as shareholder fees that a fund charges shareholders on.

The average return of mutual funds is calibrated using the duration of the investment. Learn more about average returns of mutual funds.

The average mutual fund return for a 10-year period is used by many investors to chart the long-term performance of mutual funds.

The average annual return for the U.S. stock market is often determined using the S&P 500 stock index. This index includes the.

Mutual funds offer an easy way for beginning investors to start investing in the stock market. Investing in mutual funds carries less.

The first mutual fund was established in the Netherlands in the 1820s. The New York Stock Trust, launched in 1889, was the.

Morningstar lists over 13,000 mutual funds available for investors. Each mutual fund is different, so consequently, the average returns for each fund.

Individual Retirement Accounts, or IRAs, are investment accounts that let you to invest without paying taxes on the profits earned inside the.

What Are Average Mutual Fund Expense Ratios. Mutual funds have annual expense ratios that cover the managing and running of a mutual.

Mutual funds are pooled financial assets investing in various financial products. A mutual fund company typically has different fund categories, such as.