Ten Things Dave Ramsey Got Wrong

Post on: 6 Май, 2015 No Comment

Ten Things Dave Ramsey Got Wrong

The other week I finished up a five part series of posts on Dave Ramsey’s Seven Baby Steps . It seems to have been well received and still gets a steady stream of clicks. But honestly, I was expecting a larger and more hostile reaction than I got, at least as measured by comments and emails. Ramsey has a very large and devoted following, particularly, it seems, in the blogosphere.

At least I thought so. Maybe I was wrong about that. Perhaps Ramsey is well liked but not, ultimately, taken all that seriously.

Or maybe I was just a little too subtle in what I wrote. Perhaps when I said that “His advice on higher level personal finance topics such as investing and taxes is weak and often misinformed because his knowledge in those areas is limited” my readers thought I was exaggerating for effect. And perhaps when I criticized him for giving advice “on topics such as investing, about which he should probably just keep quiet” those readers didn’t really think I meant that his listeners would be better off if he didn’t cover those topics at all.

Well, I really meant it. And for what it’s worth, let me share some of what I found on Ramsey’s website that led me to believe he has no business giving advice on several sub-areas of personal finance. All are from the “Ask Dave” section, wherein questions and answers from his radio show are summarized with an audio link. It’s a large database, but must still be only a tiny fraction of all the questions he has answered on his show. We can only assume that they are not a random sample and that Ramsey or his staff thoughtfully selected them as being some of his better work.

I will cite ten examples that suggest that Ramsey has a poor command of his material. Several I have already discussed in previous posts. It did not take me long to find these. I stopped at ten because it was getting tedious.

Let’s say you’re 30 years old bringing home $40,000 a year. If you put 15% of that into retirement, that’s $6,000 a year $500 a month. If you put $500 a month into good growth stock mutual funds that average 12% from 30-70 years old, then you would have almost $6 million. Over 40 years, you’ve put in $240,000 and your return is $6 million.

If you do that in a 401K, that money is taxable. The money went in before taxes, but the money is taxable as it comes out. Your $240,000 that went in pre-tax is almost irrelevant in light of the $6 million that is going to be taxed.

But if you put money in a Roth IRA, it grows tax-free. That means if you put the same amount into the Roth, you’ve got $6 million, none of which goes to Uncle Sam. The Roth IRA is always superior to the 401K because of this.

That last italicized bit is unequivocally wrong. The tax savings you get from the up-front deductibility of traditional IRA (or 401k) contributions is exactly the same as the tax savings you get from the distributions of Roths not being taxed, assuming tax rates are constant. If the tax rate is higher now than in retirement, a traditional will save more money.

The FICO score measures how much debt you currently have and how well you are paying it off. So if someone has no debt, there FICO score is 0. A person could have millions in the bank and no debt at all, but have a FICO score of 0.

There’s no such thing as a FICO score of 0. The lowest possible score, reflecting the worst possible credit, is 300. If you pay off all your debt, you still get a score, probably a good one. If you are completely unknown to the credit reporting agencies, meaning that you have no credit lines, have not had any for many years, and do not have, for example, an AT&T cell phone account, you will have no score at all.

If it has a very low expense ratio, then it is a mutual fund that doesn’t sell very often.

For example, you saw one expense ratio of 1.1 and that was probably an aggressive growth mutual fund. Those are sold all the time, so the expenses are higher. A growth and income mutual fund would have very low expenses because they are rarely sold.

I’m not really sure what Ramsey is talking about here. Best I can figure, he thinks that the commissions paid by the fund to buy and sell stocks are included in the expense ratio. They aren’t. (And wouldn’t make much of a difference if they were.)

Expense ratios are ultimately pretty arbitrary, based on what the fund company thinks the market will bear. If there is any general trend, it is that higher risk funds, which hopefully also have a higher potential return, also have higher fees.

[The caller’s aunt’s] CPA thinks that she’s better off borrowing money at 5% and investing it at 12%, but because the account is taxable, 12% ends up looking like 9.6%. The CPA will still say that she’s making 9.6%, which is still better than 5%, but he’s not thinking about the risk involved with investment.

Except that because the 5% is tax deductible, it ends up looking like 4%. Ramsey messes these calculations up repeatedly (for example, here and see my post on Step 6 ) and to a remarkable extent for a guy who once made his living as a real estate developer. His conclusion, that you should pay off the mortgage rather than invest in stocks, may be sound for some people, but he never seems to be able to set up the comparison properly on an apples-to-apples basis.

I recommend mutual funds because they always beat the SNP. You can own several funds that beat the SNP whether in an up-market or a down-market. It’s alright to own some SNP, but none of your retirement savings should be in that. If you do a little bit of looking you can find tax-protected Roth IRAs and 401-Ks that give much better returns than the SNP.

For example, take a mutual fund with a 25-year track record. Over the course of those 25 years if you can see that the mutual fund almost always beats the SNP, then that mutual fund contains stocks that are winning more than the overall market is winning.

Assuming that “SNP” is S&P 500, mutual funds don’t always beat it, in fact on average pretty regularly lag it. IRAs and 401ks are not investment alternatives to the S&P but accounts which can hold such things as mutual funds.

The Marriage Penalty Tax was a fluke in the tax tables and has been corrected. There should be very little difference in the taxes you pay once you get married.

A clever observer will note the existence of the “Married Filing Separately” tax schedule, as distinct from the “Single” one. Two people making $75,000 each who get married will find that they have moved from the 25% to 28% bracket. They will also find that there are many nooks and crannies in the tax code that may increase their burden now that they are married, including, for example, a smaller addition to the standard deduction if they are over 65 and the phaseout of personal exemptions at a lower income level.

For the record, I don’t think the tax code is anti-marriage, but I wish it were simpler. And the marriage penalty was/is not a fluke, but a fully intentional tax policy.

QUESTION: Tyson wants to know what a hedge fund is, and what it is for, and how it plays into the current economic situation, in this call from September 24, 2008.

ANSWER: The term hedge fund comes from hedging your bets or hedging risk. You do that by doing the opposite of what the market is doing, or some extra risk. An example is extremely high risk mutual funds. You can’t participate unless you are very rich, because you could lose. It’s so high risk that the government wouldn’t allow an old lady to put her life savings into it.

They were the first people who were bundling together the subprime loans together and selling them as a bond. They can then sell it as a bond rather than individual mortgages. When you take many of these and put them together, that’s when it starts affecting the economy. They are the Petri dish from which this whole mess came from.

That’s the entire text of the Q&A as transcribed on Ramsey’s site. I conclude from this that Ramsey does not, in fact, know what a hedge fund is. (I am also left wondering why this particular question was put on his website.) The first sentence of his answer implies hedging reduces risk and in the second that it increases it. Hedge funds were not the first people to bundle sub-prime mortgages into bonds. A firm that creates and sells bonds is called an investment bank.

Hedge funds are like mutual funds in that they are pools of jointly owned assets, but are unregulated and typically have much higher fees, presumably to compensate for superior investment performance. One the requirements to escape regulation is that they can only take a limited number of investors and those investors must be either wealthy individuals or corporations. Although the word hedge does suggest reducing risk by going short, and some hedge funds do this, many do not.

Certificate of deposits are not a secure investment. They average about 4% and that’s also the inflation rate. By the time you pay taxes, you’ll lose money. Get away from your broker if they are giving you information like this. Invest in good growth stock mutual funds that average about 12 percent.

CDs are generally FDIC insured and therefore as guaranteed as any investment could be. So secure that they are often said to be appropriate for widows and orphans.

QUESTION: Nigel says his father just received his retirement in a lump sum of $90,000. Where should he invest that to get the highest yield?

ANSWER: The best place to invest is in good growth stock mutual funds – growth, growth and income, aggressive growth, and international – if you’re going to leave your money alone for at least the next five years. He’s not going to make a ton of money off of that investment in one year though.

Yield refers to income (e.g. dividends) rather than total return. Growth stocks do not typically have much in the way of yield. “Growth and income” and “international” are not examples of growth stock fund types. Investing the entire sum in equities, never mind only growth equities, would be very risky for a retiree. Even with a five year horizon equities it would present too much risk for somebody expecting to live off the money in the near term.

QUESTION: Jake works for a good company that has stock options. He has done a budget and is trying to get out of debt. He can take a little bit away and have $200 a month to put into the stock options. The company buys the stock once a quarter and buys it at 85% of its market value. Should he do that?

ANSWER: All companies purchase at 85% of the value. It’s a bonus assuming the stock price is steady. In a year’s time, it has more than a 15% move up or down. I wouldn’t do it. Honestly, how much would you make off of it?

This last one is poorly transcribed, so you really have to listen to the recording to understand what poor Jake is asking about. It is not, as he and Ramsey call it, a stock option plan but an employee stock purchase plan. The terms are such that Jake can set aside money over the course of a quarter to be used to buy his company’s stock at a 15% discount. He can then immediately sell that stock for its full market value.

Ramsey is dismissive of this, saying that a) it is too risky and b) it is too little money to bother with. Both objections tell me that Ramsey wasn’t really listening to what the caller was saying and that he imagined for himself what the terms of the plan might be. ESPPs are strange and relatively rare beasts. I happen to have once worked for a company that had one very similar to Jake’s, so I know that the right advice is that he should max out the scheme and sell the stock immediately every quarter.

I don’t expect the host of a radio call-in show to know that off the top of his head. I can even excuse not taking up air time to tease out of a nervous caller the necessary details. But authoritatively giving advice on a topic that is of monetary importance to your listeners as if you understood the details, when you don’t, is intolerable.

And in this way this last item epitomizes the entire set. In no case does Ramsey give even the slightest hint that he is not intimately familiar with the subject at hand. And yet, in at least some of these cases, he must have known he was on thin ice. Why not say something like “I’m not really familiar with the details, but in general…” or “You know, that’s just the sort of question you should ask a qualified lawyer/accountant/broker/insurance agent.” Would that have been that damaging to his image? It sure would have improved the overall quality of his advice.

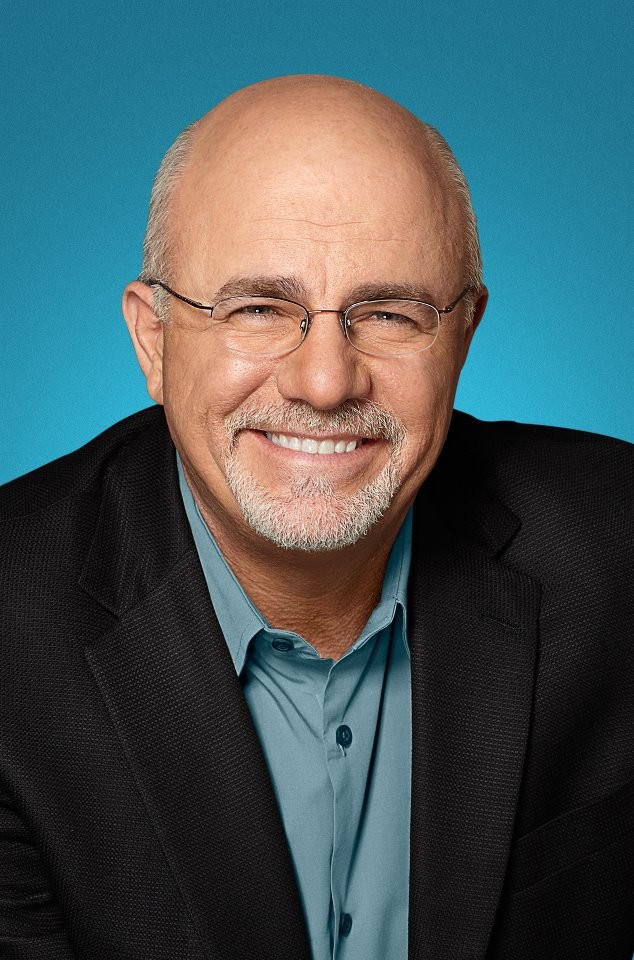

[Photo credit Kamyar Adl]

Dave Ramsey. Gurus. Investing | Frank Curmudgeon | May 13, 2009 3:00 pm