Technology Dividends A Missing Ingredient in Your Equity Income ETF

Post on: 17 Июль, 2015 No Comment

Over the past 5 years, few themes have more consistently resonated with ETF investors than equity income. Since 9/30/2009, equity income ETFs have collectively gathered over $50 billion in net inflows, with positive net inflows in 19 out of the last 20 quarters. This recent popularity can largely be attributed to investors’ growing appetite for income in a yield-starved interest rate environment, combined with the perception that dividend-paying stocks may be less risky than non-dividend payers.

As we’ve discussed in previous newsletters, however, one of the risks that investors face with equity income ETFs is sector concentration. While there is nothing inherently wrong with overweighting certain sectors while underweighting others, large sector bets may produce unexpected or undesirable results. For example, on 9/30/08, just before the collapse of the financial services sector, equity income ETFs allocated an asset-weighted average of 42.6% to financial stocks, representing a 26.6 percentage point overweight relative to the S&P 500 Index. Unfortunately for investors, financial stocks suffered extreme negative returns over the next 6 months. Interestingly, the financial sector is currently the second most underweight sector within equity income ETFs, relative to the S&P 500 Index. Conversely, utilities and consumer staples are the two most overweight sectors within equity income ETFs, with average allocations 8.1 and 7.0 percentage points higher than the S&P 500 Index, respectively.

Source: Morningstar Direct. An index cannot be purchased directly by investors. Past performance is no guarantee of future results. This chart is for illustrative purposes only and not indicative of any actual investment.

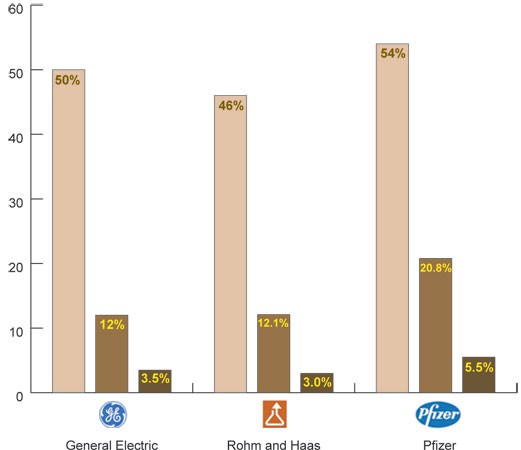

An equally important consideration for equity income ETFs is which sectors are underweight. As of 9/30/14, technology was the most underweight sector within equity income ETFs, with a 10.1 percentage point lower asset-weighted average allocation than the S&P 500 Index. This is especially notable because the information technology sector’s dividend growth rate has exceeded all other sectors over the past 3, 5, and 10 years (see Chart 1 below), and the sector currently pays more dividends than any other sector in the S&P 500 Index.

Source: Bloomberg. An index cannot be purchased directly by investors. Past performance is no guarantee of future results. This chart is for illustrative purposes only and not indicative of any actual investment.

In this newsletter, we will take a closer look at why many equity income ETFs have avoided the technology sector, why we believe investors should consider increasing exposure to dividend-paying technology stocks, and how the First Trust NASDAQ Technology Dividend Index Fund (TDIV ) may be utilized to complement investors’ equity income ETFs.

Why are equity income ETFs underweight technology?

One erroneous assumption about why equity income ETFs tend to underweight the technology sector is that the universe of dividend-paying technology stocks is much smaller than other sectors. While this may have been true in years past, today there are more dividend-paying stocks from the S&P 500 information technology sector (46) than the utilities (30), consumer staples (38), health care (34), energy (39), materials (29), and telecom services (5) sectors.

Another faulty assumption is that there are too few technology companies with above average dividend yields. In fact, roughly half the dividend-paying technology stocks in the S&P 500 offer higher dividend yields than that of the S&P 500 Index.

In reality, equity income ETFs tend to underweight the technology sector because index rules have prevented many from adapting to an evolving universe of dividend-paying stocks. For example, many popular equity income ETFs track indices requiring long-term dividend policy growth, such as the well-known S&P 500 Dividend Aristocrats Index, which requires 25 consecutive years of dividend increases. Such requirements screen out many technology stocks that have only recently begun paying dividends over the past 5 years or so.

In other instances, index rules may include “buffers” that favor stocks already included in an equity income index versus potential new holdings. While such rules are intended to reduce portfolio turnover, an unintended consequence has been that a large group of potential new holdings from the technology sector have had a more difficult path to entry versus other more entrenched holdings. In some cases, the outperformance of dividend-paying technology stocks, with increasing share prices resulting in lower dividend yields, has prevented such stocks from ranking high enough for indices that select stocks on the basis of dividend yield.

Why should equity income investors consider overweighting technology?

We believe the technology sector is well positioned for dividend growth, which has historically been associated with better performance compared to stocks lacking dividend growth. According to Ned Davis Research, during the 30 year period ending on 12/31/13, US stocks that initiated or increased dividend payments produced a 10.1% average annual return, compared to a 7.6% average annual return for dividendpaying stocks that neither increased nor decreased dividends. As indicated in the Chart 1, the technology sector has produced the strongest dividend growth of any sector over the past 3, 5, and 10 years.

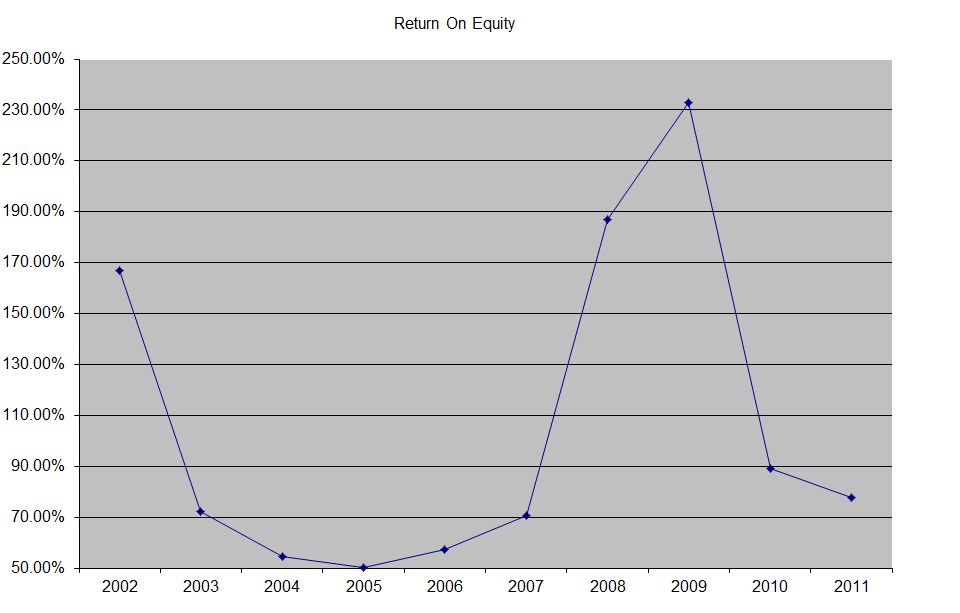

In the wake of the financial crisis of 2008, technology companies began to dramatically increase balance sheet liquidity. From 9/30/08 to 9/30/14, members of the S&P 500 information technology sector collectively increased holdings of cash and marketable securities from $245 billion to over $732 billion. This provides both a cushion supporting current dividend policies, as well as a potential source of future dividend growth.

Moreover, the case for potential dividend growth in the technology sector is bolstered by strong free cash flows and earnings compared to current dividends. As of 9/30/14, the S&P 500 Information Technology sector had a 6.5% free cash flow yield and a 5.2% earnings yield, both significantly higher than the sector’s 1.5% dividend yield. This spread between dividends compared to free cash flows and earnings suggests that technology companies may have more room to organically support longer term dividend increases, rather than simply distributing excess cash retained over the past several years.

Lastly, the information technology sector’s ratio of total debt to total assets is the lowest of any sector in the S&P 500 Index. This suggests that if and when interest rates increase in the months and years ahead, these companies may be less impacted by increased borrowing costs as debt rolls over compared to other, more leveraged companies.

A strategy to increase exposure to technology dividends

While many technology companies have matured to the point where a dividend policy makes sense, a number of others still do not pay dividends. Most traditional technology ETFs provide exposure to both groups. The First Trust NASDAQ Technology Dividend Index Fund (TDIV) is an ETF that holds 96 stocks (as of 9/30/14), avoiding technology companies that have not paid dividends within the past 12 months, or with a dividend yield below 0.5%. Accordingly, TDIV may be a useful tool for investors seeking to increase exposure to dividend-paying technology stocks. As of 9/30/14, TDIV’s 30-Day SEC yield was 2.63%; the underlying portfolio’s free cash flow yield and earnings yield were 7.4% and 6.1%, respectively.

The popularity of equity income ETFs shows few signs of slowing. These funds offer a variety of strategies for investors to gain exposure to dividend-paying stocks. But investors should be aware of potential risks and missed opportunities that may accompany current sector allocations for many of these funds. Hence, we believe investors would be well served to “look under the hood” at sector allocations within their equity income ETFs, and consider augmenting exposure to certain underweight sectors, especially technology.

ETF Characteristics

The fund lists and principally trades its shares on The NASDAQ Stock Market LLC.

The fund’s return may not match the return of the NASDAQ Technology Dividend Index℠. Securities held by the fund will generally not be bought or sold in response to market fluctuations.

Investors buying or selling fund shares on the secondary market may incur customary brokerage commissions. Market prices may differ to some degree from the net asset value of the shares. Investors who sell fund shares may receive less than the share’s net asset value. Shares may be sold throughout the day on the exchange through any brokerage account. However, unlike mutual funds, shares may only be redeemed directly from the fund by authorized participants, in very large creation/redemption units.

Risk Considerations

The fund’s shares will change in value, and you could lose money by investing in the fund. One of the principal risks of investing in the fund is market risk. Market risk is the risk that a particular stock owned by the fund, fund shares or stocks in general may fall in value. There can be no assurance that the fund’s investment objective will be achieved.

The fund may invest in small capitalization and mid capitalization companies. Such companies may experience greater price volatility than larger, more established companies.

An investment in a fund containing securities of non-U.S. issuers is subject to additional risks, including currency fluctuations, political risks, withholding, the lack of adequate financial information, and exchange control restrictions impacting non-U.S. issuers. These risks may be heightened for securities of companies located in, or with significant operations in, emerging market countries. The fund may invest in depositary receipts which may be less liquid than the underlying shares in their primary trading market.

The fund invests in telecommunications companies which are subject to certain risks, including a market characterized by increasing competition and regulation, the need to commit substantial capital to meet increasing competition and technological innovations that may make various products and services obsolete.

The fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

First Trust Advisors L.P. is the adviser to the fund. First Trust Advisors L.P. is an affiliate of First Trust Portfolios L.P. the fund’s distributor.

This material is not intended to be relied upon as investment advice or recommendations.

Performance data quoted represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate and shares when sold or redeemed, may be worth more or less than their original cost. You can obtain performance information which is current through the most recent month-end by visiting ftportfolios.com.