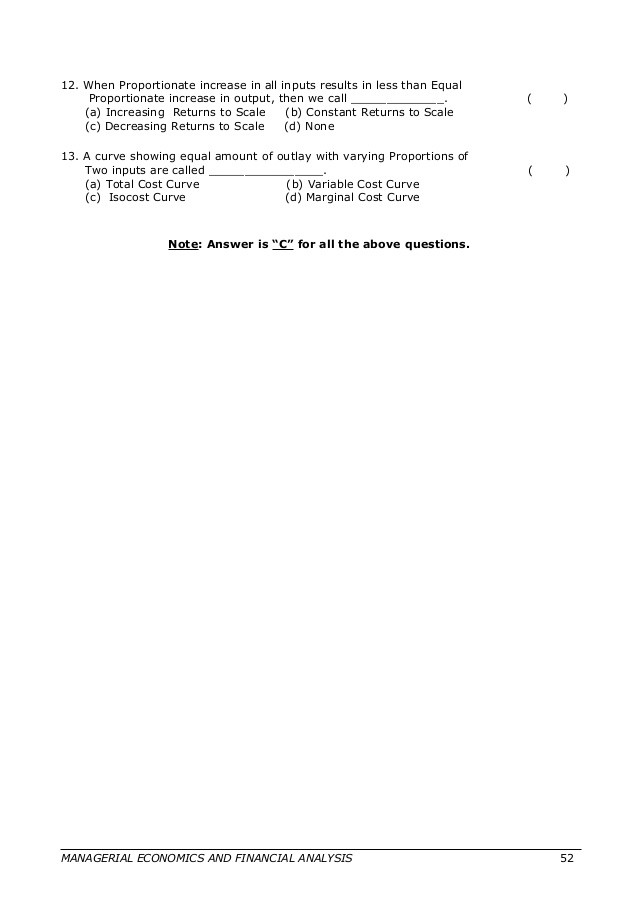

Tax Forms Every Investor Must Understand_2

Post on: 16 Июль, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

By Mark P. Cussen, CFP, CMFC, AFC

The IRS has created tax forms to cover every type of taxable income in the code. Earned income, rental income, salaries, wages and Social Security are each reported to recipients on the appropriate 1099 form so that they can report this income on their tax returns each year. Investment income is no exception, and anyone who owns stocks, bonds, mutual funds, annuities and/or retirement plans and accounts from which they are taking distributions must know which forms they can expect to receive during tax season, and where and how they must report this information on the 1040.

Types of Investment Income

Income from investments can be divided into four main categories:

Interest – Interest income is paid on bonds and other types of fixed-income securities such as fixed annuities. Interest is always taxable as ordinary income unless it is paid inside an IRA or qualified plan or annuity contract. Municipal bond interest is also tax-free, and interest from treasury securities is exempt from taxation at the state and local levels.

Dividends – These represent a portion of a company’s current profits that it passes on to shareholders. Dividends can be taxed as ordinary income, or they may qualify for lower capital gains treatment in some cases if they are coded as “qualified” dividends.

Capital Gains – This represents the amount of profit realized when an investment is sold at a higher price than that for which it was bought. Long-term gains are realized for investments held for at least a year and a day before they were sold, and are taxed at a lower rate than ordinary income. Short-term gains are taxed as ordinary income.

Retirement and Annuity Distributions – Although distributions from retirement plans are not technically a form of investment income, they are listed here because IRA and retirement plan owners can only access the gains from their investments in these accounts by taking distributions. Normal distributions are always taxed as ordinary income.

Each income type listed above is broken out on a corresponding 1099 form issued by the broker or issuer of the income generated. Every form includes the name, address and tax ID number of the issuing entity. These forms are listed as follows:

1099-INT – Breaks out the interest paid to the investor. This form is issued to anyone who owns bonds, CDs or mutual funds that invest in fixed-income securities or cash or has an interest-bearing bank or brokerage account.

- Box 1 shows total taxable interest paid

- Box 2 shows the amount of early withdrawal penalty, if any

- Box 3 shows the amount of U.S. Treasury security interest paid

- Box 4 shows the amount of tax withheld

- Box 5 shows investment expenses

- Box 6 shows foreign tax paid

- Box 7 shows the foreign payor

- Box 8 shows tax-exempt interest

- Box 9 shows interest from special private activity bonds

- Box 10 shows the CUSIP number for tax-free bond interest

- Boxes 11-13 show state ID information and withholding

1099-DIV – This breaks down the total amount of dividends paid to an investor. It is issued to holders of any common or preferred stock or mutual fund that invests in them. However, it is not issued to owners of cash value life insurance policies, as those dividends are merely a return of premium.

- Box 1a shows total ordinary dividends

- Box 1b shows total qualified dividends

- Boxes 2a-d break down capital gains from mutual funds, REITs and collectibles

- Box 3 shows nondividend distributions

- Box 4 shows federal tax withheld

- Box 5 shows investment expenses

- Boxes 6 and 7 show foreign tax paid and the foreign payor

- Boxes 8 and 9 show cash and noncash liquidation distributions

- Box 10 shows private interest dividends

- Box 11 shows specified private activity bond interest dividends

- Boxes 12-14 show state ID information and withholding

1099-B – This form breaks down the amount of capital gain or loss that the investor realized for that tax year. It is issued to everyone who bought or sold publicly traded securities at a gain or loss. Many brokerage firms issue additional statements that break down the loss or gain for each trade and then quantify them into net long- and/or short-term gains and losses for the year.

- Box 1a shows the date of sale or exchange

- Box 1b shows the date of acquisition

- Box 1c shows whether it is a long- or short-term gain or loss

- Box 1d shows the ticker symbol of the security

- Box 1e shows the quantity sold

- Box 2a shows the gross proceeds reported to the IRS both before and after commission and expenses

- Box 2b shows a checkbox if loss not allowed due to amount shown in box 2a

- Box 3 shows cost or other basis

- Box 4 shows federal tax withheld

- Box 5 shows any amount of wash sale loss that was disallowed

- Box 6 has checkboxes for noncovered securities and for sales where the basis in box 3 was reported to the IRS

- Box 7 shows income from bartering

- Box 8 is for a description of the security if needed

- Boxes 9-12 break down realized and unrealized gains and losses from derivatives contracts

- Boxes 13-15 show state ID information and withholding

- 1099-R – This form is issued to everyone who receives distributions from IRAs, qualified retirement plans or annuity contracts that are not housed inside a tax-deferred account or plan.

- Box 1 shows the gross distribution amount

- Box 2a shows the amount of taxable distribution

- Box 2b has checkboxes for taxable amount not determined and total distribution

- Box 3 shows amount of capital gain included in box 2a

- Box 4 shows federal tax withheld

- Box 5 shows employee/Roth contributions

- Box 6 shows net unrealized appreciation in employer securities

- Box 7 shows the distribution code that determines how the distribution is taxed

- Box 8 shows the value of any annuity contract included in the distribution

- Box 9a shows the value of distribution percentage that belongs to the recipient

- Box 9b shows the amount of the employee’s investment for annuity distributions where the exclusion ratio must be computed

- If Box 10 is filled, refer to instructions on Form 5329

- Box 11 shows the year the recipient first made a Roth contribution of any kind

- Boxes 12-17 show state and local ID information and withholding

1099 MISC MISC – Although most of this form pertains to earned income, it is also used to report royalty income (box 1) and working interest income (box 7) in oil and gas leases.

Form 5498 – The receiving custodian of a qualified plan rollover or IRA transfer issues this to the account holder as proof that the transfer was not a taxable event and should not be counted as a distribution.

Reporting Your Income

Although it might seem that the form numbers on the tax return would correspond to those issued to investors, this is not the case. Interest and dividends are reported on Schedule B of the 1040, and capital gains and losses are netted out on Schedule D. Much of the information on Schedule D is now computed on form 8949 and then carried over to this schedule to provide the IRS with a clearer picture of how the taxpayer calculated gains and/or losses.

The Bottom Line

Taxpayers who receive retirement or investment income need to know which forms they should receive and what information should be listed on them. Many investment firms issue consolidated 1099s that cover all of the forms listed above in a single statement. For more information on investment tax forms, visit www.irs.gov or consult your financial advisor.

Also From Investopedia: