Tax Deferred Savings Accounts and Investments

Post on: 23 Июнь, 2015 No Comment

Tax Deferred Savings Can Be Accomplished In Two Ways

You can opt-out at any time.

Please refer to our privacy policy for contact information.

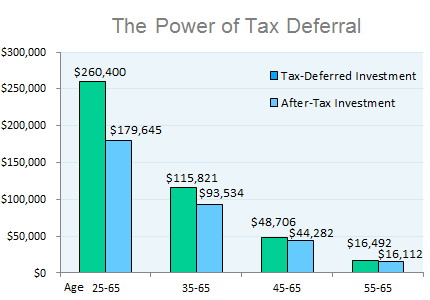

Tax deferred savings occurs when you use a specially designated account that does not require you to claim the investment income earned inside of the account each and every year on your tax return. Instead you get to defer this investment income until such time as you choose to take a withdrawal from the tax deferred savings account.

You can accumulate tax deferred savings in one of two ways:

- Use a tax deferred account like an IRA or employer sponsored retirement plan (such as a 401k, 457 or 403b plan). Inside these accounts you can purchase various different types of investments.

- Use a tax deferred annuity which is an investment that allows you to accumulate tax deferred savings. Tax deferred annuities can be fixed, offering a guaranteed rate, or variable, allowing you to choose from a variety of investments.

Example Of How Tax Deferred Savings Accounts Work

- You invest $1,000 in a tax deferred savings account (like a 401k plan, or IRA account), or use a tax deferred annuity.

- It earns 5% in investment income .

- At the end of the year the investment is worth $1,050.

- You do not have to claim the $50 as investment income on your current year’s tax return since it was earned inside of a tax deferred account or tax deferred annuity.

Early Withdrawals From Tax Deferred Savings Accounts

When you use tax deferred accounts or tax deferred annuities, withdrawals of investment gain prior to age 59 are subject to a 10% penalty tax in addition to ordinary income taxes.

Think of it like this: the IRS is allowing you to grow your funds tax deferred as an incentive to encourage you to save for retirement, but they penalize you if you use the funds too early.

When Do I Pay Taxes On A Tax Deferred Savings Accounts?

At the time that you take a withdrawal from a tax deferred savings account, you will pay taxes at your ordinary income tax rate on any investment gain that is withdrawn. If your contributions to the account were also tax deductible then you will pay taxes on the full amount of your withdrawal, not just the investment gain portion.

Tax Deferred Accounts

Below is a list of the types of accounts that have a tax deferred status. Inside of these accounts you can own just about any type of investment you can think of; mutual funds, stocks, bonds, certificates of deposit, fixed annuities, variable annuities, etc.

- Traditional IRAs . investments inside of a traditional IRA grow tax deferred. Your contributions to a Traditional IRA may also be tax deductible if you meet the IRA contribution limits and rules requirements.

When you change employers you can avoid a taxable withdrawal by using an IRA rollover to move funds directly from your plan to an IRA account, or by moving the funds directly to a plan with your new employer.

Tax Deferred Investments

- Fixed deferred annuities . interest earned in a fixed annuity is tax deferred until such time as you take withdrawals.

- Variable annuities . investment income earned inside of a variable annuity is tax deferred until such time as you take withdrawals.