Targeted Retirement Funds

Post on: 16 Март, 2015 No Comment

by RJ

You open your 401(k) packet, to find a targeted retirement fund, among the selection of mutual funds. Amazingly, this fund with a target date of 2050, matches perfectly with your investment horizon. You go to the funds website to find this target fund advertises itself like one stop shop for investing. The way the mutual fund company puts it, you dont have to do a thing once youve made your selection. You can get back to work and let the magic of compound interest work in your 401(k).

But can investing really be that easy? Can you just login to your 401(k) or IRA account, select the target date fund, and call it a day?

The purpose of this post is to take an in depth look at target retirement funds. Looking closely at the advantages, disadvantages, the disparity between funds, and finally, tips for investing in targeted retirement funds.

What is a Target Retirement Fund?

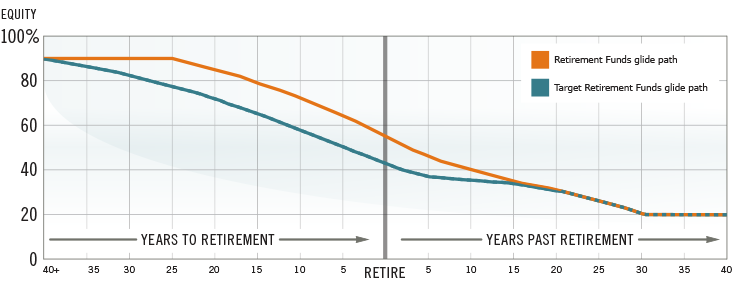

A target date retirement fund, also known as life cycle fund, offers investors a mutual fund allocated towards a specific retirement date. For example, if you invested in such a fund with a target retirement date of 2050, the fund will invest in specific asset classes that matches that time horizon.

Advantages of Targeted Retirement Funds

- Instant diversification. matched to retirement date.

- No need to rebalance or readjust asset allocaton, as you get older. The fund does so itself.

- You can get by with owning just one fund, since most target date retirement funds offer exposure to each asset class.

Disadvantages to Targeted Retirement Funds

- Targeted retirement funds base their asset allocation on years until retirement, not your individual risk.

- Even though most target retirement funds are made up of low index funds, some fund companies and 401(k) providers, charge a high fee to invest in their target funds.

- There is no standard or regulations on asset allocation for target retirement funds. Therefore, asset allocation changes dramatically from one fund to the next, even if they have the same target date. In late 2009, Morningstar reported that the range of stock allocation in 2010 target funds, ranged from 26% to 65%.

- Changes can be made to the fund’s core strategy by fund manager. For example, in 2009 Fidelity added TIPS (Treasury Inflation Protected Securities) to the Fidelity Freedom 2050.

- Many investors hold a targeted retirement fund, along with other mutual funds. Thus, their asset allocation varies from the recommended allocation of the TDRF.

A Comparison of 4 Different Target Date Retirement Funds

Below is a comparison of four different target date retirement funds. The point here is not to pick out which targeted retirement fund is the best. The purpose was for you to see how a fund with a target date of 2050, can change dramatically from company to company.