TargetDate LifeCycle Funds How Do They Work Financial Web

Post on: 16 Март, 2015 No Comment

Target-date life cycle funds are a type of investment designed to make retirement planning simple. The idea behind this type of fund is that you will be able to choose a date at which you want to retire. You will choose the date, and the investment mix will be developed for you. You will continue to invest, and the proper securities to fit in with your mix will be chosen for you. These funds are becoming very popular among those that do not want to have to actively manage their portfolios. Here are the basics of target-date life cycle funds.

Changing Investment Mix

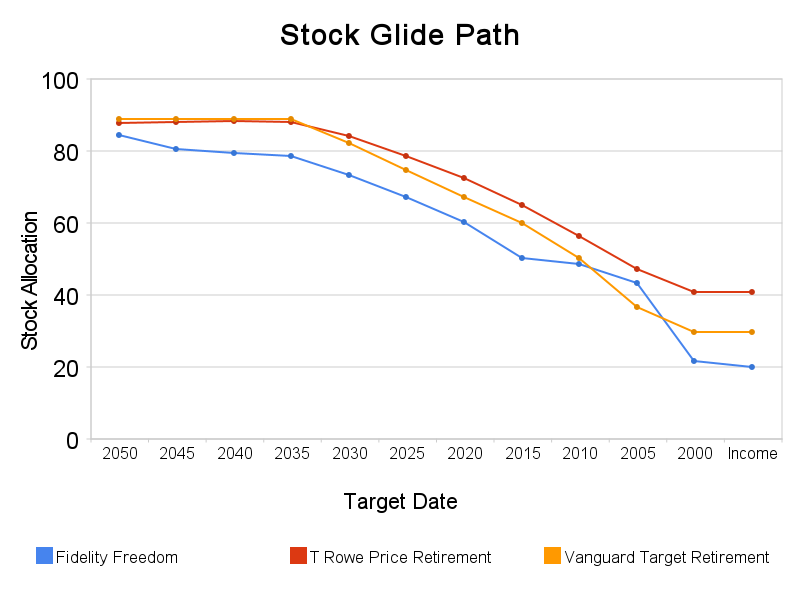

Imagine that you want to retire in 40 years and thus choose a fund that has a target date of 40 years from now. When you start investing in the fund, the majority of it will be made up of equities. This is done because you have a long period in which to invest. You have many years to make up for investing mistakes by making more money. As time passes, the mix of investments is going to change automatically. After a certain amount of time, the investment mix will change from all equities to a mixture of equities and fixed-income securities. After that, the investment mix will change to a majority of fixed-income securities.

Advantages

The big advantage of a target-date life cycle fund is that it makes the process of investing for retirement more of a hands off endeavor. You will not have to worry about making individual investment decisions. The fund manager is going to select the individual investments and will choose the investment mix for you. When you invest in this fund, you are going to have to worry only about choosing the retirement date before you invest.

Disadvantages

Although this type of investment can make things easier, it does have a few disadvantages to consider. For example, when you invest in this type of fund, you are not going to be able to decide what types of securities you want to put your money in. You are leaving everything up to the fund manager to handle for you. If you are the type of individual that likes to have some type of control over your portfolio, this may not be the best option for you.

Another downside to this type of investment is that you will have to pay some fees for the management. This type of investment requires a great deal of professional management. You will have to pay an expense ratio in order to cover the costs of administration for the fund. When you purchase shares of the fund, you will have to pay a specific sales charge as well. Some funds will charge you a certain amount of money when you sell your shares as well.

$7 Online Trading. Fast executions. Only at Scottrade