TargetDate Funds Some Pros and Cons

Post on: 18 Август, 2015 No Comment

Vanguard just reported that, at the end of 2010, 79 percent of defined contribution plans offered target-date funds and 48 percent of participants used them when offered. Target-date funds (or TDFs) offer a simple approach to investment decision making and portfolio construction and fit well with the growing use of automatic enrollment in defined contribution plans, particularly since the Department of Labor designated TDFs as a qualified default investment alternative (QDIA).

At the same time, a number of concerns have been expressed about TDFs. Those concerns should guide a prudent fiduciary’s use of TDFs and the selection of a particular TDF family.

TDFs are well suited to be a default investment for participants who are automatically enrolled in a plan and who do not assume control over their account. All in all, the Department of Labor acted wisely in identifying TDFs as a QDIA for 401(k) plans. In some cases, however, plan fiduciaries have moved to TDFs as though they are the universal solution to all fiduciary investment questions. TDFs are certainly preferable to the pre-TDF world in which participants were simply offered a number of investment choices and asked to create their own portfolios. TDFs do create a one-stop shopping portfolio for participants that, used properly, can be very helpful to participants because of the simplicity of the system.

However, plan fiduciaries and participants should consider several factors when moving into TDFs. Some of them are explained in the following paragraphs.

The To Versus Through Glide Path Issue

Put most simply, some TDFs assume that participants will move money out of the TDF at retirement and, correspondingly, the equity holdings in the TDF closest to retirement are drastically reduced over time. Other TDFs assume that participants will leave funds in the plan and in the TDF through retirement, and therefore sustain a significantly higher level of equity exposure in the TDF to and through retirement. In addition, different TDFs operate under different philosophies – in some cases the goal is to insulate participants from losses and in other cases to capture gains into retirement years.

Neither glide path is wrong. The important point, however, is to understand the glide path used by the particular TDF and to educate participants about that glide path. Many participants learned this lesson the hard way in the 2008 market downturn, learning for the first time that the close-to-retirement TDF that they thought was very conservatively invested continued to have significant equity exposure.

Although this has tempered somewhat since the 2008 market downturn, the 2010 TDFs tested in one survey had equity holdings ranging from 2 percent to 65 percent. In 2008, for example, the 2010 TDFs surveyed lost between 9 percent and 41 percent of their value, depending on their level of equity exposure. In 2009, those same funds increased from 7 percent to 31 percent, again depending on the level of equity exposure.

Participants with the discipline to remain invested have probably recovered all of those losses, and perhaps more, but participants who did not have the discipline may have been hurt substantially by that lack of knowledge.

The TDF’S Name Might Be Misleading

This point is closely related to the preceding point. While most TDF providers name the TDF to refer to the expected retirement date (e.g. the 2015 fund), some instead refer to the date of the lowest equity exposure reached in the TDF lineup. If this is not identified and explained to participants, participants may allocate their funds into the wrong TDF.

TDFs Provide Only a Rough Relationship to Risk Tolerance and Financial Goals

Clearly not everyone with a 10-year time frame to retirement has exactly the same risk tolerance and financial goals. Participants in that age range, for example, have spouses of different ages and assets outside of the retirement plan ranging from significant to non-existent. TDFs focus on one factor – expected age at retirement – as a proxy for risk tolerance, but it is possible with a bit more work to actually help participants identify their risk tolerance and place themselves in the target-date or other type of fund most closely matching that risk tolerance, whether or not it corresponds to a particular age. Once again, this should be explained to participants.

Some TDFs Use Overly Simplified Marketing Materials

In examining a TDF for your plan, be alert to implicit, if not explicit, representations of appropriateness. For example, materials often indicate that the particular TDF is age appropriate. Studies show that participants perceive a promise in the marketing materials and a feeling that it must be good, my employer picked it. So, review those materials with an eye toward avoiding over simplification and misleading statements.

Proprietary TDFs May Not Be The Best of the Best

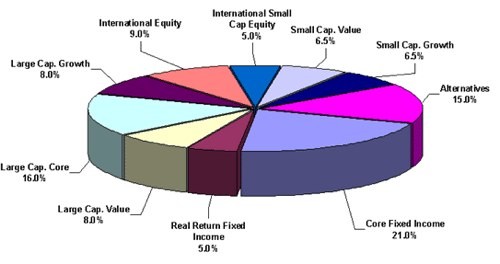

A TDF lineup consists of a number of composite portfolios designed to save participants the trouble of constructing their own portfolio. This is a good thing, since most participants are not well equipped to design their own portfolios. However, remember that the various TDFs (usually set up in five-year blocks) are themselves made up of mutual funds selected by the TDF provider.

Be alert to the fact that someone is deciding which mutual funds make up the particular target-date portfolios and that someone may have an interest in utilizing their proprietary component mutual funds rather than a competitor’s better-performing mutual funds. A problem along these lines may be difficult to cure, but there likely won’t be a cure unless you identify the problem.

Removing Underperforming Components May Be Impossible

This is a corollary of the preceding item. Even if you are alert to the problem, you may have limited ability to cause your TDF provider to remove underperforming components of a particular TDF. Of course, we would like to think that TDF providers would take the initiative in that regard, but we have seen situations where that did not occur, for whatever reason.

Comparing TDF Providers Is Tricky

It can be difficult to define and monitor appropriate peers for a particular TDF lineup. Because of the different approaches to creating TDFs and their different equity exposure, different TDFs perform differently over time, making it extremely difficult to compare one TDF lineup with another from a different provider. In addition, most TDFs do not have a long investment history that permits comparison over a lengthy period of time.

Automatic Rebalancing May Actually Be Harmful

Automatic rebalancing is usually a good thing. Participants seldom rebalance on their own initiative, so having a TDF provider handle that task is beneficial. However, there can be circumstances where that rebalancing, if done automatically on a set timetable by the TDF provider, harms participants. For example, if a TDF provider rebalances by increasing equity exposure in the middle of a significant market downturn – because the downturn has reduced the value of the equity component of the TDF – a participant in effect buys more equities in his TDF which then further decrease in value as the downturn continues.

Granted, over time, the additional equity exposure may significantly benefit the participant as the market recovers. The point is not to rebalance; the point is simply to be aware of how the TDF provider handles rebalancing so that information, too, can be passed on to participants as part of their decision-making process.