TargetDate Funds And ETFs The Major Risk Of Investing In Them

Post on: 17 Август, 2015 No Comment

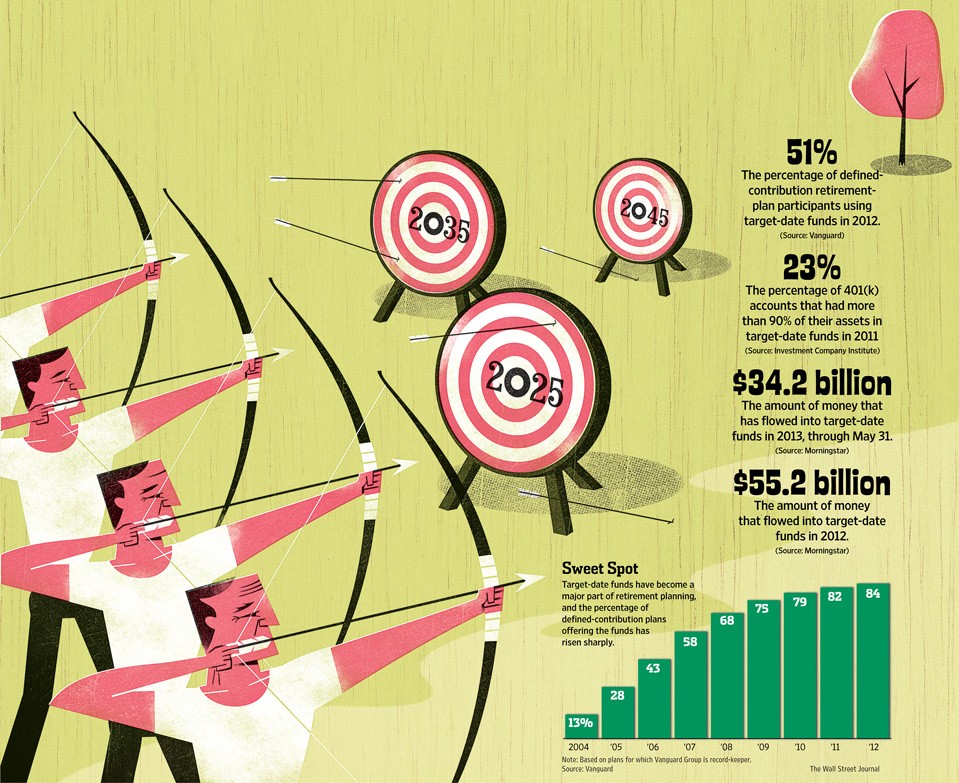

As the fastest-growing products in defined-contribution plans, target-date mutual funds are marketed as set-it-and-forget-it, one-step investment solutions for retirement plans.

They automatically increase bond exposure relative to stocks the closer the funds get to the target year in their name, theoretically reducing risk and preserving principal as investors get closer to retirement.In 2013, more than 20 years since target-date funds debuted, inflow into the funds accounted for nearly a third of new assets into management firms. The total amount invested in target-date funds topped $690 billion as of June 30, up 6% from a year earlier, according to Morningstar. Second-quarter inflow totaled $15 billion, 25% higher than the funds’ historical average quarterly inflow of $12 billion.

Falling management fees no doubt have helped boost their popularity. Average industry expense ratios dropped from 1.04% in 2008 to 0.84% in 2013, according to Morningstar, as providers increased use of indexes over actively managed portfolios within the target-date wrapper.

The three largest players Fidelity, Vanguard and T. Rowe Price accounted for three-quarters of the target-date market.

In the past five years, target-date funds have performed just as well as if not better than other asset-class benchmarks. Morningstar’s Target Date 2026-30 fund category returned an average annual 11.9% and 10.9% in the past three and five years as of Aug. 14.

They’re a middle ground between stocks and bonds. SPDR S&P 500 (ARCA:SPY ) returned 20.8% and 16.5% a year in the equivalent periods, while Vanguard Total Bond Market ETF (ARCA:BND ) earned 2.6% and 4.4% yearly.

Investment Risks

The bond portions of target-date funds may become more volatile than they were in the past if current ultralow interest rates rise back to normal. Investing in bonds might have been a no-brainer the past 30 years as interest rates trended downward, giving way to rising bond prices.

Falling bond prices could lead to losses in the bond portion of the portfolios at least in the short run just when people nearing retirement need to preserve principal the most.

The Federal Reserve, which has kept interest rates artificially low since 2008 to stimulate the economy, is expected to let rates rise in the first quarter of 2015. The benchmark 10-year Treasury yield, at 2.34% as of Aug. 15, is sharply below its historic average of 4.63%.

If interest rates do start to move significantly higher, bond investors could be in for a rough ride, Ethan Anderson, senior portfolio manager at Rehmann Financial in Grand Rapids, Mich. with $1.5 billion in assets under management, said in an email.