Target Your Retirement With LifeCycle ETFs

Post on: 16 Июль, 2015 No Comment

Life-cycle exchange-traded funds (ETFs) have joined life-cycle mutual funds (also known as target-date mutual funds) in offering investors one-stop shopping for a retirement savings vehicle. Life-cycle mutual funds were the first to arrive on the scene, and generally consist of a fund of funds. a mutual fund that invests in other mutual funds. (To learn more about life-cycle funds, read Life-Cycle Funds: Can It Get Any Simpler? )

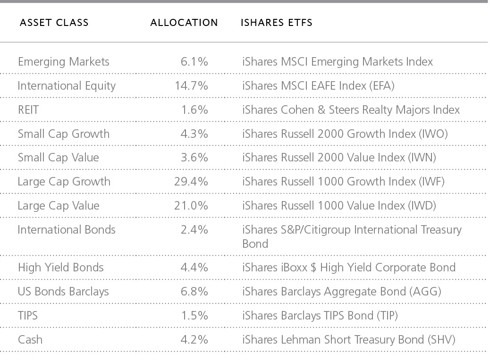

In the same way that a life-cycle fund portfolio invests in other mutual funds, life-cycle ETFs invest in other ETFs. Some life-cycle ETF portfolios also invest in individual stocks and bonds, which are used in combination with ETFs to achieve the desired asset allocation. Can these ETFs benefit your portfolio? Read on to find out.

How They Work

While their underlying investments differ, the basic concept of life-cycle mutual funds and life-cycle ETFs is the same. Both operate under an asset allocation formula that assumes investors will retire at a specific, predetermined date in the future. That date is identified in the name of the fund. So, for instance, if you plan to retire in or near 2025, you should invest in a fund with 2025 in its name. These investments can be used for other goals too, such as saving for a wedding or a college education, but are most commonly marketed to retirement-oriented investors.

Target-date investments are structured so that the portfolio’s asset allocation becomes more conservative over time. For example, at its inception, the 2025 fund would have the majority of its investments in stocks, with a small portion of the portfolio in bonds or other fixed-income investments. As 2025 approaches, the portion invested in stocks declines as assets are shifted to bonds. This shifting occurs on prearranged schedules, such as on a yearly basis. The fund’s management team handles the transaction, so investors don’t even need to think about it.

The wide and growing variety of ETFs available to investors provides a large universe of investments with which money managers can construct diverse portfolios. While many ETFs are passive investments designed to mirror benchmark indexes. the automatic rebalancing that life-cycle investment managers conduct serves as a form of active management. as trades are being made to keep the portfolio’s asset allocation in line with its stated objective. (To learn more, read Active Vs. Passive Investing In ETFs .)

Pros and Cons of ETFs

The use of ETFs in life-cycle investments provides a way to reduce costs, as the ongoing costs associated with ETFs are generally less expensive than the expense ratios associated with comparable mutual funds. On the other hand, a commission charge is associated with trading ETFs, while mutual funds have no such charge. For the investor putting away small amounts of money on a periodic basis, such as every two weeks from a paycheck, the trading costs could outweigh the savings on the expense ratio. (For more on this topic, read Are ETFs Suitable For Small Periodic Investments? )

Other Considerations

The idea of putting all of their money into a single fund and not worrying about it until retirement has a powerful appeal to many investors. Instead of worrying about what’s in their portfolios and when the holdings should be rebalanced, they simply set up direct deposit from their paychecks, sit back and wait for retirement.

It’s a simple concept, but not one that should be implemented without a considerable amount of thought. Don’t forget that life-cycle funds are designed to be your one and only retirement investment vehicle. If you have other investments, they skew the asset allocation of your overall portfolio. To use life-cycle investments properly, commit all of the money that you are going to invest toward your goal into the single target-date investment that you have chosen.

Asset allocation is the other major issue to consider. Each life-cycle ETF has an asset allocation strategy. Some begin with more aggressive allocations than others. Similarly, the asset allocations change over time; some funds maintain a greater exposure to stocks for longer periods of time, and others favor higher allocations to bonds. Before you choose a fund and entrust all your assets to it, be sure to look carefully at the initial, ongoing and ending asset allocation strategy. Compare it to the strategies employed by funds that have similar target dates, and think about the numbers in context of your personal risk tolerance and investment goals. Because asset allocation is often cited as the single most influential variable in determining long-term investment returns, you should choose carefully. (For related reading, check out Asset Allocation Strategies .)

More to Come

Life-cycle investing and ETFs both continue to grow in popularity. Because life-cycle ETFs offer a wide variety of choices, low costs and the convenience of automatic rebalancing, their popularity is likely to remain high. (To find out more, read The Pros And Cons Of Life-Cycle Funds .)