Target Date Investment Models for Investors

Post on: 16 Июль, 2015 No Comment

We have Dynamic Target Date Investing Models Too

The following text moved to be part of the Free Money eBook. Why we feel you should not invest in target fund strategies, then okay. if you insist, we offer a superior investment strategy to negate the major disadvantages while keeping the minor advantages of Life Cycle Investing.

To make a very long story very short — Our Target Date Portfolio Model calculator generates an appropriate mix of 16 asset classes, and is different from everyone else’s generic cookie-cutter approach that totally ignores you as a human being.

Target-date mutual funds were approved by the Department of Labor as a Qualified Default Investment Alternative (QDIA) for 401(k) investors in 2007.

We looked at everyone else’s target date strategy and found them all lacking. This is mostly because they only work with two (and sometimes only one) life factor.

The one life factor is the target year of retirement. The second is investment risk tolerance (most life-cycle strategies don’t even account for risk tolerance — which is much more important than the target year).

The only way to properly evaluate a target fund or strategy is to use complex benchmarking techniques to dissect them. Once you can dissect them, the individual parts (the actual bond and stock holdings) can be evaluated.

Every time this was done, their performance was pathetic.

So we made something that would do a better job.

Our target year investment models have six life factor inputs, as you can see on the Investment Model’s demo .

General Information about Retirement Target-Date Funds and Investment Strategies Comprised of them

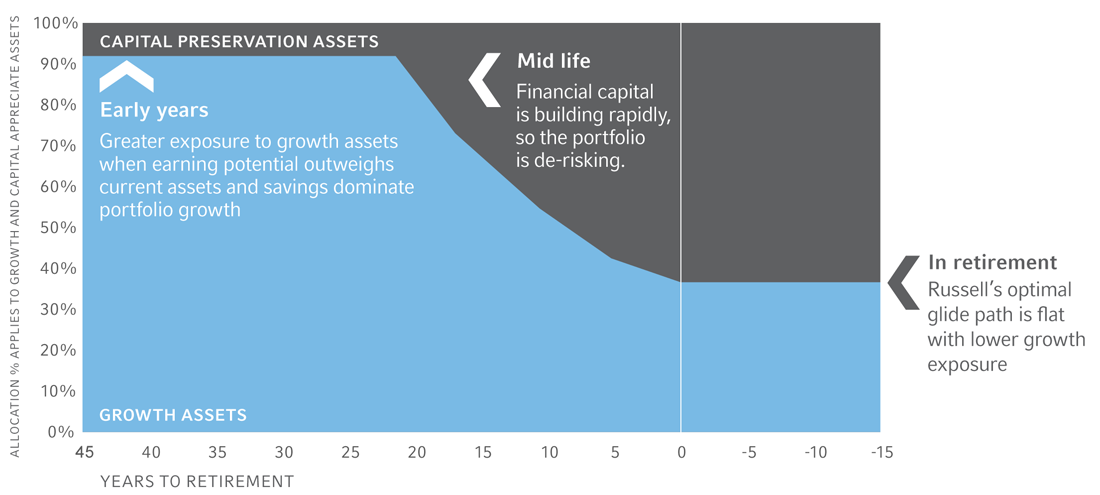

A target-date fund is just a mutual fund that gradually reduces risk as time goes on.

Target-date is just the most-common name given for this basic concept and/or investment strategy. It’s just the name of this product’s wrapping. Underneath the wrapper, it’s the same basic concept that’s been going on for decades to describe becoming more conservative as time goes on and retirement nears.

Target date funds are also known as target-risk funds, life cycle, target year, life style funds, and the list of things marketers call them continues to grow. No matter what they’re called, they’re all the same thing and there are no new ideas going on here — so all of the naming variations designed to make this investing strategy look different is just a marketing gimmick.

Target date investing strategies are for investors investing for retirement. Our Dynamic Target Date Models are hard-wired into thee Model Portfolios program (so the only way to get them is to buy the model allocation program).

Ours are dynamic, because all you do is input the year you plan to retire, choose one of thee five Investment Risk Tolerance Categories. other investor life-factors, and the asset allocation mix comprised of the current mutual fund picks change.

So if you’re investing for retirement, then all you’d have to do is buy and hold the mutual funds in that investor model and you’re done. Then you’d redo these inputs annually and repeat (yes, rebalancing is still required).

T he best thing to do if you’re a conservative investor, is to just use our No-load Conservative High-Income Model a few months before retiring.

Ours’ have the advantages of everyone else’s strategy, and also negates most all of the disadvantages of other similar retirement strategies.

To make this very long story very short, target date models are just a mix of asset classes that hold more fixed income securities and less equity as time goes on. So at the beginning of every year, a tiny bit of equity exposure (or riskier asset classes) is replaced by the same amount of fixed income (or safer asset classes).

The theory is that when the year of retirement happens, your allocation mix will be what you want it to be (less risky with more income distributions) so you can just flip a switch and they’ll start sending you a retirement paycheck from the portfolio (with minimal selling of equity shares, which minimizes capital gains taxes).

This rarely works.

We simply use the normal model asset allocation process and make your investment portfolio become more conservative and provide more income as you approach retirement. Yes this is really all there is to this investment strategy, so it was easy to just get with the same program.

These retirement models are dynamic, because all you do is input the year you plan to retire, choose one of thee five Investment Risk Tolerance Categories. other life factors, and the asset allocation mix comprised of the current mutual fund picks change.

It’s dynamic because risk tolerance and other life factors can change more than annually. Most life cycle strategies are static because there is nothing generating the asset class mix but the target year — so they’re static, meaning it’s not going to change regardless of what changes in your life — until another year just goes by.

This is never good; you need to roll with the punches in life or life will roll you.

For professional money managers, you can also choose which type of funding vehicle you want to use in each asset class. For example, if you’re working on a fee-basis, then you can only use the mutual funds that are used in the Fee-based Models. If you’re working on a commission-basis, then you’d choose to use only the load funds. Do-it-yourself investors would choose no-loads, ETFs, or index funds. You can choose between Fee-based, No-Load, All-Load, Index Fund, and ETF in each of the 15 asset classes in the models (yes you can mix them up all you want to).

It’s important to buy the annual subscription service so you can keep up with the actively-managed monthly mutual fund picks and changes in the models.

There’s nothing to see regarding our life-cycle models in the demo, except the input sheet, because things are too easy for competitors to copy. There is also no investment return track record because there are hundreds of combinations between the inputs (which one do you pick and use? Whichever one is chosen, you’ll be accused of cherry-picking).

If you’ve noticed, there’s not one large firm with a long-term track record for their target-date models. There may be soon, as this whole packaging wrapper has only been around since 2006 or so.

So the only thing you can do is compare our long-term performance of the regular models to other firm’s investment strategies.

The math in our Money eBook shows how getting just 2% less rate of return long-term results in having about half as much retirement income.

Something else that’s important to keep in mind: Now that you know what this is all about, the logical question is, whom do you trust to make these models?

Every time you see a set of Retirement Target Date Models, the buck usually stops with just one person. It’s usually a bunch of marketing people sitting around a conference table tackling the target date project, but these folks usually don’t know much about investment management.

So they pass the buck off to someone that does (usually a junior analyst, as the senior ones are too busy marketing or managing money). Then they make the allocation and pass that off to the financial calculator making people to create the money tool for it (if you noticed, just about every mutual fund family has a free target year calculator).

Read about the optimal age to collect Social Security

Financial Planning Software Modules For Sale Financial Planning Software Modules For Sale