Target Date Funds

Post on: 13 Апрель, 2015 No Comment

CONSIDERATIONS

Clicking the EXIT button on the actual Target Date Funds will take clients back to your website.

What’s in a Name?

Target funds go by a number of names. Target retirement funds. Target maturity funds. Lifecycle funds. Age-based funds. Birth date funds. They all operate in a similar fashion. If you were born in January 1970 and were expecting to retire at age 65, an investment in a target maturity fund with 2040 or 2035 in its name might be appropriate. An age-based fund for 40-year-olds might do the trick, too.

And lifestyle funds? Funds with lifestyle in their names often address an investor’s appetite for risk. Lifestyle funds may be offered for conservative, moderate, and aggressive investors, with asset allocations reflecting the degree of risk. Generally, the asset allocation percentages of lifestyle funds do not change over time.

The Basics

Target date retirement funds or lifecycle funds they go by a number of names — are designed to simplify investing, particularly investing for retirement. The target date is typically expressed as a year. Find the year thats closest to your anticipated retirement date among the target date funds offered in your retirement plan, and thats the fund for you. Simple enough.

A target date fund usually invests in a number of asset classes and mutual funds within those asset classes. Thats one of the advantages of investing in a target date fund. It diversifies your retirement investments. When you invest in a target date fund, you avoid being over invested in a single investment option.

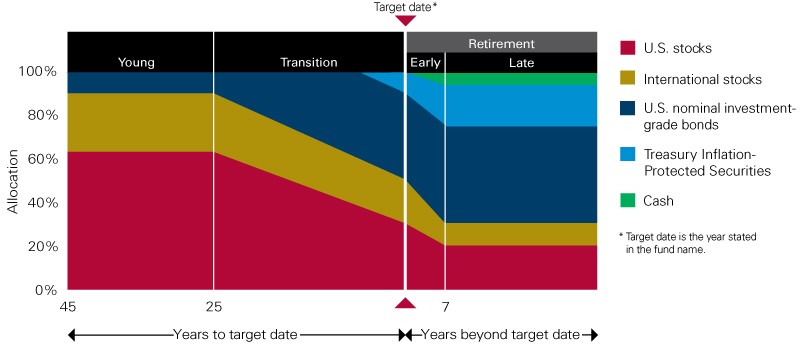

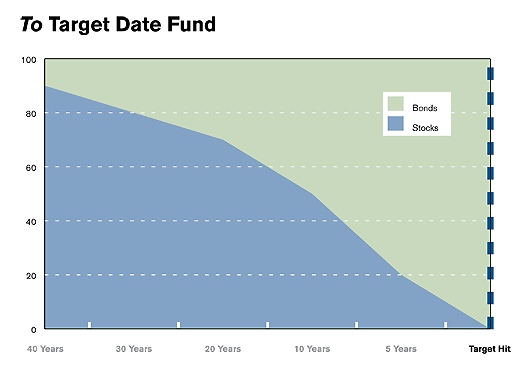

As the target date approaches, the target date funds investments become more conservative. In general, the idea is to take more risk (and potentially earn a larger return) while the target date is far in the future and to take less risk as the date gets closer (so as not to risk big losses and to preserve capital).

Heres a simple illustration.

Equities are generally regarded as a riskier investment with a higher potential return than fixed income investments and cash equivalents (presumably, the least risky investment). The 2020 fund has a more conservative (i.e. less risky) allocation strategy than the 2050 fund. And thats appropriate if your retirement is within sight. You dont want to risk your retirement nest egg by assuming too much risk.

The chart below may help.

Note how the equity allocation (the riskier part of the fund) is largest in the 2050 target date fund and grows smaller as the target date approaches the present. The riskier component declines the nearer you get to retirement. Correspondingly, the more conservative allocations increase the closer you get to retirement.

Target date funds in retirement plans are generally available in 5- or 10-year intervals. You may have the Golden Years 2020, 2030, 2040, and 2050 funds in your plan, for example. Or you may have the 2020, 2025, 2030, 2035, etc. funds. The selection process remains the same. Determine your retirement date and choose the fund that comes closest.

The managers of target date funds, who are investment professionals, reallocate the funds investments as the years go by so that the fund gradually becomes more conservative as the target or retirement date approaches. Thus, the 2050 fund may have 70% or more in equities in the year 2020 (30 years from the target date) but will own a much smaller percentage of equities in the year 2049.

And thats another advantage of target date funds. Investment professionals implement an asset allocation strategy that is appropriate for the retirement plan participants retirement date. Studies show that asset allocation may be the most important component of retirement investing. Still, many plan participants dont understand or appreciate its importance. With a target date fund, all you need to do is determine the year when youre planning to retire. Experts do the allocating for you.

They also do necessary rebalancing. Suppose the funds target allocation for a particular year is 65% equities, 25% fixed income, and 10% cash. Thanks to a stock market rally, the equity percentage of the fund climbs to 70%. To rebalance, the fund manager takes money out

of the equity portion so as to get the asset allocation percentages back in line with the target percentages. Rebalancing is important if youre managing your own retirement account investments. With a target date fund, rebalancing is taken care of for you.