Supply Demand And Interest Rates How They Relate

Post on: 16 Март, 2015 No Comment

Interest rates are prices

Overview

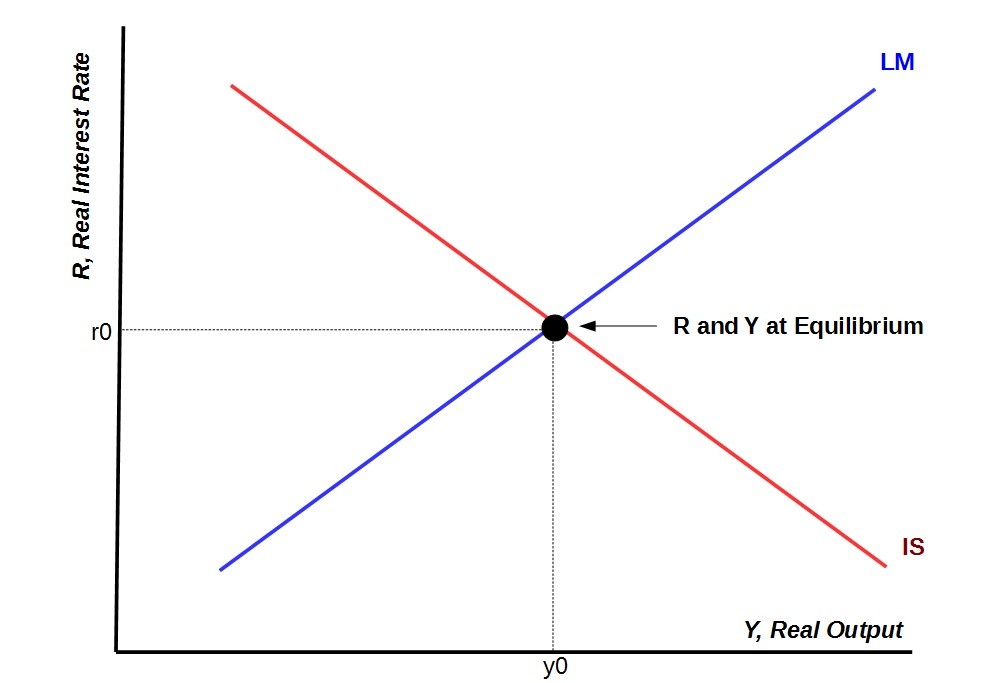

The starting point in any analysis of interest rates is the recognition that they are prices — and as prices the best way to understand them is with the supply and demand tools we learned earlier. We have used the supply — demand model to explain wages, stock prices, and exchange rates and now we will use it to explain the price of money. The graphical version of the Supply — Demand model of the money market appears below.

Diagram 1

Money Market

While we will not embark on an extensive review of the Supply and Demand model of prices, you should review the cookbook approach. The important steps in the approach are:

- identify the market

- identify the players (buyers and sellers)

- explain the behavior of the players

- describe the situation graphically

A schematic of the cookbook approach to the money market appears below. The market is the market for money in which the interaction of suppliers (Fed and banks) and demanders (individuals and firms) determines the price (interest rate). In the remainder of this section we will fill in some of the details concerning the Players in the market.

Diagram 2

A Schematic of the Money Market

We will begin our analysis of money and interest rates with a treatment of money demand based on the work of Keynes. This will be followed with a discussion of the money supply process which will include a discussion of the Fed, the central bank of the US, and the process of money creation that links the Fed, banks, and the money supply. When we are done you should be able to explain past interest rate movements and / or forecast future interest rate movements.

Money Demand

Why do people want / demand money? As you will recall from our earlier discussion of the Classical economists (1930s ), money was traditionally viewed as simply a medium of exchange. Money had no intrinsic value so people demanded money simply to facilitate their transactions — if they had money they would spend it, and if the volume or price of their transactions increased, they would need more money. This transactions demand is described in the Transactions Demand schematic below where more income leads to more transactions which leads to demand for more money.

Transactions Demand for Money