Study Only 24% of Active Mutual Fund Managers Outperform the Market Index

Post on: 24 Май, 2015 No Comment

- Only 24% of professional investors beat the market over the past 10 years

- Index funds outperform actively managed funds by 0.80% annually, but active managers have lower risk

- Active managers outperform the index by 0.12% before fees, but charge more in fees than the value they create

- Large funds significantly outperform small funds with much higher returns and lower risk

- Smaller stocks are riskier than large stocks, but don’t necessarily deliver higher return

- Growth stocks significantly outperformed value stocks over the past decade

Do professionals outperform the market? The data still says no.

Mutual fund investors must make the decision to pay to have their money actively managed by a professional or to passively invest in the market index at a lower cost. Past academic studies have indicated that professional investors are not worth the cost because the after-fee return is lower than that of the market index. Theoretically, active managers as a group will have a hard time outperforming the market over the long-run because professional investors are a large portion of the market and once fees are netted out, they are likely to underperform a passive index.

Despite the academic theory, investors have continued to pay for active asset management, preferring to try to pick a winner rather than playing it safe. As of December 31, 2012 there was over $7 trillion invested in over 23,000 actively managed mutual funds and ETFs, almost three times the $2.5 trillion invested in passive funds. Could this many people really be wrong?

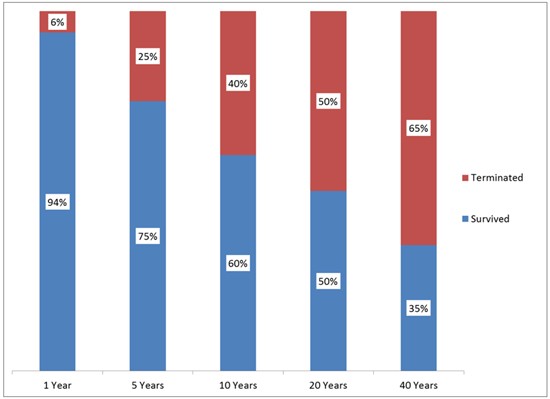

NerdWallet investigated by examining the actual outcomes over the past decade of investing with active versus passive management. The study looked at more than 24,000 mutual funds and ETFs available to U.S. investors for the ten-year period ending on December 31, 2012. Of these, only 7,943 were in existence for the full ten years.

The asset-weighted average return of the actively managed mutual funds over this period was 6.50% while the passively managed index products averaged 7.30%. Similarly, for equity funds the average return was 7.19% for active managers and 7.65% for passive funds. Index funds outperformed actively managed funds regardless of whether returns were measured by asset-weighted average, median, or a simple average.