Stock Trading Strategies Predator or Prey

Post on: 5 Июнь, 2015 No Comment

Understanding time frames and how traders with different stock trading strategies interact, is challenging to understand for even experienced traders. There are many different stock trading strategies that work and this lesson unifies all those stock market trading strategies into one grand unified theory lesson.

Many years ago, Steve Sando who lives in Californias Central Valley, posted an article on www.HardRightEdge.com where he compared the interaction of different stock trading strategies in different time frames, to fish in a pond. You can read Mr. Sandos article here: Predator Or Prey? Mr. Sandos article, in my opinion, is the grand unified theory of all stock trading strategies. Rather than looking at each trading strategy as a different style, it unites all styles under one lesson. Dont be surprised if Mr. Sandos article stays within your head for the rest of your trading career. If there was a noble prize of stock trading, my vote would be for Mr. Sando and his grand unified theory of stock trading.

I have found there are two ways that investors and traders will respond to this lesson. The first group will have a light bulb moment when they first read this lesson. They will email and write me that this is one of the most enlightening lessons they have ever seen. The second group will get extremely angry. They will email me and say, Lance, you are sick. Thats gross and a real fatal way of looking at stock trading.

The second group of people are usually investradors. The term investrador is a combination of the words investor and trader. The term investrador designates the trader who starts out going for a 5% to 10% gain in a stock. The price action moves against his position but instead of selling for a loss, he morphs into a long term investor. Investradors provide food for all the other fish in the pond to feed on.

In the video below, I made Mr. Sandos article into a short animation. Enjoy!

Frequently Asked Questions about Stock Trading Strategies: Predator or Prey

What do day traders look for?

Day traders look for quick positions that they can be out of in minutes to hours. Day traders usually close all positions before market close of the trading day.

Day traders look for stocks that have good volatility and good liquidity. Day traders also look for stocks that have narrow spreads between the bid and the ask.

MarketGeeks posted the excellent video below called How To Select The Best Stocks For Day Trading.

What are institutional traders?

Institutional traders trade with huge amounts of capital. They are the biggest fish in the pond. Institutional traders are banks, finance companies, mutual funds, pension funds, insurance companies, and so on.

Institutional traders are the biggest participants in the market. They account for roughly 70% of the trading on the NYSE.

Institutional traders are usually buy and hold investors but there are institutional day traders as well.

Watching what institutional traders are doing can be very helpful in predicting market direction.

I posted the video below about what I use to track institutional buying activity.

What does Market Maker mean?

A Market Maker means a company, or individual, that provides liquidity to certain markets by quoting both a buy and a sell price on stocks held in inventory, with the goal of making money from the bid-offer spread.

Most exchanges and markets have designated Market Makers, formerly known as specialists, who act as the official market maker for a given security. The Market Makers provide a required amount of liquidity to the securitys market, and take the other side of trades when there are short-term buy-and-sell-side imbalances in orders. In return, Market Makers are granted various informational and trade execution advantages.

The most important Market Maker to look for is called the Ax. This is the Market Maker that controls the price action in a given stock. You can find out which Market Maker this is by watching the level II action for a few days the Market Maker who consistently dominates the price action is the Ax.

A few designated Market Makers you are likely to come across are on your level II quotes are: NITE, SCHB, TDCM, ETRD, ARCA.

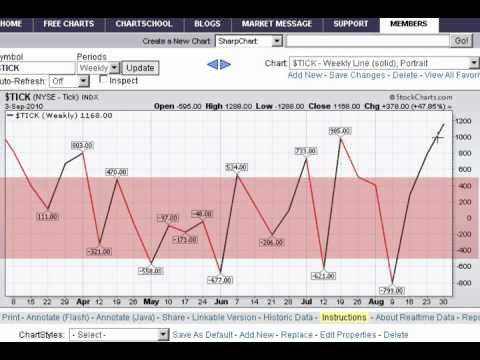

The way I track institutional buying is by watching the Market Makers ability to match up a buy order with a sell order. If the Market Makers are unable to match up a buy order (+1 tick) with a sell order (-1 tick), by the end of the day, that suggests wide-spread buying by institutional traders across entire sectors when that imbalance exceeds +700 or -700 on the tick.

MoneyWeek posted the excellent video below called What are Market Makers?

What is scalper trading?

Scalping is a type of trading strategy based on fast momentum trades.

Scalpers move quickly in and out of a stock dozens of times a day. Scalpers are so active because they are only going for small profits on each trade and these small profits will add up to a lot of money by the end of the trading day.

TheMoneyManiacTV posted the video below called Day Trading Scalping Strategy.

Are You Tired of Being Everyone Elses Food? Learn To Go From Being Prey, Into Being a Predator. Click Here To Learn More About Jason Bond Picks Swing Trade Service and For a Special Offer!