SREIT Investor All about REIT The IPO Prospectus

Post on: 16 Март, 2015 No Comment

Try Earthfie!

Directory

All about REIT Introduces concepts and terminologies about REIT.

Stock Target Price Stock target price or recommendations by brokerages.

About a Reit Talks about a particular REIT. Includes latest or historical performance, its business, and more.

Books and Thoughts About investment books and thoughts after reading.

Sunday, November 28, 2010

All about REIT — The IPO Prospectus

In recent weeks we have seen an increase in the number of companies going for IPO. The most notable ones being that of Global Logistics Properties (GLP) and Mapletree Industrial Trust (MIT), which are linked to GIC and Temasek Holdings respectively. Just last week, we were looking at the listing of Sabana Reit, the first Shari’ah Compliant Reit in SGX.

For an IPO, the main avenue for retail investors to access and evaluate a company will be the IPO prospectus. However, it is very unlikely for someone to read the whole IPO prospectus because it is usually a few hundred pages thick. For example, the IPO prospectus for Sabana Reit comes with a whopping 480 pages! So what shall we look out for in an IPO prospectus? I will be sharing here some of the main items I will look at in the IPO prospectus for a Reit. Though the sharing here is Reit-centric, I think most of the things should apply equally well for the IPO of normal companies. I shall use the IPO prospectus of Sabana Reit as a reference here.

Where to Find the IPO Prospectus

First and foremost is of course where to get hold of the IPO prospectus. I remember few years back when I was working near the SGX centre, I will frequently see a desk being placed outside, with a staff manning a few hundred copies of the IPO prospectus whenever there is an impending IPO. Thanks to the advent of technology, now we no longer need to go all the way to SGX centre to carry back the very thick prospectus. With the MAS Opera site, we can easily download the PDF copy of the prospectus through the internet. You can easily find the MAS Opera site by googling for the phrase MAS Opera. The site should appear right at the top or near the top.

Once you are in the main page of the MAS Opera site, you should be able to see a category called Collective Investment Scheme Offers. The IPO prospectus for Reits can be found under this category. This category also includes prospectus of Unit Trusts to be launched by Fund Houses. For normal companies you should look under the category Share Offers .

Preliminary and Final Prospectus

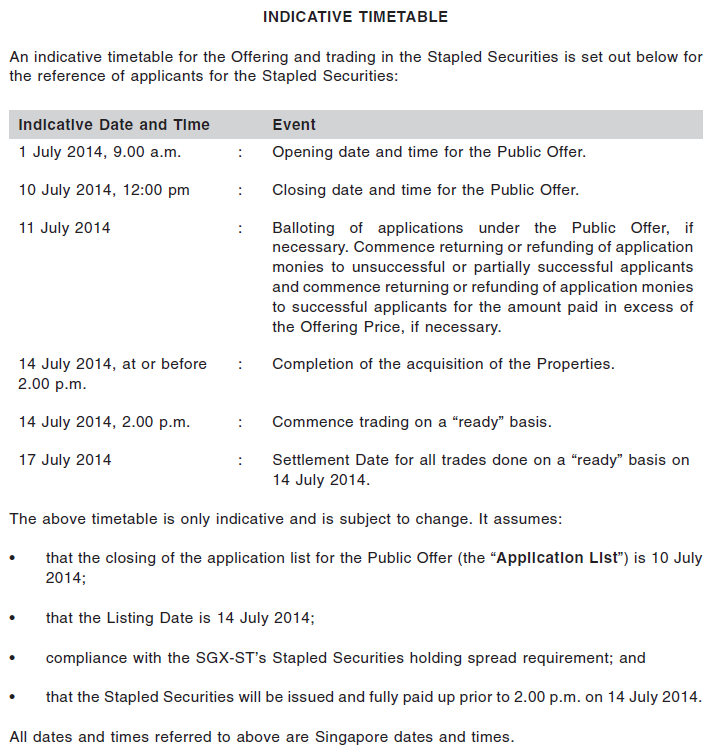

When a company or a Reit has announced its intention for listing, it will usually lodge a preliminary IPO prospectus with the Monetary Authority of Singapore (MAS) first. When its nearer to the IPO date, the final prospectus will be lodged. There shouldn’t be too much differences in the contents, except that the final prospectus should provide details of the important dates for the IPO, such as the subscription period and listing date. Both the Preliminary and Final Prospectus can be found in the MAS Opera site.

The Cover Pages

Without even going into the main contents IPO prospectus, the cover and the first few pages alone will usually give you a general idea about the company/Reit. For the Sabana Reit prospectus, it has provided in its cover pages the summary information about its IPO price, number of units to be issued, its nature of business, its strategies, the projected yield, the indicative timetable, etc.

Use of Proceeds

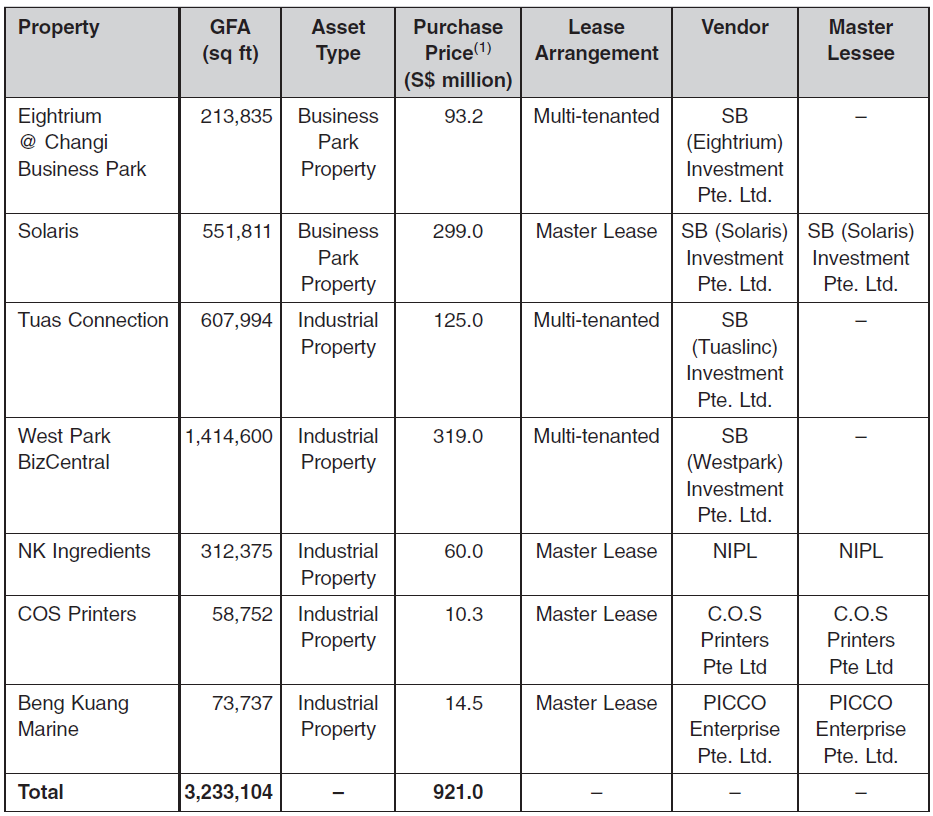

We should get some idea of what the proceeds raised for the IPO will be used for. Other than for acquisition of the initial properties from the Sponsor, sometimes it may also be used for initial debt payment, which is the case for Mapletree Industrial Trust.

For Sabana Reit, the details of the Use of Proceeds can be found in Pg 75. Most of the proceeds of about S$885 million will go into Acquisition of the Properties, with about S$34 million as transaction costs.

Projected Yield

The projected yield is a very important information for Reits and it will usually be provided in the prospectus, as it is mandatory for Reits to distribute at least 90% of its distributable income. The projected yield is calculated based on the IPO offer price of the Reit. For IPO prospectus of normal companies, this information may not be provided as some companies may be more focused on growth, and thus the dividend payout may not be that predictable.

In the Sabana Reit prospectus, the projected yield can be found in the cover pages, and more details are provided in the PROFIT FORECAST AND PROFIT PROJECTION section on Pg 36. The projected yields for Sabana Reit are 8.22% and 8.25% for 2010 and 2011 respectively, based on the issue price of S$1.05. This information can then be used to compare with yields of other Reits, preferably in the same sector, i.e. industrial Reits.

Initial Gearing

Sometimes comparing yield with other Reits alone is not sufficient. We should also compare the gearing. Gearing is defined as the debt over the total assets.

The gearing may not be provided in a standard section in the prospectus. You can search for key words like Gearing or Aggregate Leverage to find it.

For the Sabana Reit prospectus, the gearing or aggregate leverage can in fact be found in quite a number of places. One such place will be the section on Capital structure that provides stability and future financing flexibility. Here the figure provided is 26.5%. This is lower than most of the industrial Reits, which are around 30 to 39%.

Sponsor

The sponsor of the Reit may not be something quantifiable like the yield or gearing, but it does give us an idea of how well the Reit can be supported in times of need. Market may give the Reit a premium by virtue of its sponsor. Most of the earlier Reits have sponsors that are either listed blue chip companies (Capitaland, Keppel Land) or government linked private companies (Mapletree Holdings). Recently we are seeing listing of Reits by smaller players such as CWT, sponsor of Cache Logistics Trust.

In the prospectus for Reits, there is usually a section about the Sponsor. For the Sabana Reit prospectus, it can be found on Pg 160. The sponsor of Sanaba Reit is Freight Links Group, a leading international total logistics solutions provider with a strong presence in Singapore and the Asia Pacific region. It is also listed in the SGX mainboard, though many may not be familiar with it before the IPO of Sabana Reit.

NAV per Unit

The NAV per unit is usually used to compare with the share price of the unit to determine how much it is in discount or in premium. The IPO price is usually higher than the NAV per unit. It may not be favourable if the price has too much premium over the NAV per unit. You may also need to compare with the market whether Reits are generally trading in premium or discount, and by how much.

For Sabana Reit the NAV per unit is S$0.99. This can be found in the section UNAUDITED PRO FORMA BALANCE SHEET AS AT THE LISTING DATE on Pg 35. The IPO price of S$1.05 is at about 6% premium.

Pro Forma Financial Statements

The Pro Forma statements will help you have a rough idea of how the Reit is going to be performing after IPO, like what is the net profit is going to be like based on the initial portfolio of properties. But you must take note of the assumptions made in the prospectus in coming out with the figures. The Reit may not perform as indicated in the Pro Forma statements as they are after all derived based on the assumptions made.

Others

Although the above figures and information are important to look at in the prospectus, it doesn’t mean that other information is not important. If time allows, you should try to cover as much of the prospectus as possible. Items such as Risk factors are definitely worth a look in helping to evaluate the IPO. It will be good if you can look for external sources of information about the Reit and its sponsor, such as any analyst report about the IPO to get a better picture.

Now the above figures are primarily useful for comparing with Reits of similar nature in the market. They are not useful for predicting the opening price on the listing day, as that is usually sentiments driven. Personally I find that compared to normal companies, it is easier to gauge whether the price of a Reit has run up too much on listing day, as its yield cannot be too far off from its peers in the market.