SMART INVESTOR There s No Point In Trying To Pick A Winning Fund Manager

Post on: 23 Апрель, 2015 No Comment

Get the best Credit Tips at Credit Visionary

In the world of investment guidance, no concern gets individuals more riled up than this:

Whats the very best method to beat the market?

There are two kinds of answers those from individuals who believe individual investors in fact can beat the market (and have any company attempting), and those from individuals who find the concept downright absurd.

In a recent tete-a-tete, wealth manager and author Daniel Solin handles Investopedias Michale Schmidt, who recently wrote a post suggesting to assist investors choose a fund with a succeeding manager in order to much better their probabilities at beating the market.

Theres a reason those who discuss selecting winning mutual funds are long on rhetoric and short on information, Solin composes. Theres no trustworthy evidence anybody has the capacity to take part in this exercise successfully.

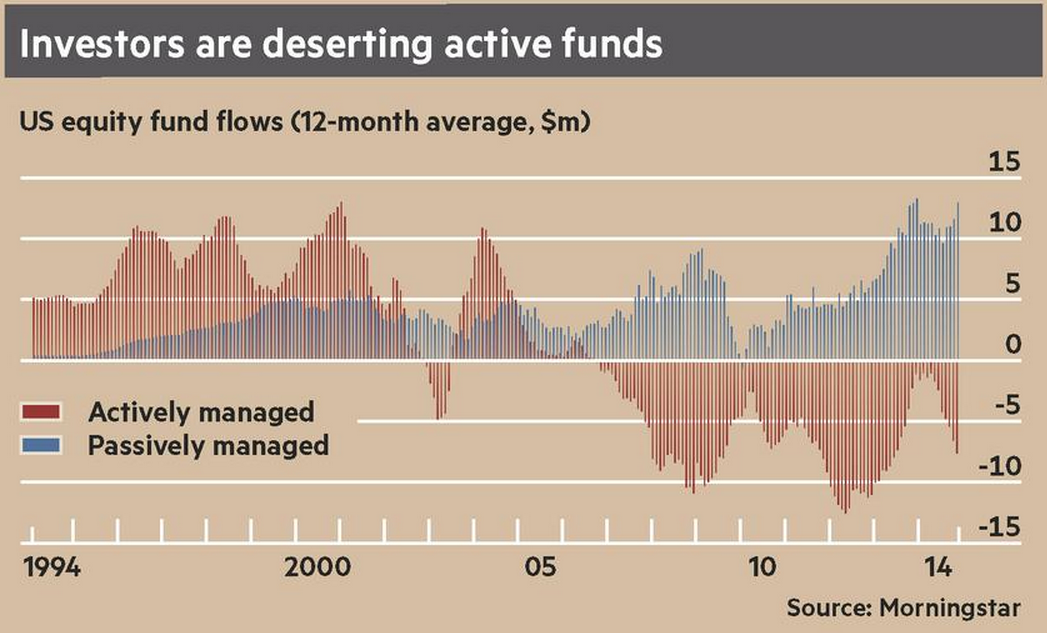

In his takedown, Solin highlights a research by financial investment management company First Quadrant, in which the authors found the ordinary actively handled fund underperformed its standard by a 4.17 % after taxes over a 10-year period. Just 9 % of the funds beat their benchmark after taxes, and of that pool, they won just 1.79 % of the time.

The benchmark they sought to beat? The Lead 500 Index Fund, a low-cost fund thats quickly available to most individual investors.

That backs up the claim in a current white paper by Portfolio Solutions and Improvement, The Case For Index Fund Portfolios, which also found that they can rarely be beaten.

Looking at sophisticated portfolios holding 10 possession classes in between 1997 and 2012, researchers found index fund portfolios outperformed similar actively handled portfolios a shocking 82 % to 90 % of the time. And the longer investors held those investments, the better shot theyd at outperforming active funds over time.

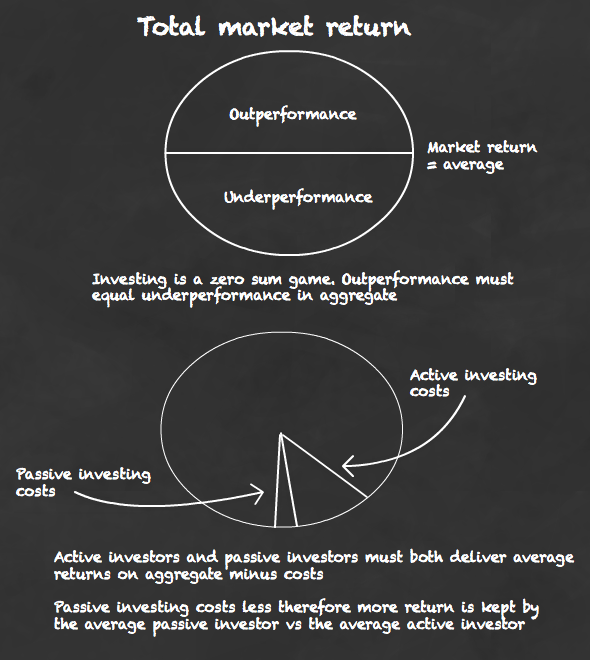

Heres the bottom line, as Solin puts it: The game of trying to pick outshining fund managers isnt deserving of your time or effort. Youre unlikely to be successful. Rather, you must concentrate on your property appropriation, purchase a worldwide varied portfolio of reduced management fee index funds and concentrate on aspects you can regulate, such as diversification, fees, bills and taxes.

Join the conversation about this story