Smart Alpha Addresses Inherent Risks Of Smart Beta

Post on: 18 Апрель, 2015 No Comment

- Article Comments (0)

By DailyAlts Staff

Smart beta has become the darling of the financial media, but the popular strategy has several shortcomings that most investors don’t properly appreciate, according to the authors of the new whitepaper, Understanding the Risks of Smart Beta, and the Need for Smart Alpha . In the paper, authors Richard Yessenchak and Phillip Whitman, both portfolio managers at INTECH, cite several risk factors for smart beta and introduce the novel concept of smart alpha.

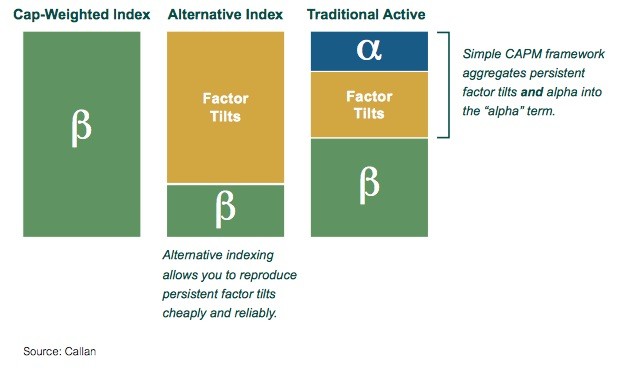

While traditional stock-market beta is typically measured by the market cap-weighted S&P 500, smart beta strategies are indexed to customized, non-cap-weighted indexes. The idea is that traditional cap-weighted indexes inherently overweight overvalued stocks and underweight undervalued stocks, thereby depressing returns.

Smart beta strategies weight their investment allocations according to alternative factors, such as quality, value, momentum, and dividend yield, rather than (or in addition to) price and size. Investments within a smart beta portfolio are often rebalanced frequently, which differentiates them from other passively managed strategies and gives smart beta features of active management.

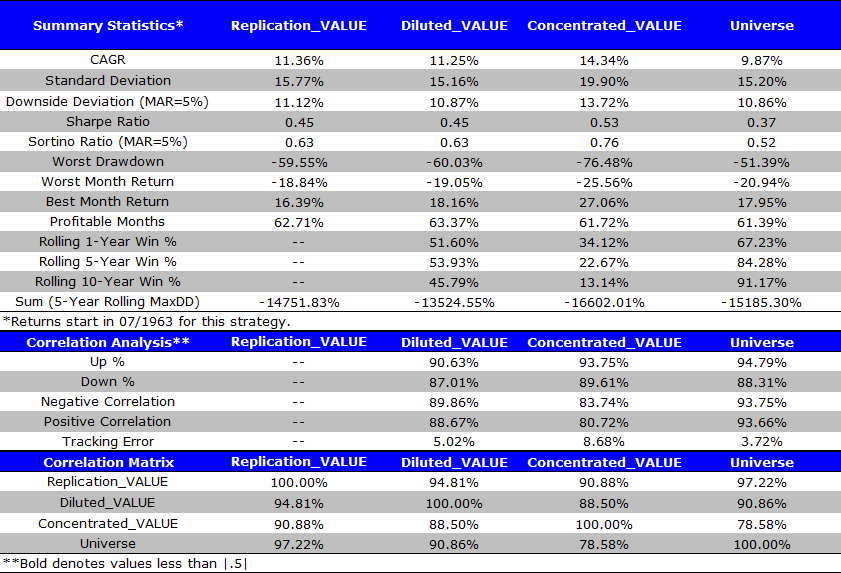

Unfortunately, while smart beta correctly identifies some problems with traditional market cap-weighted and price-weighted indexes, smart beta itself has three major but largely unappreciated risk factors:

- Exposure risk. Smart beta portfolios are often non-diversified, with concentration risk arising from the selection methodology;

- Relative and absolute risk. Smart beta portfolios have difficulty managing tracking error and achieving an optimal tradeoff between risk, return, and transaction costs; and

- Implementation risk. Smart beta portfolios have liquidity risks, as well as the risk of overcrowding.

Overcrowding occurs when too many investors flock to a particular strategy, driving up prices and thereby depressing returns. As the image below demonstrates, money has been flowing into smart money ETFs and mutual funds at an accelerated pace since 2009:

INTECH’s research indicates that the systematic rebalancing of smart beta strategies has contributed more to their recent returns than anything related to specific smart beta factors. With this in mind, Mr. Yessenchak and Dr. Whitman introduce their cap-weighted but frequently rebalanced smart alpha concept.

In contrast to smart beta, smart alpha targets a more optimal tradeoff between return, risk, and transaction costs. Smart alpha allows for customized solutions to meet investors’ specific risk budgets and return targets, based on a deep understanding of when and why to re-weight portfolio holdings. This understanding allows portfolio managers to control risk, increase efficiency by specifically avoiding liquidity risk, overcrowding, and predatory trading.

By using market cap-weighting with active rebalancing, smart alpha creates a more diversified portfolio across industries and factors than smart beta, and thereby manages exposure risk and improves the consistency of portfolio returns. Smart alpha uses proprietary optimization processes that also mitigate relative / absolute risk and implementation risk, and randomization processes to thwart predatory trading. In the words of Yessenchak and Whitman, smart alpha provides better risk controls that potentially lead to higher returns at comparable or reduced risk compared to smart beta strategies.

Smart beta is seen by some as a media darling, by others as a marketing gimmick, and still others as an interesting new way to balance risks and potential returns. In Understanding the Risks of Smart Beta, and the Need for Smart Alpha. Mr. Yessenchak and Dr. Whitman demonstrate that a significant portion of smart beta’s recent returns have been derived from well-timed rebalancing, not the strategic selection of factors. Smart alpha provides a market cap-weighted strategy for achieving returns above beta, which is an interesting alternative to smart beta’s alternative indexing.

Read more articles from Seeking Alpha:

- Actively Pursuing Growth: Validea’s Market Legends ETF

- Why European Equity?

- How To Beat The Market Using Tactical Asset Rotation

- New Report Concludes Alternatives Needed For Changed Market

- When Will The VIX Tell Us It’s Time To Buy SVXY?