Single Stocks Vs Mutual Funds Making the Right Choice for You

Post on: 4 Апрель, 2015 No Comment

If you were to really look at the core of most retirement plans and investment portfolios in America, you would uncover a battle of single stocks vs mutual funds.

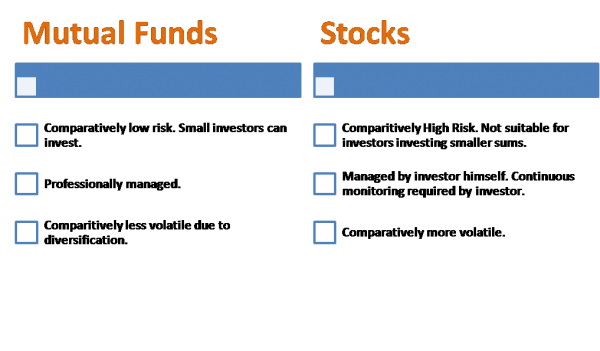

Single stocks are assets that the investor purchases through investment companies or brokerages. Mutual funds are more of a hands-off approach to investing that does not require the investor to get involved in the process too deeply.

Though both ways have proven to be good investment choices with their own risk factors, knowing the key differences is vital for the investor to make the right choice.

When you compare stocks to mutual funds, mutual funds may be the first choice for an individual as it offers diversification, low cost and convenience over the single stocks. This is more of a passive method of investing whereas with individual stocks the investor is required to participate actively in the process to see appreciable gains.

The two methods ultimately give you the profits you seek to achieve. But the approach they use is different and should be considered with care before you opt for a particular method.

Single Stocks Vs Mutual Funds Diversification Reduces Risk:

It is a given point among investors that diversification is the only way to minimize the risks involved and make huge profits. When you consider the individual stocks portfolio, you can diversify it by purchasing different stocks from companies that belong to different sectors. You can also hedge your investment by purchasing dividend paying stocks .

For a portfolio to be risk free and give you great returns a minimum of 20 different stocks are needed. The only risks present are in relation to the market fluctuation. But buying so many different stocks is not something that everyone can afford.

When you compare the individual stocks with mutual funds in this aspect, the mutual funds score better as they come with an inherent diversification. Investors can choose from different asset varieties like for instance, industrial sectors like tech, energy or financial to foreign exchange, commodities and retail.

With mutual funds, you can easily have several stocks with the equity making up only a minor percentage in the portfolio. This in fact is both just as much an advantage as it can be perceived as a drawback.

Controlling the Investment:

When you compare individual stocks with mutual funds, you need to take into account factors like

- The amount of time you can spend on the investment procedure

- The experience you have in the field

- The capital you need for the investment

All the above factors are important and play a crucial role in your decision. If you do not have the time or the experience needed, handing over the control to the mutual fund management is the wise choice.

But if you are confident of controlling the investment, going for the individual stocks rather than the mutual funds will give you a greater advantage and potential for profits. You can also considering opting for the single stocks as well as mutual funds, if you are sure of managing them properly.

Commission Concerns:

In case of the individual stocks, the commission you pay for the brokerage firms for buying or selling the stocks is the only amount you have to think of.

In mutual funds, you have to contend with both commission charges as well as other charges, which are not present in the single stocks. The additional charges include a 1% expense ratio for seeing to the overheads in the fund, the redemption fees for the management and marketing of the fund, and also the sales load. The sales loads are estimated to be around 8.5%, while redemption fees account to around 2%

Convenience Matters:

While equating the individual stocks with mutual funds. the mutual funds are more convenient, as the key decisions like asset allotment, research needed and keeping track of the market trends are taken over by the mutual fund management.

Even if you are ready to concentrate and give your whole attention to the investments, the possibilities of losing still loom large. Similarly even mutual funds do not give a total guarantee of value appreciation, but the complicated and challenging decisions that you need in the single stocks is not present here.

Tax Efficiency:

For a better control over the taxes you pay, stocks are the best bet. Tax efficiency is better in the United States as you can decide on when to sell or buy. Even if you use a portfolio manager, the fee you pay is deductible.

If taxes do not matter much to you, mutual funds can be opted for. Here the management fees are not tax deductible, and you cannot control how much or when you pay the taxes.

In a negative market situation, even if your fund value goes down, you still have to pay taxes for the capital gains that the managers make by selling of the winning stocks to compensate the losses.

As you can see when it comes to single stocks vs mutual funds, it all depends on your preferences and the resources you have at your disposal. While for some the minimal volatility of mutual funds is attractive, for those who do not mind the risks involved, the individual stocks are better choices. Both are effective investing methods and the choice depends on the objectives the investor has in mind.