Signs You Need a Money Manager Now

Post on: 10 Июль, 2015 No Comment

Do you know if you will have enough money in retirement? And is your current portfolio performing up to expectations? These are two important questions to ask yourself, and if you don’t know right now, you may want to consider an outside money manager this year.

You Have Significantly Underperformed the Market

One of the most straightforward signs that you need a money manager is if your portfolio is failing to meet up to expectations. The most obvious comparison investors should make (and don’t make often enough) is their current money manager’s performance versus the appropriate index. A very important component of investing is relative performance, or compared to a benchmark. For stocks, the S&P 500 is a logical and straightforward bogey to compare against. For 2013 “the market” (benchmark) was 32%. If your stocks did far less than the market, something may be wrong with your current situation. On the other hand, one year isn’t always enough. Performance over the past five years compared to an index is worth a look.

A more general consideration is whether you aren’t saving enough for retirement. This warrants a more absolute analysis. Back when interest rates were closer to 5%, a $1 million retirement portfolio could be counted on for $50,000 in annual income. This didn’t protect it much against inflation, but the 10-year Treasury rate is currently only at 2.73% and means it now takes closer to $2 million to have a similar level of income in years past. Hiring a money manager can help you crunch the numbers and get a more definitive savings plan in place.

You are not an Enterprising Investor

Ben Graham. widely considered the father of modern security analysis and value investing, made a unique distinction between the two main types of investors. In one of his more favorite quotes in the classic investment text the Intelligent Investor. Graham wrote: “The rate of return sought should depend, rather, on the amount of intelligent effort the investor is willing and able to bring bear on his task.” In other words, investors who are especially enterprising have the time and interest to devote to their own investing. On the flip side, defensive investors don’t have the time or interest and should therefore look to outsource their money management activities to an outside money manager. This basically boils down to do-it-yourself or do-it-for-me investing. Those in the latter category should hire a money manager, or new one if the current manager isn’t stacking up to the index.

Your Plan Requires You to Choose a Manager

Most investors in the U.S. have retirement assets in which they don’t have a lot of control in selecting asset managers and individual investments. Retirement plans, including the more traditional pension (defined benefit ) and 401(k) (defined contribution ) are controlled by the underlying company that is trying to please a large group of employees at once. Pensions would simply pay a set amount after a number of years of service.

And though 401(k) plans leave the individual investment choices to employees, the list is likely going to be limited. Most of these plans specialize in offering mutual funds, many of which are actively-managed and by definition have an outside manager running them. In this case, you will need to “hire” the best ones per asset class. Important metrics to look for include the aforementioned performance results, how long the manager has run the portfolio, and analyzing the information the employer provides on the individual investments.

You Understand the Game

If you hire an advisor, the two most important metrics to be aware of are fees and performance. We touched on performance above. Regarding fees, an active manager (one who is actively looking to beat the market) earns his or her paycheck by outperforming the market. This should ideally be over a full market cycle of three to five years, though one extremely bad year could be cause for concern. And if a manager can beat the market, he or she needs to outperform by more than the management fee to add to value for clients. Generally, a fee of 1% is quite reasonable to manage a stock portfolio. Large 401(k) plans should charge less than 1%, as should bond funds. Be very wary of investments that charge more, such as hedge funds that generally charge a 2% management fee and can take as much as 20% of the profits when outperforming their benchmark.

Another perfectly viable option is passive options. In that case, their fee should be much less than what an active manager might charge. In return, the best an investor can do is match the index, less the small passive fee needed to run the portfolio. Jack Bogle founded Vanguard Group on this premise and is widely considered the father of passive investing. In his mind, most active managers fail to outperform the market consistently and don’t deserve the active fee they charge.

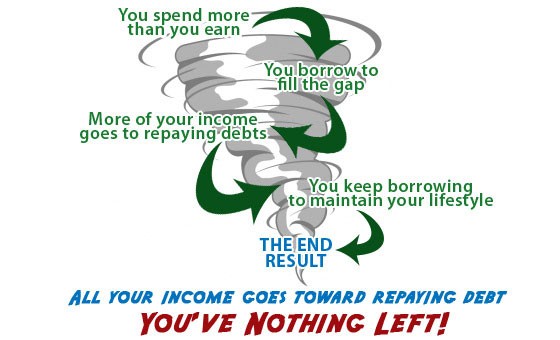

You are Just Not Good with Your Money

Returning to portfolio performance, some people simply have problems staying disciplined with their finances. This includes not spending within their means or not putting 10% of each paycheck away in retirement. This level is widely considered necessary to be worth $1 million or more at retirement. If you believe you need more help setting financial goals, outside help from a money manager could prove ideal. One article even suggested a daily money manager to help you sort mail, pay bills, reconcile accounts, and help out with the nuts-and-bolts of being disciplined with your money.

Considering an outside manager can be an important step to eventually securing financial freedom, or at least enough funds in retirement to cover bills and leave funds to travel and enjoy life. Fees and performance are the two most important components if you hire an outside manager, though there are many other considerations too.