SideBySide Management May Favor Hedge Over Mutual Funds

Post on: 10 Июль, 2015 No Comment

The hedge fund industry has seen substantial growth over time as high-net worth individuals have flocked to this investment class. Its attractive structure and compensation have also attracted some of the best money managers in the world, often at the expense of the mutual fund market. To help minimize the impact of this shift, institutional investment advisory firms have argued that for mutual funds to maintain talent they should be managed by people also running hedge funds. In this article, we’ll show you how to decide if it is beneficial for you to have one firm handle both your hedge and mutual funds together.

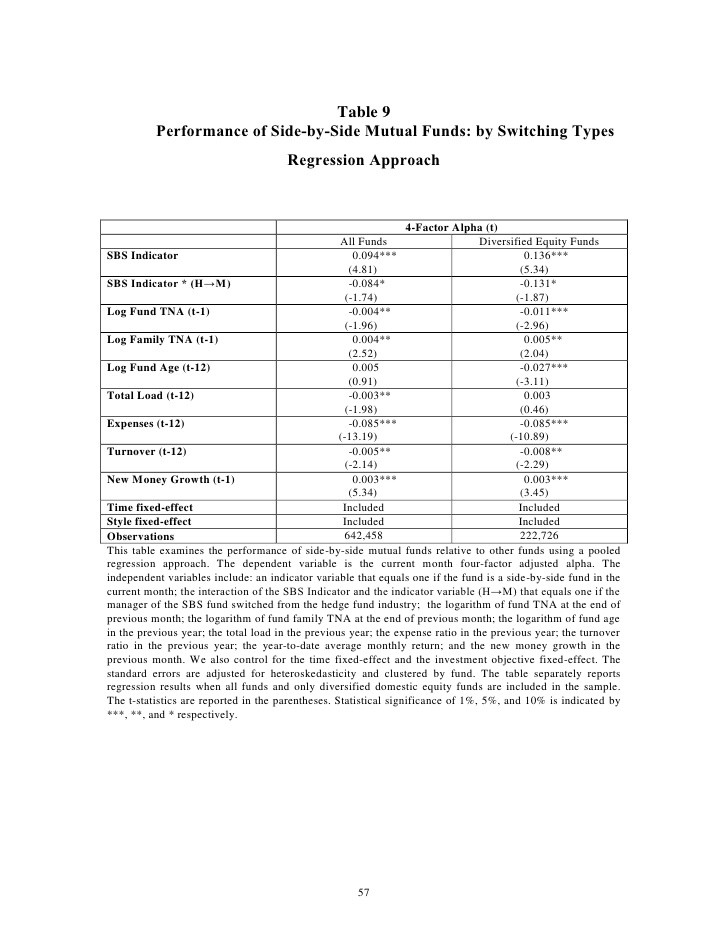

A new study that analyzes the performance of institutional investment advisors who manage hedge funds side by side with mutual funds tells a different, more complicated story. The researchers found that the structural differences between fees and ownership often cause side-by-side managers to make portfolio decisions that favor hedge fund investors at the expense of mutual fund investors, with expense being the key word.

Empirical Evidence

The study, For Better or Worse? Mutual Funds in Side-by-Side Relationships with Hedge Funds. (2006), found that conflicts of interest motivate side-by-side managers to strategically transfer performance from mutual funds to hedge funds.

The study was produced by three academic researchers, Gjergji Cici, Scott Gibson and Rabih Moussawi, from the WhartonSchool (University of Pennsylvania) and the College of William and Mary. It tracked the performance of 71 advisory firms who managed 457 equity mutual funds. These funds were run side by side with hedge funds for at least some period of time between 1994 and 2004. For control purposes, the researchers also chose a group of funds that were the same in major respects, except that these funds were not affiliated with a hedge fund at any time.

The study makes several key points that investors should know about:

- Fund managers receive higher compensation (relative to mutual fund managers) when hedge funds perform well.

- Mutual funds that are unaffiliated with hedge funds generally perform better than mutual funds that are in side-by-side relationships with hedge funds.

- Side-by-side mutual funds generally received a significantly lower portion of low-priced shares of initial public offerings (IPOs).

- According to the study, the 457 actively managed funds underperformed the comparable unaffiliated funds by 1.2% per year, representing an estimated loss of some $5.6 billion in potential returns during 2004.

Until the new study was published, there was no actual evidence about whether these side-by-side arrangements created conflicts of interest in which mutual fund investors were disadvantaged relative to investors in hedge funds. According to the co-authors, the study supports concerns expressed by regulators about potential conflicts of interest caused by these side-by-side arrangements .

We find strong empirical evidence that regulators’ concerns about managerial conflicts of interest are justified. Side-by-side funds exhibit return gaps that underperform those of matched [unaffiliated] funds by economically and statistically significant margins, the study reads.

Keep in mind that this is not a good guys versus bad guys scenario. Hedge funds have, and likely will, continue to have an important role in the world’s securities markets. According to a May 2006 Securities And Exchange Commission (SEC) report, although hedge funds represent just 5% of all U.S. assets under management, they account for about 30% of all U.S. equity trading volume.

Regulatory Concerns

Financial media and other organizations that report on investment topics usually refer to hedge funds as lightly regulated or largely unregulated. This is true especially when compared with mutual funds (open-end and closed-end investment companies), which are regulated very closely, primarily under the Investment Company Act of 1940 .

Hedge funds are not subject to the 1940 Act. Also, because hedge funds issue securities as private offerings, they are neither required to be registered with the SEC under the Securities Act of 1933. nor do they have to make periodic reports under the Securities Exchange Act of 1934. The main disclosure document for hedge funds is called the offering memorandum. which is not required to be as comprehensive as a mutual fund’s prospectus or other required offering documents.

Mutual fund shares are public offerings that must be registered with the SEC under the 1933 Act, and fund companies are required to make periodic reports to shareholders as required by the 1934 Act. Hedge funds are under no such obligation.

These differences in regulation prompted the SEC to study the operation and practices of hedge funds. The SEC’s 2003 report Implications of the Growth of Hedge Funds highlighted several areas of concern. The report prominently mentions the side-by-side management of client accounts in hedge funds and mutual funds, and says that conflicts of interest between investment advisors and their clients are not new. Unique facts, however, including the nature of the fees paid, the interests of the advisor and the nature of hedge fund strategies themselves. bring[s] these conflicts into even sharper focus.

In December 2004, the SEC adopted rules that required most hedge funds with assets greater than $25 million to register under the Investment Advisors Act of 1940 unless the hedge fund required investors to lock up their investments in the fund for two years. The rules went into effect on Feb. 10, 2005, and advisors were required to register under the rule had to do so by Feb. 1, 2006.

Problem Solved?

The road to creating a hedge fund regulatory structure is blocked, at least for the present. On Jun. 23, 2006, the U.S. Court of Appeals for the District of Columbia Circuit threw out the proposed hedge fund registration rule, which means that the legislative process has to start over again.

A subsequent hedge fund regulation bill was introduced in the U.S. House of Representatives by Massachusetts Representative Barney Frank a short time later. However, in view of SEC Chairman Christopher Cox’s decision not to appeal the district court’s decision, it appears that the process of developing hedge fund regulations will have to start all over again.

What Investors Can Do

Investors will need to think seriously about whether or not it makes sense to put their money in mutual funds that are managed side by side with hedge funds. A simple alternative is to avoid investment advisory firms that have such arrangements altogether.

However, investors who are considering going with a firm that manages these funds side by side should do to their homework. First, investors need to take an honest look at such critical factors as your age, income, cash flow needs, tax status, investment objectives, risk tolerance, general financial situation and needs.

Carefully evaluate the financial incentives under which the advisory firm or investment manager operates (for example, performance and other fees). If these are not compatible with your investment goals and objectives, move on. There are plenty of firms out there that will do right by their customers. It is well worth the legwork necessary to find them.