Should You Use Target Retirement Funds Pros and Cons 20s Finances

Post on: 17 Август, 2015 No Comment

Posted on November 5, 2012 by JT 13 Comments

Target date funds are a new innovation on Wall Street, a product designed for convenience and easier retirement planning.

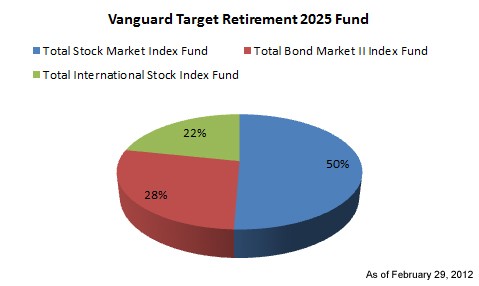

A target retirement fund is one which builds an asset allocation mix based on a retirees expected retirement date. Over time the fund makeup changes to moderate the portfolios risk as the future retiree gets closer to their ideal retirement date. Lets look at target retirement funds and lay out the pros and cons.

Are Your Investments Linked to Your Age?

Pros of Target Retirement Funds

Here are the main advantages to target retirement funds:

- Automation A target retirement fund automates asset allocation decisions. Each year, the portfolios are also rebalanced to return to their target allocation going forward.

- Availability – Target retirement funds are everywhere. Virtually every 401k sponsor and brokerage firm carries a target retirement fund for investors.

- Tax efficiency – When based on index funds, target retirement funds are very tax efficient as there are only a few transactions that would pass on taxes to fund investors. Keep in mind that taxes only matter when funds are held outside of a tax-sheltered retirement account.

- Simplicity – Never has investing been easier than simply picking a target retirement date and making automatic contributions. There is no need for analysis paralysis – a simple list of choices encourages many more people to invest who might not otherwise if they had to make their own selections.

You probably notice a trend in the advantage above. A target retirement fund makes retirement planning easier, more convenient, and automated. The major advantage is the ease at which someone can start saving for retirement.

Cons of Target Retirement Funds

A full analysis requires consideration for the downsides of target funds. Here are some of the disadvantages:

- Fees – Some target date funds are packed with fees. As target funds are funds of funds (a mutual fund or ETF that holds other mutual funds and ETFs), investors are hit with double fees.

- One size fits all planning – We are all different. Our finances are very different. A target date fund does not take into consideration key retirement factors like home equity, existing debt, or other assets and liabilities that you have outside of the fund.

- No side benefits – You pay for financial advice in one way or another. When you hire a financial planner, you pay commissions or fees for advice on matters that extend beyond investments and into insurance, estate planning, and taxation. You dont get the same advice with a target date fund that you might get for a similar price from a financial planner.

- Less useful for people closest to retirement – A target retirement fund is a “good enough” way to save, not “the best” way to save. As your savings grow and you near retirement, it makes much more sense to seek professional advice for your individual situation than to accept the one size fits all approach to planning.

The primary disadvantage of a target retirement fund is that it makes decisions based solely on when you wish to retire. A proper financial plan is formulated from far many more variables than the date at which one wants to enjoy life without working.

Should You Use Target Retirement Funds?

Im a big fan of low-cost target retirement funds for people who are just starting the process of saving for retirement. When you have a less than substantial amount of savings or net worthsay, less than $100,000, it would be difficult if not impossible to add to performance after costs by paying higher commissions or flat fees to a financial planner.

There is a point at which hiring a financial planner to independently assess your situation and your finances makes economic sense to the extent that you get more finely-tuned planning at a lower relative price. Seeing as fee-only financial advisers charge by the hour, or as a fixed percentage of assets based on how much you invest, it makes sense to hire a planner for “hands-off” planning when you have accumulated a significant net worth. A net worth of $100,000-250,000 seems like a good ball park number for moving to individual advice.

Another Useful Resource

If you are looking for a great tool to help manage your investments, try using Personal Capital. It allows you to view all of your investing and banking accounts in one place. I personally use Personal Capital to keep track of my portfolio and it makes everything so much easier. Not only can I see the changes in various investments, but I can track my net worth. In the past few months, it has saved me hours of time and helped me make smart investing decisions.