Should you invest lump sum in a rising equity market

Post on: 16 Март, 2015 No Comment

Sridevi Ganesh

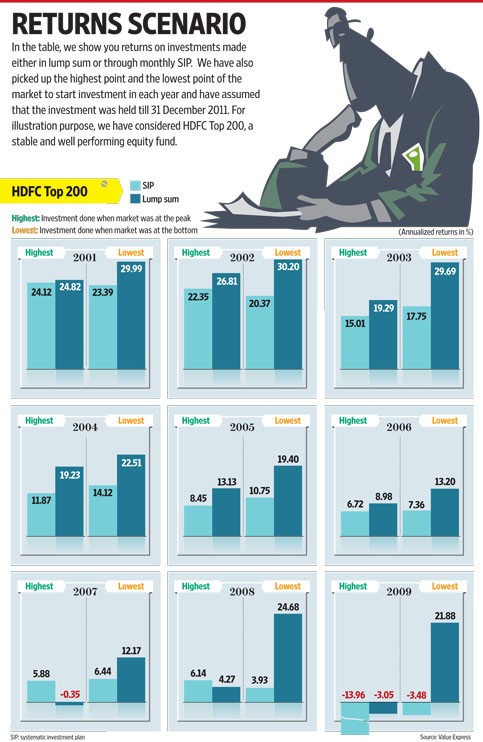

Whenever one year return is more than the average, investors generally end up asking such questions. SIP or Lump sum is a never ending debate. Lump sum in a rising market Is that the best way to invest? Before getting deeper, let us look at data available.

If an investor had invested a lump sum of Rs.12 lakhs, a year back what would be his return now? I have taken some schemes from different fund houses. The selection was done in a random fashion across market caps. Birla Sun Lifes MNC has doubled the money in the past one year, whereas schemes like Franklin India Bluechip, HDFC Top 200 and IDFC Sterling Equity would have delivered 48.85%, 55.27% and 73.01% respectively. In the same period, CNX NIFTY would have delivered 41.77% returns. It is quite obvious from the data that midcap oriented schemes outperformed large caps, though that is not the point we are looking for.

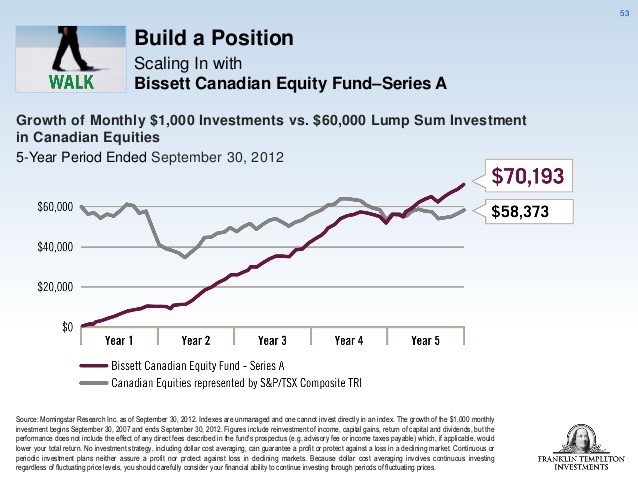

Instead of investing a lump sum, if the same investor had chosen to invest systematically by contributing one lakh a month for 12 months, what would be his return? Birla Sun Lifes MNC Fund would have given him a corpus of Rs.19,08,591.06 which is less by a whopping margin of 5 lakhs that he would have earned in addition by choosing to invest the lump sum. Same is the story with other schemes too. Does this put an end to the debate? Not at all! Market movement is not always on the up or always on the down. The only sure thing about market is its volatility. So, the big question gives rise to a few questions in addition. What would have happened, if the market kept falling for the analysed period? What would have happened if the market went up for 6 months or so and fell for the subsequent months?

We can drill down further using various schemes and generate a comparison. But that would be a futile exercise, as the results wouldvary depending on how the market has moved during the testing phase. So, what should an investor do?

Instead of asking questions that do not throw us useful revelations, ask the right questions that can positively impact your finances! Many pundits keep predicting where markets will move, whether local or global. It is another gruesome data mining process, to find out how many predictions of these pundits came true and how many did not. Whatever said and done about equity markets, it is a fact that no one can guess where the market will be in the next one month, one year or even one decade. Many individuals could provide fantastic calculations to arrive at a number and even a few could turn out to be true if not exact. To you, the investor, these predictions would be of no help.

Even in a rising market, by investing systematically you would not have lost your money. You would have got relatively less return. Is that really bad? If you answer yes to the question, I think you are being greedy. Investments in equity markets should be done systematically, for the very simple reason that it is very very hard to time the market. If timing is so easy and fruitful, then why mutual fund schemes managed by professionals end up delivering negative returns when the market tanks? As an investor, you choose mutual funds to create wealth or achieve your goals because you do not have the time and expertise to manage your money. How then you can time the market? Systematic investing is a time tested method that definitely limits the upside in a rising market but limits the downside in a falling market!

If you have a lump sum, then invest in a liquid fund and systematically transfer to an equity fund, depending on your goal. If you do not have a lump sum, then the best way to reach your goals is to embrace a systematic investment plan. It is more important to reach your goals in life than to generate maximum returnsfrom the equity market. Hence, ask the right questions! Why am I investing? When do I need my money back? What is the return that I can expect from equity mutual funds over a long term? These questions will empower you to take the right decision of investing systematically rather than comparing various methods taking in to account returns as the only criterion.

Investing is a marathon and not a 100m dash! Completing your marathon itself is a huge achievement! Do not chase returns!