Should You Invest in Equity Funds or Individual Stocks

Post on: 9 Июль, 2015 No Comment

Should You Pick Equity Funds or Individual Stocks for Your Portfolio?

Should you be investing in equity funds or picking your own individual stocks? That can seem like a daunting choice but these considerations might help make the decision easier. Artifacts Images / Digital Vision / Getty Images

One of the most important, and difficult, choices you as a new investor will face is whether you should invest in equity funds or invest in individual stocks. I’ve made no secret of the fact that I don’t believe many average investors have to pick their own stocks to be successful. a stance that has garnered a small amount of hate mail .

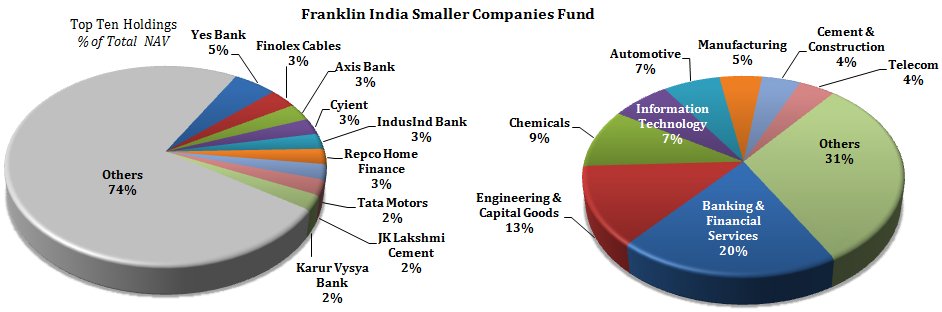

As you know by now, investing in an equity fund means buying shares of a portfolio overseen by a professional portfolio manager. The portfolio manager is responsible for picking the stocks in the portfolio, as well as the buy, sell, and hold decisions. Once you’ve chosen a good equity fund, your responsibility is to continue buying shares, reinvesting your dividends and capital gains. and checking the mutual fund annual report each year to ensure the management company is sticking to the financial philosophy in which you believe; that you are comfortable with the holdings. In a lot of ways, it would be like checking the performance of a building manager you hired to oversee your rental properties.

On the other hand, picking individual stocks means it is your responsibility to build a portfolio, pour over annual reports and 10k filings. make acquisition and disposition decisions, and keep up to date with what is happening at each of the companies in which you maintain an investment. It is, after all, your hard earned money! For a lot of people, that sounds like the equivalent of intellectual torture.

Here are a few ways to tell if you should invest in equity funds or, instead, pick your own individual common stocks.

1. Do You Have the Ability to Read and Understand Financial Statements?

Can you read GAAP financial statements, including the income statement and balance sheet. If you have that skill, selecting your own individual stocks shouldn’t be any more difficult than analyzing a division or private business opportunity such as investing in a limited liability company. In such a situation, it seems a little silly to hire a professional money manager to sit around and research businesses for you all day unless you would rather focus on your primary occupation.

2. Do You Enjoy the Process of Studying, Understanding, and Analyzing Companies?

There are very few things I enjoy as much as finding a great company, then learning about its business, industry, products, cost inputs, strategy, and how it fits into the world. I have an insatiable curiosity. I love being able to walk into a grocery store and tell you the gross profit margins for the company that distills a certain brand of whiskey, or pass a hotel and know the average cost per room to construct it, as well as the total pre-tax profit it should be generating if it is well run and moderately successful. For me, studying businesses (and individual stocks, by extension) is a way to understand the world and what people truly value.

If you don’t care about those things, it doesn’t make a lot of sense to waste your time trying to find individual companies in which you can become a partial owner. Pay a professional their management fee and acquire good, well-diversified equity funds, instead.

3. Do You Mind the Complexity of Managing Multiple Investment Positions, Or Would You Rather Hold a Handful of Equity Funds?

Even a focused investment portfolio will likely include 10 to 20 stocks; a widely diversified portfolio could contain 30 to 100 stocks. Do you want to have to keep track of all those securities? The dividend dates and income? The cost basis for each position? If you don’t mind, and have a large enough portfolio to justify it, individual stocks might be for you. If you want to be able to build your entire investment portfolio history on a single, short spreadsheet, equity funds are probably the better selection.

4. Do You Have an Obsessive Need to Check Your Stock Prices Every Five Minutes?

If you aren’t able to think like a long-term investor, you might want to build in a layer of protection and choose equity funds over individual stocks. Unless you go the ETF route (exchange traded fund), mutual funds only adjust their stock price, or Net Asset Value. once per day, after hours. This frees you from the need to be glued to a screen or panicking over a fifty cent move in a blue chip stock that shouldn’t cause you any consternation.