Should a Diversified Portfolio Include a REIT Mutual Fund

Post on: 11 Апрель, 2015 No Comment

W e discussed REITs in the first part of this series. Now lets look at why you should consider including them in your portfolio.

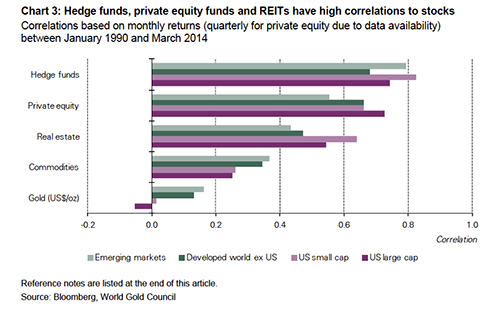

The main benefit of REITs, in my view, is diversity. REITs are one of the few asset classes that are not highly correlated to the S&P 500. That means that the performance of REITs doesnt follow in lock-step the performance of the market. At the same time, REITs historically have performed very well. From 1989 to 2001, REITs returned 10.7% with a standard deviation of 16.1%, according to David Darst in his book, The Art of Asset Allocation. Asset Allocation Principles and Investment Strategies for any Market .

What this means is that REIT mutual funds during this period were highly volatile, with 95% of yearly returns ranging from -21.5% (the average minus two standard deviations) to 42.9% (the average plus two standard deviations). In a well diversified portfolio, however, REITs can improve returns with little added risk to the overall portfolio. I own two REIT funds:

- Vanguard REIT Index (VGSIX)(6.2% of my portfolio)

- Fidelity International REIT Index (FIREX)(2% of my portfolio)

So far in 2007, VGSIX has lost 13.6% and FIREX has lost 5.1%. From 2003 through 2006, however, VGSIX returned 35%, 30%, 12% and 35%. As Ive repeated many times, with potentially greater returns comes potentially greater risk.

You will see that my allocation to REITs is about 8%, and my goal is 10%. Youll read many books that recommend anywhere from 0% to about 20%. In William Bernsteins book, The Intelligent Asset Allocator: How to Build Your Portfolio to Maximize Returns and Minimize Risk , he recommends 5% in one of his portfolios.

Should I own a REIT if I own real estate

This question comes up a lot. My answer is yes. I own four rental properties and my home, and I still put 10% of my portfolio in REITs. Why? Because REITs typically invest in office buildings, strip malls, apartment buildings and the like, not single family homes. Some REITs do invest in mortgages, so there can be some overlap with residential real estate, but for the most part, my REIT investments will behave differently than my rental properties. Others, however, believe that the investment in their home is sufficient exposure to real estate, and so avoid REIT mutual funds. Youll obviously have to make your own decision on whether to own a REIT mutual fund.

One final thought. You probably own REITs even if you dont own a REIT fund. Most REITs fall into the mid-cap category, so if you own funds in that category, those funds likely include some REITs.