Sharpe Ratio Information Ratio

Post on: 21 Май, 2015 No Comment

Sharpe Ratio & Information Ratio

Sharpe Ratio/Sharpe Index/Sharpe measure or reward-to-variability ratio is a measure of the excess return per unit of risk in an investment asset or trading strategy. The Sharpe ratio is used to characterize how well the return of an asset compensates the investor for the risk taken, the higher the ratio the better. The Sharpe ratio is directly computable from any observed series of return as long as the measured returns are normally distributed, as the returns can always be annualized. As not all asset returns are normally distributed therein lies a weakness in the Sharpe ratio.

R: asset return

R f . return on the benchmark asset, such as the risk free rate of return

E [R − R f ]: expected value of the asset excess return over the benchmark return

σ: standard deviation of the asset excess return. This is often confused with the excess return over the benchmark return (i.e the tracking error) which is used in calculating the Information Ratio.

Note: With positive Sharpe ratios, a portfolio’s Sharpe ratio decreases if the risk increases, all else equal. With negative ratios, however, increasing risk results in a numerically larger Sharpe ratio. Therefore, in comparison of negative Sharpe ratios, the larger Sharpe ratio cannot generally be interpreted as better risk-adjusted performance. However, if the standard deviations are equal the portfolio with the ratio closer to zero are superior.

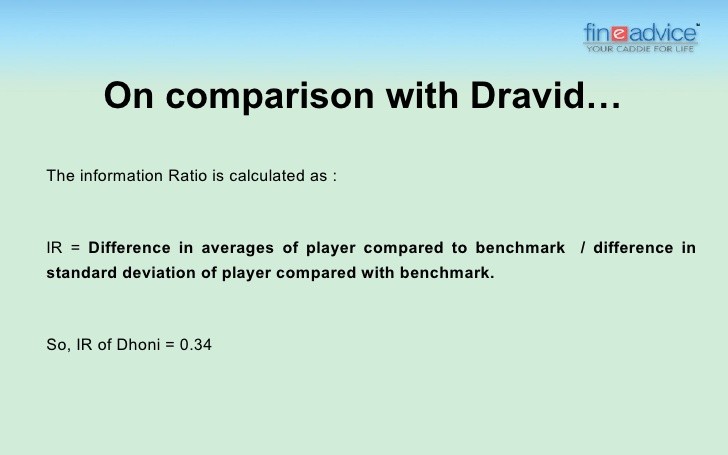

Information Ratio

Information ratio/appraisal ratio is a measure of the risk-adjusted return of a financial security, asset or portfolio. It is defined as expected active return divided by tracking error, where active return is the difference between the return of the security and the return of a benchmark index and the tracking error is the standard deviation of the active return. The information ratio is used to gauge the skill of managers of hedge funds, mutual funds etc. In this case it measures the expected active return of the manager’s portfolio divided by the amount of risk the manager takes relative to the benchmark. The higher the information ratio, the higher the active return of the portfolio given the amount of risk taken, and the better the manager.

,

R: portfolio return

R b: benchmark return

α = E [R − R b ]: expected value of the active return

ω = σ: standard deviation of the active return (tracking error)