Seven Tips to Keep Your ETF Investing Expenses Low

Post on: 11 Июнь, 2015 No Comment

Exchange traded funds represent one of the fastest growing investments available today. While ETFs are a relatively new investment vehicle, they are growing in popularity due to their relative simplicity, built-in diversity and low costs. There are many who see advantages in ETFs. since they are not only well-suited for long-term, buy and hold investing. but can also be adapted for use in short-term trading strategies and even options and shorting.

Even with these advantages, though, ETFs do come with risks. Some ETFs are riskier than others, and there are some investment decisions that can increase the costs of ETFs. If you want to invest in ETFs. it is a good idea to make sure that you are keeping as much of your money as possible. Here are seven tips to help you keep your ETF investing expenses low (and net returns high):

- Dont trade too often. Buy and hold is one of the most effective ways to save money on any investing. Whether you are looking for a mutual fund with low turnover or investing in individual equities, it can be to your benefit to avoiding trading too often the fees will start to stack up. Because ETFs are traded like stocks on the market, you incur the same brokerage fees and/or commissions that any normal stock would end up with. If you trade ETFs often, you will start to rack up fees.

- Use a discount broker. When trading, one of the best things you can do is open an account with a discount broker. These are brokers that usually offer online investing services at a discount. You can get discounts (usually a flat rate) on trades, being charged mainly when you buy or sell. Usually, a discount broker comes with two advantages: you dont pay as much for trading and the account minimums are usually lower. However, when you use a discount broker, you are usually on your own when it comes to choosing investments; no expert advice. (Some discount brokers do offer advisement services á la carte.) However, if you are careful and take the time to do a little research, you can usually do pretty well choosing ETFs to buy. Some discount brokers include Scottrade. E*Trade. Zecco. TD Ameritrade. ShareBuilder. SoGoTrade and TradeKing .

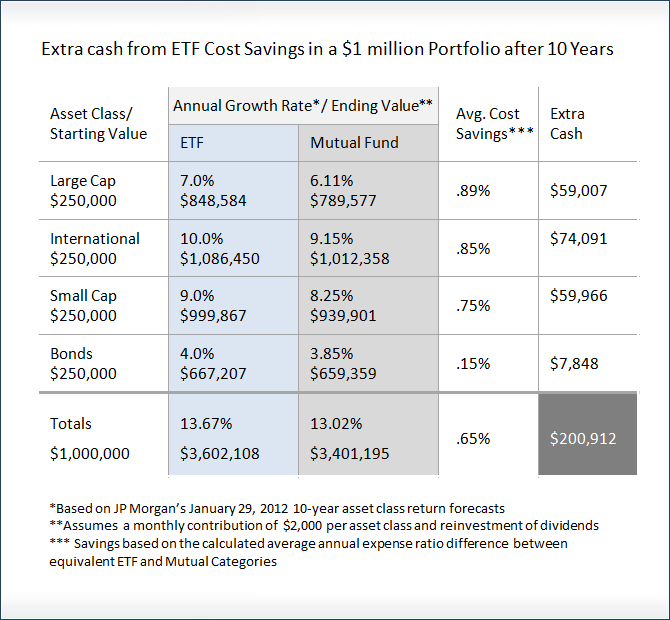

- Look for ETFs with low expense ratios. Funds have expense ratios. Some funds have higher ratios than others. The same is true of ETFs. Expense ratios on ETFs are often in the 0.15% to 0.50% range, although there are some ETFs with lower or higher expense ratios. As you might guess, the lower your expense ratio, the more of your money is actually invested. While this is important, it is important to realize that choosing a good ETF goes beyond expense ratios. Per-trade fees can erase your potential and your expense ratio savings. So choose wisely (low expense ratio), and dont trade to often. This is actually sound advice when you are buying index funds and mutual funds as well. However, realize that index funds and ETFs have lower costs than mutual funds .

- Be aware of taxes. Taxes will get you every time. If you are not careful, you will find yourself owing taxes. Everyone talks about how ETFs have great tax efficiency, but you have to know what you are doing in order to take advantage of ETFs. You have to pay taxes on dividends earned from ETFs. For qualified dividends, you are taxed between 5% and 15%, depending on your tax bracket. In the highest bracket, you only pay 15%. However, with unqualified dividends, you pay the same rate as your income tax bracket. If you want to invest in ETFs that pay dividends. make sure you know whether they are qualified or not. Also, consider long-term vs. short-term capital gains. Try to wait at least a year to sell your investment, since long-term capital gains taxes are lower than short-term capital gains taxes. (Since I am not a tax professional, it is a good idea to consult one to get an even better idea of your situation, and what you can do to reduce costs.)

- Watch out for automatic investment plans for ETFs. One of the mistakes you can make when when investing in ETFs is to get too into dollar cost averaging. While dollar cost averaging can be a good strategy for any type of investment, it is important to be careful when using it with ETFs. Since ETFs (unlike mutual funds) are traded like stocks, you are charged the transaction fee each time. A weekly investment of $25 or even $50 into an ETF can quickly be eroded. On the other hand, you can use dollar cost averaging with ETFs on a monthy or quarterly basis. Dollar cost averaging is just regularly putting in the same amount of money. You can do this more spread out with ETFs to lower your costs. $200 a month or $800 a quarter into an ETF will be more cost-efficient than breaking it up into a weekly thing.

- Avoid non-ETF ETFs. Let me explain. There is a definite difference between exchange-traded funds that are really closed-end mutual funds and ETFs. Closed-end mutual funds are traded during the day in a way similar to stocks. However, they are still mutual funds, and they are usually actively managed. This means that there are the same sort of mutual fund fees involved. You might be surprised, if you do not do your due diligence when investigating ETFs, to find that the costs are higher than you expected because you might not be invested in a true ETF.

- Watch out for brokerage fees. Even with a discount broker, there are fees. Make sure you understand what the broker fees are for, and try to avoid them. Watch for recurring fees, and make sure you maintain the required account minimum. Also, realize that dividends from ETFs are paid in cash, and not automatically reinvested. While some brokers will allow you to reinvest the dividends into an ETF for no extra fee or charge, there are brokers who will charge you the transaction fee when you reinvest.