Series 65 Exam_1

Post on: 16 Март, 2015 No Comment

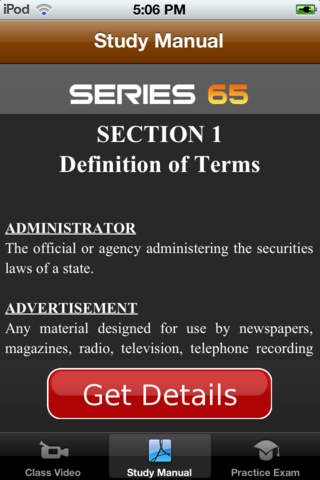

Series 65 Exam Prep

Series 65 Uniform Investment Adviser Law Examination

Online Exam Prep Course

The Uniform Investment Adviser Law Examination is developed by NASAA, The North American Securities Administrators Association. The Series 65 exam, is designed to qualify candidates as investment adviser representatives.

Series 65 Uniform Investment Adviser Law Examination Textbook

Series 65 Uniform Investment Adviser Law Examination

Exam Info

Description

Course Description

This course helps the candidate to prepare for and successfully pass the Uniform Investment Adviser Law Examination (Series 65). The Series 65 exam entitles the candidate to give investment advice and sell securities in those states that require Series 65 registration.

Designed for individuals who must satisfy state investment adviser requirements, the exam focuses on: federal securities law, the Uniform Securities Act, economics and analysis, investment vehicles, investment recommendations and strategies, ethics and legal guidelines for investment advisers, and unethical business practices of investment advisers.

Series 65 exam is required by most states for individuals who wish to act as investment advisers. This exam is waived by some states if the applicant has the CFP (Certified Financial Planner), the ChFC (Chartered Financial Consultant), APFS (Accredited Personal Financial Specialist), CFA (Chartered Financial Analyst), the CIC (Chartered Investment Counselor), or other designations or items as ruled by the (state) administrator.

In addition, this course features a myriad of practice quizzes by lesson to sharpen test-taking skills, as well as feedback rationale for each question that clarifies and improves retention. The course also offers unlimited number of practice finals that simulate the actual FINRA exam to help ensure exam readiness. Study emphasis should be placed on the quizzes and final exams: successful completion of the quizzes will be benchmarks indicating your progress in preparing for the license exam.

Learning Objectives

- Learn the basic concepts of economics.

- Learn the analysis of financial statements and methods to evaluate investments.

- Learn about the risks in economics.

- Understand the various investment vehicles.

- Learn about the investment recommendations and strategies.

- Understand the fundamental terms and concepts of trading securities and how to calculate performance.

- Understand which practices are considered fraudulent and prohibited and the provisions for violations.

- Study the federal acts, including the Securities Acts of 1933, Securities Exchange Act of 1934, Investment Advisers Act of 1940.

- Learn about the ethical and unethical practices of investment