Selling Your Investments Are They LongTerm or ShortTerm Capital Gains

Post on: 28 Апрель, 2015 No Comment

One of the realities of our current tax system is that we are required to pay taxes when we log gains from our investments. So, if you sell a stock, you will need to pay taxes on the gains. The good news is, that you dont have to pay taxes on this type of income until you sell and lock in the gains.

As you make the decision about whether or not to sell a stock. it can help to consider whether or not your gains are considered long term or short-term.

This will make a difference in how you are taxed on your capital gains.

Long-Term Gains versus Short-Term Gains

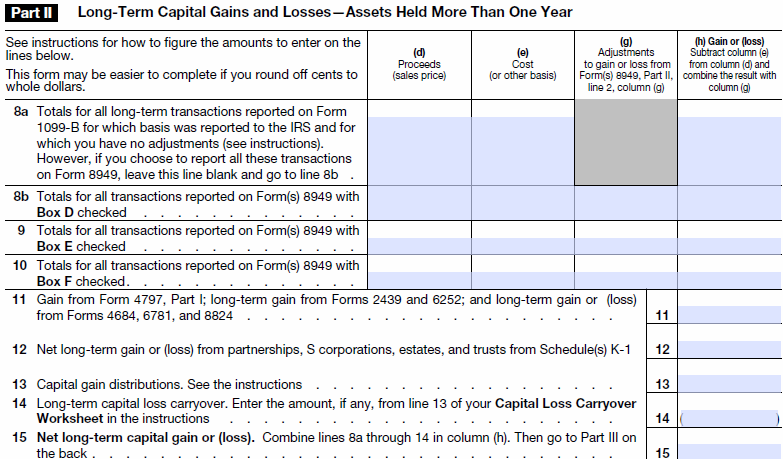

The amount of time you hold an investment matters when figuring what you owe in terms of taxes. If you hold something for a year or less, it is considered a short-term investment. On the other hand, if you hold a stock for more than a year (one year plus one day), it is considered long-term.

Understanding this is vital as you consider taxes, since short-term capital gains are taxed as regular income, and long-term capital gains have their own tax rates.

Currently, the long-term capital gains tax is capped at 20%; if you are ordinarily taxed in the 10% or 15% tax bracket, you pay no long-term capital gains tax at all.

If you are in a tax bracket above 15%, then your long-term capital gains are taxed at a rate that is lower than your ordinary rate. If, however, you sell an investment that you have held for a year or less, the gains are taxed at your regular rate.

Before you sell an investment for a gain, it can help to consider when you bought it at the very least you want to reduce what you pay in taxes.

First In, First Out

When you are using an investment account. or selling shares in a mutual fund, its important to understand the method of asset management used. Many are straightforward, taking a first in, first out (FIFO) approach. This approach assumes that shares acquired first are those sold first.

So, if you sell shares in your investment account at a gain, and you want to take advantage of the lower tax rate on long-term gains, if the FIFO method is used, you only sell enough shares to correspond with what you bought more than a year ago.

You want to verify the method used, though, since some mutual funds actually take an average age of the shares to determine how long you have owned them.

This can mean that you pay more in capital gains taxes when you sell, so you should find out how your investments will be classified before you commit to sell.

Getting the Most When Selling Your Investments

How long you have been holding an investment matters. If you havent held it long enough, you could end up paying more in capital gains taxes.

As you prepare your portfolio for tax season, dont forget to consider the length of time youve owned a stock.