SelfDirected IRA vs Traditional IRA Retirement Investment Strategy

Post on: 6 Июль, 2015 No Comment

What a Self Directed IRA Will Allow Me To Invest In

With a Self Directed IRA, an account holder can invest in anything the Internal Revenue code allows. (The list is almost endless.) Investments with a Traditional IRA, held by a bank or Wall Street brokerage company, are mostly restricted to their own products.

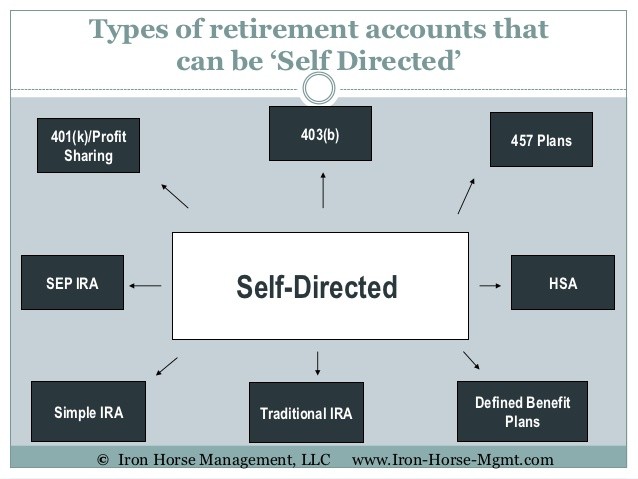

A Self Directed IRA?

Making the distinction between an IRA account that is held by a large financial institution and a truly Self Directed IRA account, can be somewhat confusing. After all, many traditional IRA custodians advertise themselves as offering a Self Directed IRA, but what that really means is that you can direct your IRA as long as you direct into one of their offerings.

Repetitive, Commodity-Type Transactions

Over the years, large institutions have learned how to leverage their ability to earn huge commissions from repetitive, commodity-type transactions that are best performed by state-of-the-art computer software. Theyre simply not geared for complicated transactions that have to be handled by human beings, such as the purchase and sale of real estate, tax liens, notes, private stock offerings and a myriad of other non-traditional investments.

A Lack of Knowledge

The biggest challenge facing retirement investors who want to unlock their funds and move them out of the control of the traditional financial services industry and into a Self Directed IRA is simply a lack of knowledge. Banks, brokerage firms, insurance companies, mutual funds companies and most financial planners have nothing to gain from informing investors about their real choices.

Objective Guidance?

In many cases, these same institutions are making money with your money by lending out the invested funds at a higher rate of return than theyre paying you. Your retirement account is a source of capital for them. So, again, theyre not very excited about providing objective guidance on how to place retirement funds into investments where they cant earn a profit.

Its Your Money!

Rememberits your money and youre not constrained now that you understand how much control you actually possess. If youre currently with a financial services provider that restricts investment options, now is the time to make a move. Although there are some important considerations and guidelines for Self Directed IRA investing, if you treat the process with the respect it deserves, unlocking your retirement plan will be both exciting and rewarding. We can help you navigate the process in a timely, efficient and cost effective manner.