SEC Proposes New 12b1 Fee Rules CBS News

Post on: 29 Март, 2015 No Comment

Last Updated Jul 27, 2010 9:52 PM EDT

Podcast

Your browser does not support the audio element.

SEC Chair, Mary Schapiro, announced new proposed rules as to how Wall Street should charge those 12b-1 marketing fees. These are fees some mutual fund companies charge to market and distribute mutual funds to the public. Here is a little background on these fees and a summary of the proposed changes the SEC is considering. Finally, I’ll conclude with my take on the matter.

The birth and growth of the 12b-1 fee

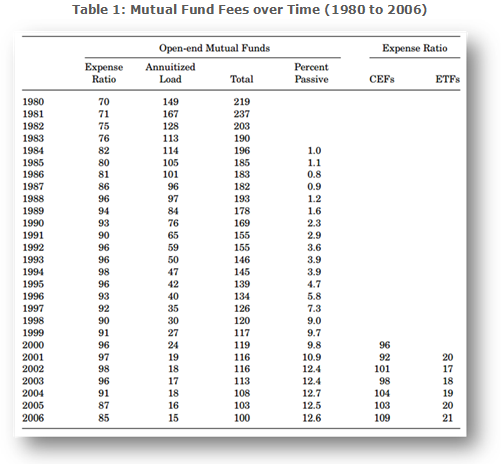

In 1980, the SEC allowed funds to charge marketing and distribution fees with the argument that these fees would actually benefit investors. The logic was that these 12b-1 fees would lead to the funds’ growth and the resulting economies of scale would be passed through to the funds’ owners by a reduction in fees.

Of course, we don’t live in the fantasy land of assumptions that was used in 1980 to create these fees. Many studies show funds charging these 12b-1 fees underperform their no-load counterparts by even more than the 12b-1 fees collected. And the argument that consumers benefit from paying these fees by the investment advice they receive from their advisors has been discredited in a study assessing the costs and benefits of brokers in the mutual fund industry .

The SEC’s Four New Rules

In the video below, SEC Chair Mary Schapiro announces the proposed rules for the new 12b-1 game. She notes the purpose is to enhance clarity, fairness and competition when investors buy mutual funds.

1. Cap the fee. If investors buy funds that charge 12b-1 fees over time (b shares ), instead of up-front (a shares ), fund companies would have to stop charging when the ongoing annual fees equal the amount they would have paid if they used front end loaded funds.

2. Disclosure: The term 12b-1 fee will be done away with, and the funds would instead be required to call them an ongoing sales charge. Funds would have to disclose how much of this fee is going to a marketing and service fee, as well as limiting it to 0.25% annually.

3. Separate disclosure on Confirmation Statements — Confirmation statements will have to clearly convey that some fees will be deducted from the fund each year to compensate the professional selling the fund.

4. Broker Dealers will set fees — The broker dealer can decide to collect fees at amounts lower than those set by the fund itself.

Though to date the SEC has shown little or no interest in my opinion, I’d give them a C- grade on this one. Despite these fees having been shown to only enrich the industry at the cost to the investor, it’s better than nothing. In my opinion, proposing new rules that makes these fees slightly less bad is setting the bar too low.

My proposed rule changes would be to:

1. Cap the fees at zero — which is to say, eliminate these fees.

2. If you don’t take recommendation 1, call them 12b-1 broker sales loads and put a similar warning that you’d see on a pack of cigarettes — fees and brokers are hazardous to your wealth. It took three decades for the term 12b-1 fee to earn that bad name — don’t get rid of it now!

3. Every brokerage statement going forward should disclose total fees — 12b-1, annual expense ratio and other costs that are now hidden. Better yet, make the investor write out a check for these fees.

4. Make every broker-dealer advertisement show how much they collect in 12b-1 fees.

Too little too late

I’m glad the SEC is looking into these 12b-1 fees, but I’m even happier that the consumer didn’t wait for the SEC to level the playing field as, over the past decade, the lowest cost funds garnered over 85 percent of new assets. It was investors that sent the message rather than the SEC.

Avoid 12b-1 fees like BP on Earth Day. Even if the SEC changes its name, remember that it’s the same fee with a different label and you should still avoid it. If you see a fund that has an a, b, or c class after the fund name, you can be sure it’s better for your broker than it is for you.

MORE ON MONEYWATCH