SEC Introduces IDEA Database to Collate XBRL Reporting Tags

Post on: 28 Январь, 2016 No Comment

The XBRL reporting software tags pushed by the Securities and Exchange Commission are moving on to phase two, as the SEC debuts IDEA, a database to collate the XBRL tags attached to electronic filings. XBRL reporting software tags allow public companies and mutual funds to submit information in a standardized, tagged format for analysis and comparison by investors, government officials and citizens. IDEA users will be able to instantly collate information from thousands of companies and forms. The SEC currently has a voluntary program for tagging financial documents with XBRL. Microsoft, General Electric and United Technologies are already participating in the program.

The SEC has already formally proposed requiring U.S. companies to provide financial information using interactive XBRL data beginning as early as 2009. The SEC has separately proposed requiring mutual funds to submit their public filings using interactive data. The SEC currently has a voluntary program for tagging financial documents with XBRL. Microsoft, General Electric and United Technologies are already participating in the program.

The decision to eventually replace EDGAR marks the SEC’s transition from collecting paper forms and documents to making the information itself freely available to the public.

IDEA will ensure that the SEC continues to stay ahead of the needs of investors, Cox said. IDEA’s launch represents a fundamental change in the way the SEC collects and publishes company and fund information-and in the way that investors will be able to use it.

EDGAR will continue to be available for the indefinite future. During the transition to IDEA, investors will be able to take advantage of new interactive, IDEA-like features that will be grafted onto EDGAR in the short run.

The transition will make it possible for investors to use IDEA’s advanced search capabilities and to use the information from EDGAR within spreadsheets and analytical software, which is not possible with EDGAR. The EDGAR database also will continue to be available as an archive of company filings for past years.

When Congress created the SEC, and even when EDGAR was launched, the markets worked on paper and by mail. Today, the marketplace works online and by e-mail, said William D. Lutz, who is leading the SEC’s 21st Century Disclosure Initiative. Companies and investors alike compile, analyze and produce information and reports electronically. With the move to an electronic data-based filing system, the SEC will not only keep pace with the markets, but will provide investors with a dynamic, usable system they can use to get the information they need.

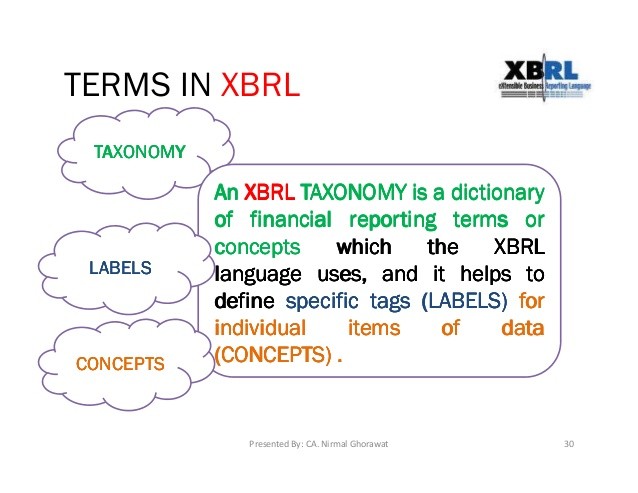

Formatting financial documents with XBRL allows the data to be easily searched on the Internet, downloaded into spreadsheets, reorganized in databases and put to any number of other comparative and analytical uses. An international nonprofit consortium of approximately 450 major companies, organizations and government agencies is developing the open-source, royalty-free language.

David Blaszkowsky, the SEC’s director of Interactive Disclosure, said, After 75 years of document-based static financial reporting, whether in paper documents or in electronic equivalents like PDFs, it is exciting to see the SEC poised to cross the ‘data threshold’ and help investors receive financial information that is dynamic, usable and ready to go as they make their investment decisions.