SEC Form 13F How to Invest Like a Hedge Fund Manager

Post on: 26 Май, 2015 No Comment

How to use SEC Form 13F to find stock tips

I recently opened a Scottrade account for my SEP IRA. For the first time in 20 years of investing, Ive decided to buy individual stocks in this account rather than mutual funds. And this decision has made me confront a fundamental investing question: How do I find stocks to invest in?

My first purchase was 2,200 shares of Citi (ticker: c). The rationale behind this decision was really nothing more than at $3.40 the stock is significantly underpriced, in my opinion. So far the decision has been a good one. It closed on Friday (3/12/10) at $3.97, making for a nice 16% gain in two weeks. Im not thumping my chest here; Citi could plunge on Monday for all I know. But now Im left with finding another investment, and that brings us to Form 13F and Hedge Funds.

Form 13F is a form that certain investment managers are required to file with the SEC. According to the SEC. institutional investment managers who exercise investment discretion over $100 million or more in Section 13(f) securities must report their holdings on Form 13F with the SEC. In other words, hedge fund managers and other investment managers (including Warren Buffett, by the way) must disclose to the public the stocks theyve decided to buy or sell.

And these Form 13F filings provide a wealth of information that individual investors can use. So lets look at how you can find Form 13F filings, and then well look at how they can help you come up with investing ideas.

How to Find Form 13F Filings

There are several ways to get Form 13F filings. If you already have a brokerage account, simply go to your online broker website. On Scottrade. for example, I searched for BRK.A (Berkshire Hathaway). Scottrade returns a wealth of data about the company, including a tab labeled SEC Filings. Under that tab I found that Berkshire had filed a Form 13F with the SEC on February 16, 2010. I clicked on the link and was reviewing the Form 13F instantly.

If you dont have a brokerage account, you can simply go to the SEC website. The SEC has a pretty easy to use search function that allows you to search for public filings. You can check out the SECs search page by clicking here. A quick search of Berkshire Hathaway brought up all of the companys public filings, including all of its Form 13F filings. You can also narrow your search so it only brings up the type of filing you are looking for.

So thats how you find Form 13Fs; now lets look at how they can help you invest.

How to Use a Form 13F Filing for Investing Ideas

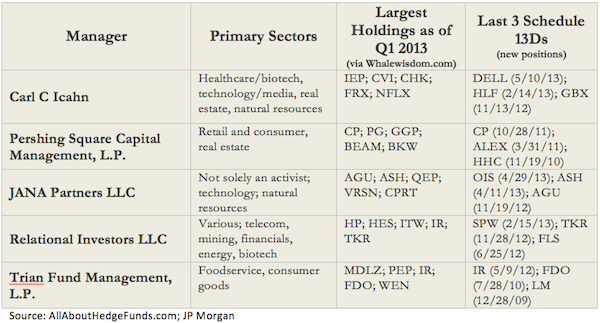

Once youve found the Form 13Fs for the institutional investors youre interested in, what do you do with it? First, dont assume that just because a big name investor invested in a stock means it was a good investment. In addition, institutional fund managers have already made their trades by the time they file Form 13F. That means that the stock may not be as good a deal by the time the investment is made public as it was when the trade was executed. But with these caveats, a Form 13F still has some great information.

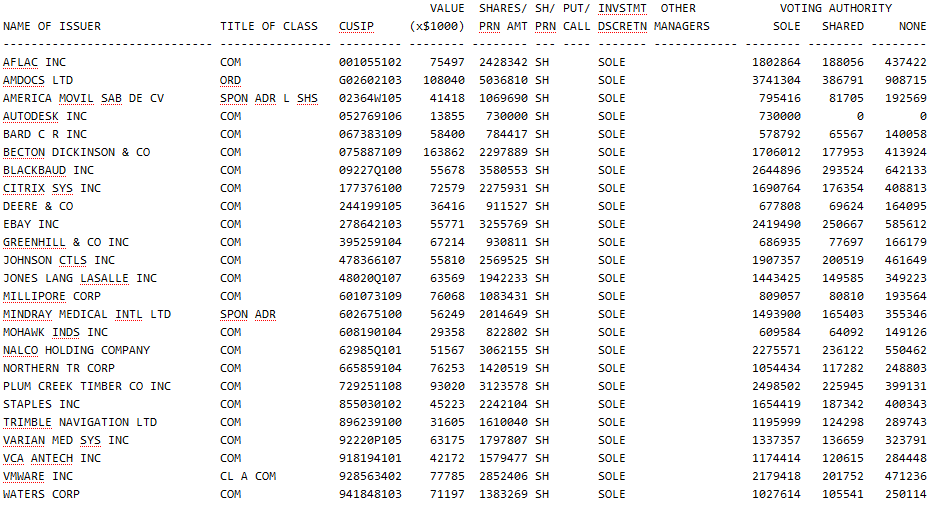

The form lists all of the companys holdings. In the case of Berkshire, for example, Form 13F lists the stocks that Buffett has invested in, showing the amount the company owns and the market value of the stock. By comparing Form 13Fs, you can see what stocks hes bought and what hes sold. Either way, the list of stocks can be a great way to at least begin thinking about investment ideas.

One final tip. If you are at a loss when it comes to finding institutional investors to spy on, so to speak, check out Morningstar. The investing website has an entire section on hedge funds, and even lists them based on performance. You do need to sign up for Morningstars Premium service. but Ive found it well worth the investment.