Screening Mutual Funds

Post on: 26 Апрель, 2015 No Comment

Screening mutual funds in each of the categories that represent your universe should be a methodical and unemotional process. Intuition will help in your analysis, but you’ll want to stifle your emotions.

Before you start screening mutual funds in earnest, do some broad research and screening to determine what mutual fund families you like the best, as this will have some bearing on where you establish your account. Or, if necessary to get the funds you like best, various accounts; but treat them as a single portfolio in your analyses. Establishing an account with one of the mutual fund families or a discount brokerage that offers a wide selection of funds with small or no transaction fees is your best bet cost wise, plus it’s a lot easier to keep track of your portfolio if it’s all in one account.

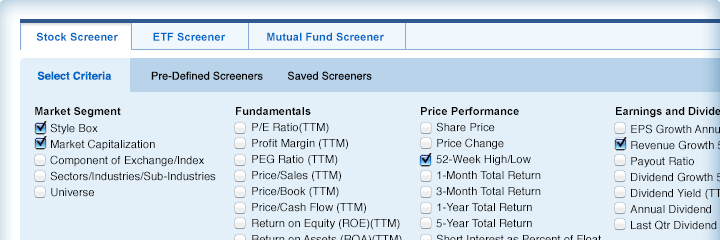

Once you have defined your universe and decided where you’ll probably establish your account, you’ll be ready to start screening mutual funds to find the best candidates for your portfolio. Use the selection criteria described in the prior section, Compare Mutual Funds. to conduct your screening. Most sources will not provide all of the statistics, but you should find enough to do your screening. If not, try another source.

You don’t need to use all of the statistics available for screening mutual funds. As you become more adept at screening mutual funds and selecting the best for your portfolio, you’ll gravitate toward a set of statistics that work well for you and with which you feel confident in using. Whatever set of statistics you choose to use, use them methodically to compare various mutual funds on a common basis.

The universe you have chosen will determine which categories you will be searching in your screening process. You’ll be screening mutual funds in each of those categories to find a few good candidates for the respective asset classes in your universe.

It’s good to start screening mutual funds by looking at return and risk independently then in tandem. List them side-by-side: return, risk, risk-to-return. I like to use average return, standard deviation and the Sharpe Ratio, or, if the Sharpe Ratio isn’t available, I use the inverse of the coefficient of variation, i.e. return divided by standard deviation, which is a passable approximation for comparing funds within a category over a period when interest rates were fairly constant. Although one of your objectives is to diversify away specific risk, total risk is a good parameter for comparing funds within a category.

I give the most weight to 10-year data and take a look at the three and five year statistics to see if there appears to be a noticeable trend in risk and return. As I said earlier, funds can and do change over time. If it looks like something is changing, dig deeper to see what you find.

If most or all of your assets are in tax-deferred accounts, you don’t need to pay much attention to yield other than to make sure it’s included in the return. However, if you are screening funds for a taxable account or one of your objectives is to generate income, you’ll want to use yield as one of your screening criteria.

If you’re comparing funds within a category, you shouldn’t need to look at the risk-adjusted return, as the risk-to-return parameter will tell you all you need to know. But you may want to look at it anyway just as a matter of interest or for the purpose of comparing categories.

Together, beta and R-squared provide some insight to the probable degree of correlation between a fund and the general market. They won’t actually tell you the degree of correlation, but they can provide a hint as to whether a particular fund has good diversification potential. If it looks like a fund may have good diversification potential, it may end up being a better addition to your portfolio than some other fund that wins on a the risk-to-return basis.

The next statistics to look at are the expense ratio and turnover rate. Both will take a bite out of your return and turnover will create a tax liability in taxable accounts. The expense ratio is pretty straight forward. Expenses, including 12b-1 fees, are deducted from funds’ assets, thus reducing the funds’ NAV and their rate of return is therefore reduced by the amount of the expense ratio. Published returns should be net of expenses but may not be, so make sure you check and make any necessary adjustments. (See Special Considerations with Load Mutual Funds for computing returns on load funds.)

Trading costs attributable to turnover are deducted from the NAV as they are incurred, so the cost of turnover will be reflected in the NAV. If a fund has a low rate of return relative to its category average and it has a higher than average turnover, trading costs explain at least part of the fund’s underperformance.

The final thing to look at is manager tenure. The longer, the better. If the same person has been managing a fund for 15 or 20 years, then their abilities, good or bad, should be implicit in the fund’s performance and there should be a high level of consistency in the fund’s investing strategy and performance. However, the next question is: What if something happens to the manager?

If a fund’s long-term manager quits, retires, dies, etc. who is going to fill that void? Funds that are co-managed have addressed this issue. Fund managers that have a competent protégé who has been thoroughly indoctrinated have also addressed this issue. Funds that haven’t adequately addressed this issue pose a major risk to investors. Thankfully, those funds are becoming rare.

Some people like to look at Morningstar’s mutual fund star rating when screening mutual funds. I feel that Morningstar puts way too much emphasis on recent performance for this to be of much value. I think you’ll be better off if you base your evaluation on the long-term statistics then check the more recent statistics to see if there are any apparent trends that warrant further investigation.

If the more recent statistics indicate that a fund is not doing as well relative to its peers as it has done in the past, something may have changed. However, it’s entirely possible that the fund is holding a set of assets that is markedly different than its peers and those assets aren’t currently doing well. You’ll find this situation quite often in international stock mutual funds, they don’t all invest in the same countries and therefore have varied short-term performance. So don’t reject a fund just because it’s had couple of bad years; there may be a good reason for its relatively poor short-term performance and it could be poised for a big rebound.

You should do additional research on the likely candidates you find while screening mutual funds to ensure that they’re satisfactory. At a bare minimum, check their prospectuses to see what they are actually invested in and what the fund managers’ strategies are. You may find that the funds’ assets are too heavily weighted in one sector (like a natural resources fund with 75% of its assets invested in the energy sector or a supposedly diversified large-cap fund with 25% invested in the technology sector) or that the strategy doesn’t match the stated style (the fund has suffered style drift). Other things to look for are trends in returns and the variability of returns, i.e. see if a fund’s long-term average return is trending downward or if it’s becoming more volatile. What you find may cause you to reject some candidates, in which case you may need to find substitutes.