Schwab Fundamental Index

Post on: 26 Апрель, 2015 No Comment

New Fundamental Index ETFs: An Alternative Approach to Index Investing

On August 15, Charles Schwab Investment Management (CSIM) launched six new Fundamental Index exchange traded funds (ETFs) to join its existing suite of fundamental index mutual funds. Leveraging the Research Affiliates methodology and tracking Russell Fundamental Indexes . Schwabs new ETFs offer an innovative way to gain broad market exposure while keeping costs low.

Active or Passive? Both.

Very few top-performing actively managed funds stay on top over time, according to an S&P Dow Jones Indices report. However, investors who forgo active strategies entirely may miss opportunities to take advantage of momentum and market inefficiencies.

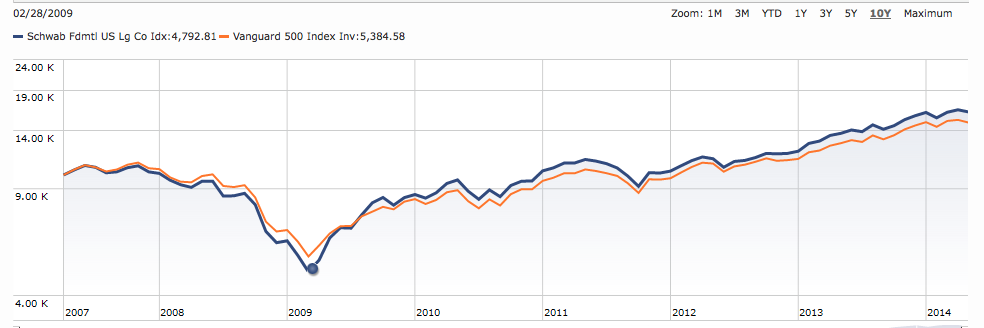

Fundamental index strategies combine the broad-based market exposure of cap-weighted indexing with a transparent, rules-based approach. Research Affiliates three-factor methodology selects and weights securities based on fundamental measures that better reflect a companys true economic footprintadjusted sales, retained operating cash flow, and dividends + buybacks.

The fundamental index methodologywith its potential for higher diversification and lower volatilitycan be a good complement to cap-weighted and active management strategies when building a diversified portfolio.

Cost and Flexibility Lead ETF Growth

The ETF market is growing quickly as advisors and end-investors recognize the benefits of ETF investing. Globally, investors have more than $2 trillion in ETFs, an increase of more than 40% since the end of 2011.

ETFs tend to have lower costs because their portfolio management structure allows for greater tax efficiency and reduces many of the factors that can lead to sizable premiums and discounts. Theyre also more transparent than most mutual funds because ETF managers are required to report their holdings daily. And if you need trading flexibility, ETFs can be traded throughout the day, allowing you to use sophisticated trading strategies, such as limit and stop-loss orders, to pursue your investment goals.

New Fundamental Index ETFs From Schwab ETFs

Backed by the experience of Russell Indexes and Research Affiliates, the six new Schwab Fundamental Index* ETFs are among the lowest-priced of any fundamental index ETFs. They join CSIMs existing suite of traditional cap-weighted ETFs to offer more choices for you and your clients. Our new Fundamental Index ETFs continue our commitment to providing low-cost, quality ETFs you can use as the foundation of a diversified portfolio.

The six new Schwab Fundamental Index ETFs trade commission-free** as part of Schwab ETF OneSource.