Rotational System Fidelity Select Sector Rotation Strategy

Post on: 3 Май, 2015 No Comment

3,048 views

This is the first in a series of tests on rotational systems. Read Part 2.

The bottom line is that my results show that the strategy above loses money. I could not get even close to replicating the results. However, my test suffers from some severe limitations (Im using ETFs instead of the Fidelity Select Funds) which do not allow for exact replication. Ill address the limitations in a bit.

Here is a good link listing the Fidelity Select Funds (FSFs) with descriptions and their benchmarks: Fidelity Select Fund List.

The Rules:

1) Track the 25 day (or 5 week) price change in all of the Fidelity Select Mutual Funds.

2) Invest in the Fidelity Select Fund with the highest percentage gain over that 5 weeks.

3) Hold that Select fund for at least 30 calendar days, to avoid the Fidelity early redemption fees.

4) After 30 days, if that Select Fund is still the top Select fund, continue to hold it. Otherwise, exchange it immediately for the currently top ranked Select fund.

5) Hold the new Select Fund for 30 calendar days.

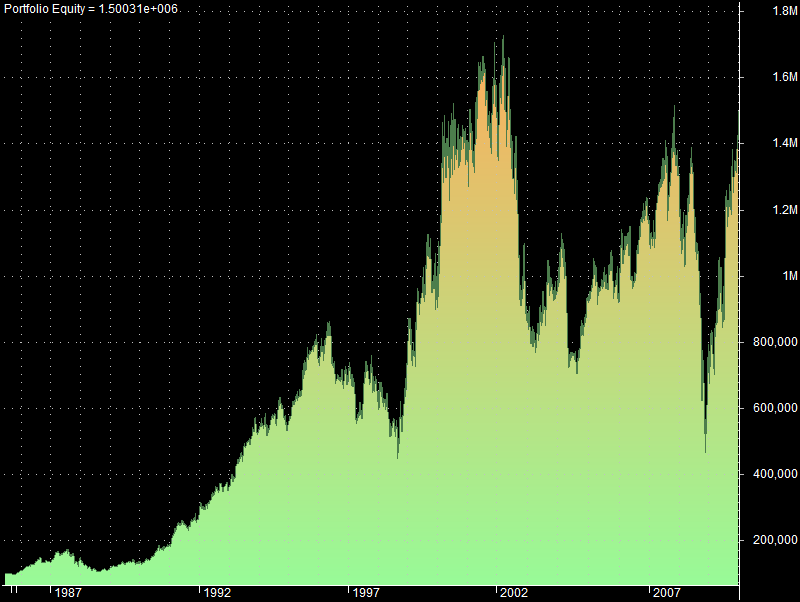

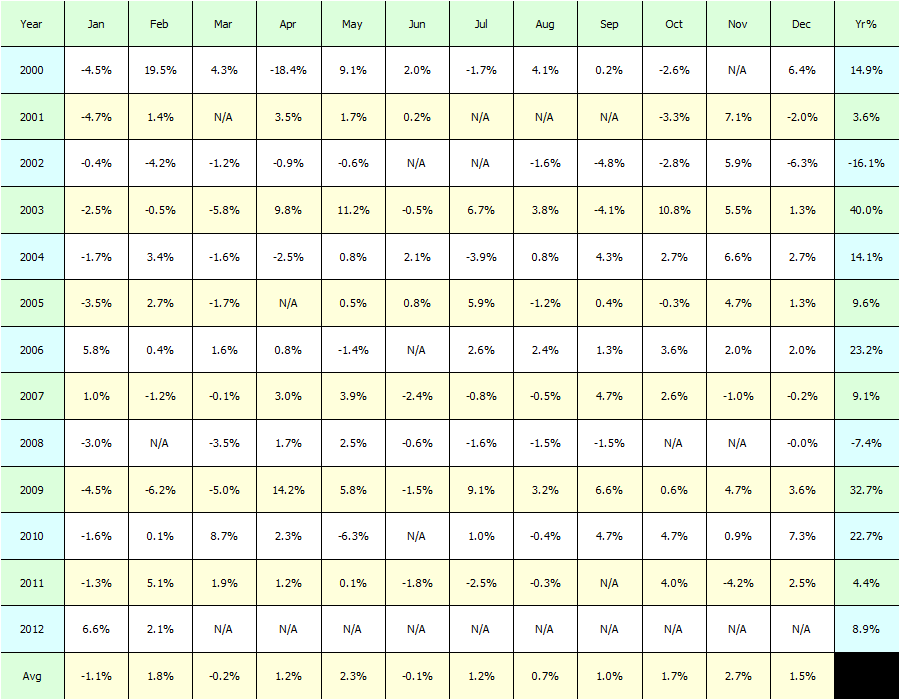

The Results:

Click on the graphs to enlarge

Limitations:

1. Im backtesting over a list of ETFs which was generously constructed by a reader. View the list here: ETF Equivalents for Fidelity Select Funds. Not only is the list not entirely complete, but not every FSF has an ETF that is highly correlated.

2. Some of the FSFs have been around for almost two decades longer than the ETFs.

3. I set the backtest up quickly, and it is not rotating on exactly the open of the 31st calendar day. Instead, it is rotating on the open of the 2nd trading day of every new month.

4. Other limitations which I havent yet discovered.

Whats Next for This System?

I would really like to complete a more accurate test. A quick look at Yahoo data shows that they offer a data history of the FSFs. I should be able to load these up into the ol wayback machine and test over actual FSF data.

Once I get better data, we can attempt some improvements. Ive already discovered one improvement, although it might not work on the actual FSFs.

I would also like to check and see if I can find more correlated ETFs. Im sure thankful for Thomas compiling the list, but I should probably double check for better equivalents, just to be sure.

If you would like an Excel sheet with all the trades, email me: Woodshedder73 over at gmail with the subject line of Rotation Strategy Trades.