Rooting out risk in your bond portfolio

Post on: 30 Март, 2015 No Comment

TFile photo of traders working the floor of the New York Stock Exchange during the final minutes of trading in New York, June 8, 2006.

Analysis & Opinion

CHICAGO (Reuters) — When U.S. Federal Reserve governors start talking about overheating episodes in credit markets, as did Jeremy Stein in a February 7 speech in St. Louis, it is time to prick up your ears.

Stein warned that in an attempt to reach for yield, investors have been taking on ever-greater risks in vehicles like high-yield corporate junk bonds, insurance products and real estate investment trusts. And that means that even though most of the drama in recent weeks has been focused on a bullish stock market — the S&P 500 Index is up nearly 7 percent year-to-date through February 15 — you need to pay even closer attention to bonds.

Of course, yield-hungry bond investors are taking risks because they have been frustrated since 2008, when the Federal Reserve slashed interest rates to practically nothing. The Fed is expected to keep rates low through 2014.

But an economy that is gaining steam can lead to inflation, which is typically the enemy of bond prices. You may need to rework your portfolio now to spread around risk.

The main argument for bond caution, at least as it concerns U.S. Treasury bonds, is what has become known as financial repression. Many critics of the Federal Reserve believe that by keeping rates so low for so long to re-float banks, bond yields are not reflecting what is going on in the larger economy in terms of growing inflation. Yields should be much higher, and perhaps will eventually reflect actual conditions and then depress bond prices.

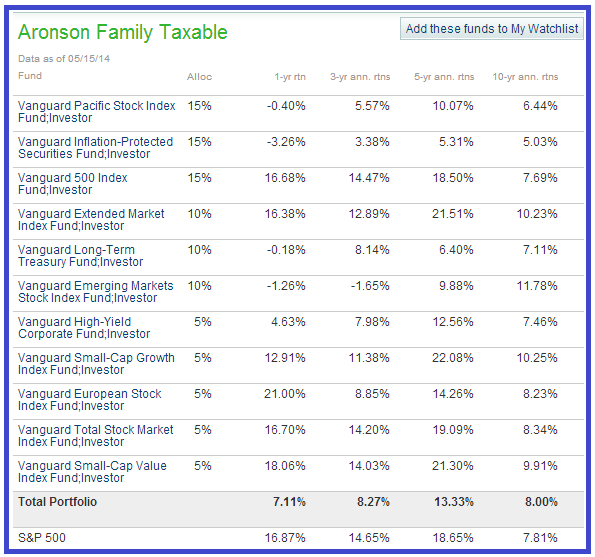

One prominent voice urging caution is Burton Malkiel’s. An emeritus professor at Princeton University, he is now on the investment advisory board of Rebalance IRA, a company that sets up low-cost index fund portfolios for clients. He says simply that he is not a fan of bonds now.

Because of the growing risk in the U.S. bond market, Malkiel surmises that emerging market debt may be less risky than American bonds. He still believes in diversification, however. There’s a necessity to fine-tune your income strategy, he said. Diversify more, even more so than in the past. Investors who can’t stomach volatility should look at their bond portfolios carefully.

What does reworking your bond portfolio mean in practical terms? You will need to see where most of your income portion is concentrated and make some changes. First, identify those vehicles most vulnerable to changes in interest rates. Bond mutual funds or exchange-traded funds that hold securities with mid- to long maturities — five years or more — need your attention first. Then look at some alternatives:

- iShares JP Morgan US Dollar Emerging Markets Bond ETF. The fund tracks an index of emerging-markets bonds. It is currently yielding 4.3 percent.

- iShares Barclays TIPS Bond ETF. Unlike conventional treasury bonds, Treasury inflation-protected U.S. Bonds or TIPS pay a premium yield based on inflation. While the cost of living has been low in recent years — and TIPS returns have been paltry — the fund is yielding 2 percent now.

- SPDR Barclays High Yield Bond ETF. Investing in low-rated corporate junk bonds, this higher-risk fund is yielding almost 7 percent. This fund tracks an index of junk bonds.

- Vanguard High Dividend Yield Index ETF. If you can afford to take more stock-market risk, this index fund invests in high-dividend stocks and offers a 3 percent yield.

- Vanguard Total Bond Market ETF. The index fund invests in a broad swath of the U.S. bond market. Although the yield is under 3 percent, it holds more than 3,000 bonds.

At the very least, if you need income, hold fast to the virtue of diversification. Spread out your holdings by issuer, type, region and country. Always look at a bond or portfolio’s duration, which is how much you can lose if interest rates climb 1 percentage point.

Single bonds, for example, offer you very little diversification and large exposure to credit risk, although little interest-rate risk if you hold them to maturity and they carry the highest ratings.

Those perturbed by low yields should avoid any income products that promise outlandish yields. Unlisted REITs, structured notes and some variable insurance products that are illiquid and highly risky have been promising investors unrealistic returns over the past several years. Avoid them.

A truly diversified income portfolio holds municipals, high- and low-yield corporates, U.S. Treasury, U.S. agency, and non-U.S. bonds. If you cannot achieve this kind of diversification on your own, seek the services of a financial planner, registered investment adviser or chartered financial analyst who can set up or remake your portfolio to buffer it against risk.

(The author is a Reuters columnist and the opinions expressed are his own. For more from John Wasik see link.reuters.com/syk97s )