Risk and Return in Mutual Fund Selection

Post on: 14 Апрель, 2015 No Comment

EXECUTIVE SUMMARY

- INVESTORS—AND THE CPAs WHO ADVISE them—need objective criteria so they can understand the risks inherent in mutual fund investing. Understanding the fundamental relationship between risk and return will make it easier for CPAs to provide their clients with responsible and informed investment recommendations.

ROBERT A. CLARFELD, CPA/PFS, CFP. is president of Clarfeld & Company, P.C. a New York City CPA financial planning firm. He is chairman of the American Institute of CPAs personal financial planning executive committee investment services task force.

PHYLLIS BERNSTEIN, CPA. is director of the AICPA PFP division. The authors gratefully acknowledge the assistance of Lawrence Busch of Clarfeld & Company in writing this article. Ms. Bernstein is an employee of the American Institute of CPAs and her views, as expressed in this article, do not necessarily represent the views of the AICPA. Official positions are determined through certain specific committee procedures, due process and deliberation.

The mutual funds mentioned in this article are for illustration purposes only and in no way imply a recommendation or endorsement by the authors, the AICPA or the Journal of Accountancy.

M utual fund investors still get only half the story. The focus—in both the financial press and in advertisements—is on investment return, often precisely quantified by historical returns over several time intervals, with any mention of the funds relative risk relegated to imprecise generalities.

Investors—and the CPAs who advise them—need objective criteria concisely communicated to enable them to understand the risks that accompany these returns so they can make rational mutual fund selections. Unfortunately, the financial press often treats mutual fund investors as though they are incapable of understanding basic risk statistics and the fundamental relationship between risk and return that should drive all investment decisions.

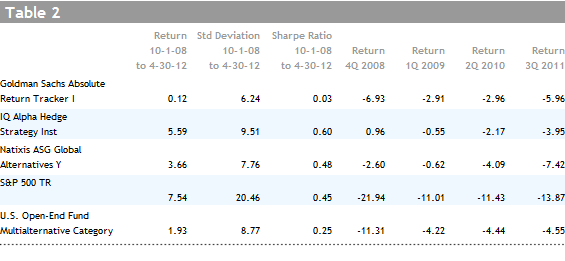

The mutual fund universe often is divided into two distinct camps—winners and losers—based solely on performance. The same publication that praises a fund manager for outperforming a bull market will criticize the manager for exceeding market losses in a downturn, even though this is a logical expectation based on the funds aggressive investment style and high-risk profile. Furthermore, the aggressive manager may be investing toward a very different benchmark, say, the Russell growth index rather than the Standard & Poors 500. (See the sidebar ) This type of reporting often comes at an inappropriate point in the investment cycle—promoting high-risk funds at the peak of a bull market, when it is too late for investors to benefit, and defensive funds after the market already has declined.

Mutual fund lists featuring funds to consider for the next millennium or the 17 greatest funds in the history of the universe appear frequently in the media and make interesting reading. But, over time, such lists have not proven to be particularly insightful. Funds with records of steady gains and favorable risk—reward characteristics usually are better choices for long-term investors. This may be apparent following a deep market correction but difficult to fathom during rising markets, a time when many of these same funds are labeled laggards. Reducing mutual fund selection to simplistic levels presumes an ignorant investing public, which does little to promote successful investing.

This article is designed to help CPAs interpret the various statistical measures of risk as they apply to mutual funds so they will be in a better position to advise their clients on this often complex aspect of stock and bond investing. Knowing how to interpret this information correctly will make it easier for CPAs to make responsible and informed investment recommendations to their clients.

UNDERSTANDING RISK

Many investors believe the United States is in a period of great uncertainty in its investment markets. This is a conclusion that applies during all market conditions—except in hindsight. The risk an investor takes is what provides the opportunity for higher returns. Recognizing this makes it clear that more emphasis should be placed on risk analysis when CPAs and their clients make investment decisions. Risk analysis is central to mutual fund research. Focusing on the long-term relationship between risk and return will enable CPAs to establish realistic expectations as to expected performance under various market conditions.