Review of MarketIndexed CDs

Post on: 31 Май, 2015 No Comment

POSTED ON SATURDAY, AUGUST 1, 2009 BY Ken Tumin

The Wall Street Journal has an article today that looks into market-indexed CDs. Here’s how the article describes what a market index CD is:

Unlike traditional certificates of deposit, which earn a preset interest rate for a specific term, an indexed CD is linked to one or more financial indexes, such as the Standard & Poor’s 500. If the market index to which your CD is tied rises in value, you capture at least a portion of that return. If the index falls, you still get your original deposit back. That deposit is also protected by the Federal Deposit Insurance Corp. up to standard limits.

Update 8/01/09: There’s a useful post at WSJ’s The Wallet blog at How To Shop for Market-Indexed CDs .

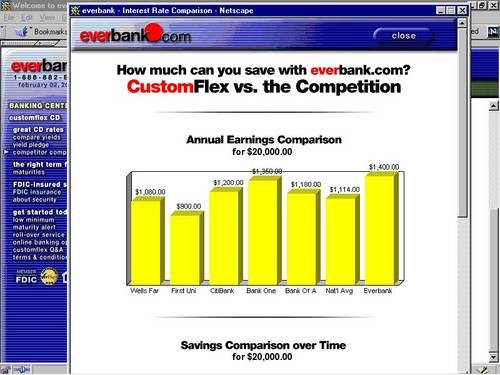

I’ve covered these CDs a few times during the last four years. My last post was in March when Compass Bank was offering this type of CD. I’m not sure if they’re still offering it. EverBank has long offered several types of market-indexed CDs; however, its current MarketSafe CD is linked to foreign currencies instead of a stock market index. In the past EverBank’s MarketSafe CDs were linked to the S&P 500 index.

As the WSJ describes, there are many potential downsides to market-indexed CDs. Some potential downsides as compared to stock mutual funds and/or regular CDs include (not all are mentioned in the WSJ article):

- limits your upside compared to the market

- substantial cost for early withdrawals (such as selling at a loss in the secondary market, a surrender charge or early-withdrawal penalty)

- taxed as income not as capital gains (and the tax may be more than expected)

- stock dividends not usually included in returns

- tend to be very complex

Some of the above downsides are from other sources including this CNN article .

In my March post I described how one could build his own stock market CD by putting a portion of money into a regular 5-year CD and a portion into a stock mutual fund. Also in that post, readers provided some important potential issues to consider. Here is one comment from Andy:

If you consider an equity index CD, be sure and get really good details about how your interest is reported to the IRS each year. Some of these instruments have bad rules regarding this. I’ve seen some that report the 1099-INT as if you owned the STOCK for the year. You could find yourself paying a lot of income tax with no access to your money. It could be a very ‘Anti-Roth’ type investment.

Also, I’d triple check FDIC insurance charters if you buy one of these. Don’t assume the bank you buy this from is the charter your insurance is under. These are often sold under the investment wings of banks and could be insured by another charter. Of course this is no problem unless you’d go over a limit.

Here’s another potential downside described in the comments by OC Steve:

Another issue that I can remember from some years ago is. if. the bank fails, and the time period to determine the index change has not lapsed, the FDIC considers NO interest has been earned. This is the worst case I think with these type of index related CD’s

If you have experience with these types of CDs or if you know of banks or credit unions offering these, please leave a comment.

Thanks to the reader Tuphat who mentioned this WSJ article in the Daily News & Deals Post .

Edit 8/01/09: Updates made to take into account critiques from the comments.