Revenue Sharing And Investment Policy Statements What Is A Fiduciary To Do –

Post on: 1 Июль, 2015 No Comment

June 6, 2012

Previously published on May 21, 2012

Tussey v. ABB, Inc. . No. 2:06-CV-04305, 2010 U.S. Dist. LEXIS 45240 (W.D. Mo. Mar. 31, 2012)

The Tussey decision provides an 81-page discussion of how a retirement committee should conduct its fiduciary business. It scrutinizes some conduct it found shoddy. It also supports many common practices. The case involved two 401(k) profit sharing plans of ABB, Inc. exceeding $1.4 billion in assets and more than 17,000 participants. The fiduciary retirement committee of ABB selected the investment funds and administrative platform. The law firm representing the Tussey plaintiffs is pursuing similar suits against several other very large plans, so there may be more to come.

These are the highlights:

Revenue Sharing: The court upheld the use of revenue sharing to pay administrative fees. However, the third-party administrator (TPA) retained all revenue sharing and the committee didnt know how much the plan was paying for services. This resulted in the plan paying above the market for TPA services.

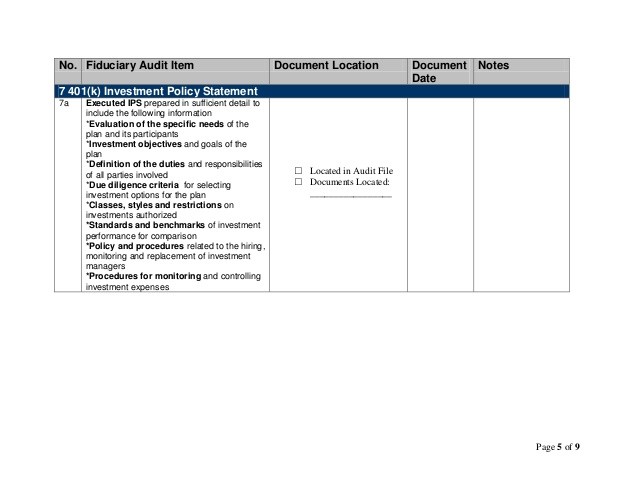

Investment Policy Statement: The committees detailed investment policy statement, or IPS, did more harm than good. Failure to follow detailed requirements of the IPS resulted in several fiduciary breaches.

Investment Advisor: The committee did not have an independent investment advisor but looked primarily to the TPA for information. A consultant was hired for a benchmark study but its recommendations were ignored. The committee did not know when the TPA was negotiating its own business interests and when it was wearing its fiduciary hat.

Committee Members Personally Liable: $35 million of the damages awarded to the plaintiffs is the personal liability of the members of the committee.

What Happened?

The ABB plan was managed through a typical bundled services arrangement. The TPA was Fidelity Trust. Mutual funds were provided through its affiliate Fidelity Investments. Fidelity collected revenue sharing from the mutual funds, including 12b-1 fees, and some per-participant fees. Fidelity also provided payroll, SERP administration and other corporate services to ABB.

The committee did not seem to compare the expense ratios or revenue sharing in making investment fund selections, other than to ensure that there was sufficient revenue sharing to avoid per-participant charges and billings to ABB. When the committee decided to eliminate a large Fidelity proprietary fund from the platform, Fidelity responded by imposing a per-participant charge to make up the lost revenue sharing. To avoid this charge, the committee decided to replace its balanced portfolio fund — the Vanguard Wellington Fund — with the Fidelity Freedom Funds, i.e.. Fidelitys target date funds. The Freedom Funds provided much more revenue sharing to Fidelity than the Vanguard fund they replaced.

The most serious issue seems to be the failure to follow several policies in the IPS. The IPS required the committee to prefer funds with lower expense ratios and use revenue sharing to offset vendor fees paid by the plan. The court ruled that ERISA does not require a fiduciary to find the funds with the lowest expense ratios. But a fiduciary cannot ignore such a requirement in its IPS. In addition, a fiduciary has to know how much it is paying to service providers and if the costs are competitive. The committee never attempted to leverage the plans substantial size to negotiate a better deal for participants.

The IPS also stated that an investment fund could be replaced after it under-performed the market over a long period. A detailed process was required to find a replacement fund. The court ruled that replacing the Vanguard Wellington Fund, which was performing well, violated the policy and was a fiduciary breach. The IPS said the Wellington Fund could only be replaced if it was not underperforming. In addition, the process to select the Fidelity funds did not track the detailed IPS procedures. The court also found that replacing the Vanguard fund with Fidelity funds was done to subsidize the costs that ABB was paying Fidelity for its corporate services.

Fidelity Trust was also found liable as a fiduciary for retaining $1.7 million in float interest that it retained through fund transfers held in an overnight account. The float was deemed an asset of the plan and Fidelity could not retain the money in the absence of a fee agreement for necessary services.

What A Fiduciary Should Do Now

This is perhaps the first court decision to apply such a large award — over $37 million — to routine fiduciary committee conduct. It illustrates that there is no simple, turn-key approach to sloughing off ERISA liability. Going forward, fiduciaries should:

Consider revising your investment policy statement to eliminate detailed procedures that have hard-wired triggers. ERISA does not require an IPS for a defined contribution plan, so fiduciaries have flexibility to draft a document that outlines general investment prudence.

Understand the revenue sharing and fees paid by the plan and what services are received in return. Hopefully, this will improve with the advent of fee reporting under section 408(b)(2) of ERISA.

Hire an independent investment advisor who specializes in the retirement plan market. Few fiduciaries have the time and extensive training needed to stay abreast of a complex and evolving market.

Periodically benchmark expenses. This does not require a full scale RFP. Fiduciaries should know how their plan compares to the marketplace. A good investment advisor can provide the benchmarking information.

Make sure you have specific ERISA indemnification from your employer through an indemnity agreement or board action. Your employer is not automatically obligated to pick up the tab. ERISA fiduciary insurance is also available, often as a rider to a policy covering directors and officers or errors and omissions.