Retirement Savings How Much Is Enough

Post on: 5 Апрель, 2015 No Comment

Ten percent is the historical recommended savings rate. Is this simple rule of thumb an accurate metric for a financial advisors ’ clients?

First, take a look at the savings landscape today. You may be surprised that the actual, reported savings rate is well below the 10% rule of thumb.

There is an extreme mismatch between the U.S. savings rate and the optimal savings rate. According to the St. Louis Federal Reserve Bank, today’s savings rate is less than 5%. Other reports list the U.S. consumer savings rate below the 5% level.

5% Retirement Savings Rate

How would a retiree fare if she saved 5% of her earnings during her working life?

Let’s assume that Beth, a 30-year-old client makes $40,000 per year and expects 3.8% raises until retirement at age 67. Further, with a diversified portfolio of stock and bond mutual funds, Beth expects a return of 6% annually on her retirement contributions.

With a % savings rate throughout her working life, Beth will have $423,754 saved up (in 2051 dollars) at age 67. If Beth needs 85% of her pre-retirement income to live on and also receives Social Security, then her 5% retirement savings are significantly short of the mark. (For more, see: Retired or Near-Retirement? Check Out These Multi-Asset Income ETFs .)

To match 85% of her pre-retirement income in retirement. Beth needs $1.3 million at age 67. So, a 5% savings rate doesn’t even place Beth’s savings at 50% of her expected retirement funds.

Clearly, a 5% retirement savings rate isn’t enough.

So how much does the saver need to sock away in order to enjoy a comfortable retirement? You’ll find various calculators out there, but here’s what to expect.

Savings Rate: What’s Enough?

If the advisor keeps the assumptions constant, then a 10% savings rate yields Beth $847,528 (in 2051 dollar) at age 67. Her projected needs remain the same at $1.3 million. So even at a 10% savings rate, Beth misses her preferred savings amount. (For more, see: How to Save More for Your Retirement .)

If Beth pumps up her savings rate to 15%, then she reaches the $1.3 million (2051) amount and along with anticipated Social Security, her retirement will be funded.

Does this mean that the individual who doesn’t save 15% of their income will be doomed to a sub-standard retirement?

Not necessarily.

Conservative Assumptions

As with any future projection scenario, we’ve made certain conservative assumptions. Investment returns might be higher than 6% annually. Beth might live in a low cost of living area where housing, taxes, and living expenses are below the U.S. averages. She might need less than 85% of her pre-retirement income, or she may choose to work until age 70. In a rosy case, Beth’s salary might grow faster than 3.8% annually. All of these optimistic possibilities would net a greater retirement fund and lower living expenses while in retirement. Consequently, in a best case scenario, Beth could save less than 15% and have a sufficient nest egg for retirement. (For more, see: Retirement Planning: How Much Will I Need? )

What if the initial assumptions are too optimistic? A more pessimistic scenario includes the possibility that Social Security payments might be compromised. Or Beth may not continue on the same financial trajectory as the advisor assumes. In contrast with the former caveats, Beth might live in Chicago, Los Angeles, New York, or another high cost of living region. With the gloomier hypotheses, even the 15% savings rate might be insufficient for a comfortable retirement.

No one knows the future or what savings rate is enough. Nor do we know our eventual investment returns. Fortunately, the saver can control how much he or she saves. The advisor can help the client by explaining how returns compound and the importance of starting to save earlier, rather than later. There’s no disputing the fact that starting to save earlier and saving as large an amount as possible will pay off in the long run. (For more, see: The Income Property: Your Late-In-Life Retirement Plan .)

If you’re looking for the number or the target retirement nest egg figure, there are guidelines. Advisors may recommend saving 12 times your annual salary. Using this rule of thumb, a 66 year old $100,000 earner would need $1.2 million at retirement. But, as the former examples suggest and as long as the future is unknowable, there is no perfect retirement savings percentage.

The Bottom Line

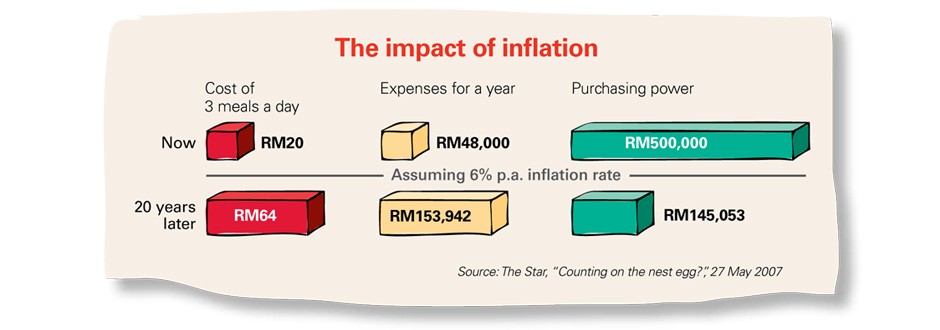

When considering saving for retirement, the client needs to understand the impact of several retirement savings concepts. Starting to save earlier gives the client’s money more time to compound. Where she retires has a major impact on how much money she needs in retirement. Future unknowns such as inflation, Social Security, and salary trajectory recommend conservative estimates. Be careful when predicting future investment portfolio returns of 8% or 9% as they may be unrealistic. These types of projections are above historical norms for a balanced stock and bond mutual fund portfolio. Finally, it’s helpful to explain retirement savings as a method to take the client’s income during the earning years and spread the money across his or her lifespan. (For more, see: Will Your Retirement Income Be Enough? )