Retirement Savers Should Benefit From Declining TargetDate Fund Fees

Post on: 16 Март, 2015 No Comment

NEW YORK ( TheStreet ) — Many target-date funds have been slashing fees.

Allianz Global Investors recently reduced its expenses from 0.91% to 0.64%, while Nationwide (NFS ) cut costs from 0.64% to 0.42%.

Companies such as Fidelity Investments and TIAA-CREF have introduced index funds with expense ratios less than 0.50%. The average expense ratio of the target funds is 0.72%, according to BrightScope.

The reductions are important for retirement savers because the target funds are staples in many 401(k) and IRA accounts.

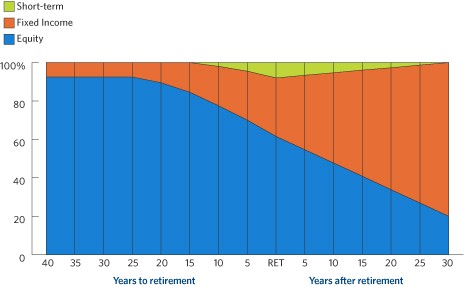

Target-date funds are designed for people who will retire around a certain year, such as 2020 or 2040. These funds, which have diversified portfolios of stocks and bonds, have been embraced by employers seeking convenient choices for 401(k) plans. At many companies, target-date funds are now default choices; if employees take no action, money is automatically withdrawn from their paychecks and deposited into target funds.

In recent years, money has flowed into target funds, which now have $431 billion in assets, according to Ibbotson Associates.

As more participants have invested in target funds, employers have become increasingly concerned about maintaining low fees.

The emphasis on fees is likely to increase because of new 401(k) disclosure rules. Starting this fall, employees will receive written statements in the mail detailing the costs of the plans.

The statements could be an eye-opener for many plan participants, says Eddie Alfred, BrightScope’s vice president of data and research.

A lot of people don’t think they pay any fees at all for their 401(k)s, he says. It could be a rude awakening when they suddenly see that they are paying 1% or 1.5% of plan assets in fees.

Average expense ratios could fall sharply in coming years because companies are introducing target funds that invest in low-cost index mutual funds and exchange-traded funds. New entrants include BlackRock Lifepath Index Portfolios and Lincoln Advisors Presidential Protected Profile Funds.

Index funds track benchmarks such as the S&P 500. Because they make no effort to outdo the markets, index funds can come with low costs. In contrast, actively managed funds must charge more to support analysts and portfolio manager who seek to outdo benchmarks.