Retirement Income Mutual Funds How to Find the Best

Post on: 21 Июнь, 2015 No Comment

Definition and Examples of Best Income Mutual Funds

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Definition: Retirement income mutual fund portfolios usually consist of a mix of stocks, bonds, and cash and are most appropriate for those investors already in or entering retirement. The objective of these portfolios is typically one of conservative asset allocation. These portfolios aim to provide investors with steady income throughout retirement.

How to Find the Best Retirement Income Mutual Funds

In general the best retirement income funds have a fundamental objective that balances preservation of assets, income, and growth, prioritized in that order. For example, the highest priority is to achieve positive returns (above zero percent); the second priority is to achieve returns at or above inflation; and the lowest priority, which is not really a goal, is to grow the assets. This is because growth significantly above the rate of inflation would require too much exposure to market risk. which increases the odds of loss of principal.

In simple terms, you want to look for retirement income funds that have average annualized returns of 3.00% to 4.00%. Also be sure to focus more on the 5-year and 10-year returns for the fund and give less attention to short-term performance .

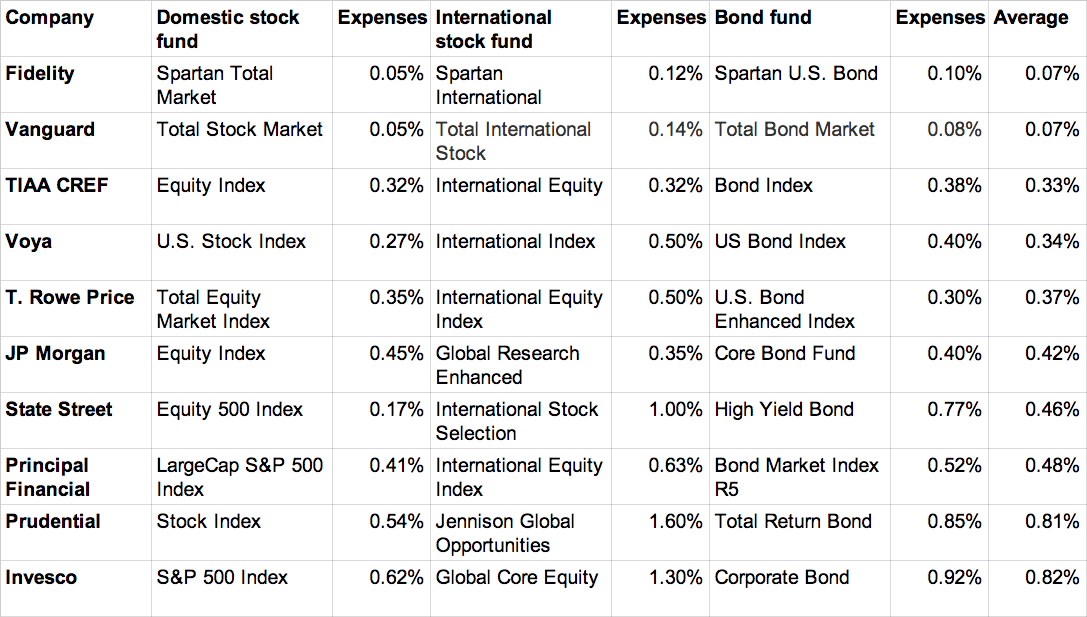

You also want to look for the best no-load funds with low expense ratios. You need to keep every penny possible for your retirement income!

Best Retirement Income Fund Examples

To perform my search for the best retirement income funds, I used Morningstar ‘s Principia Pro software, but you can use any of the best sites to research mutual funds .

Including all share class types. I found more than 300 retirement income funds. To narrow my search, I excluded all front-load and back-load funds, all funds with 12b-1 fees and all funds with expense ratios above 0.50%. This narrowed the selection down to just 15 mutual funds. Of those funds, I selected one with a moderate asset allocation and one with a conservative allocation:

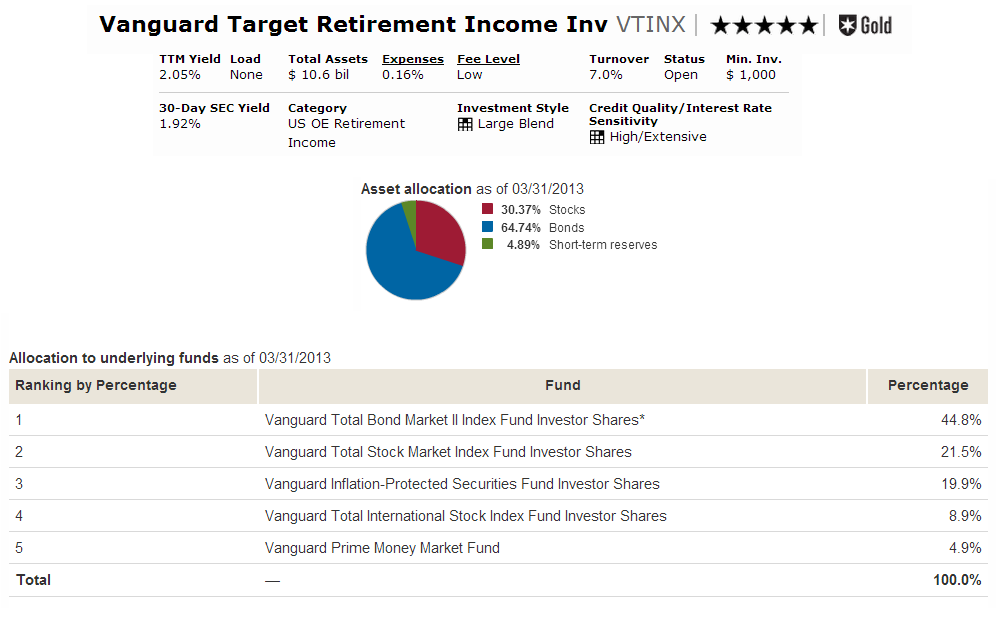

This is one of three mutual funds that Vanguard calls their Payout Funds, which are intended to supplement an investor’s retirement income by paying different levels of monthly distributions (or ‘payouts’).

Although VPDFX has a moderate-risk allocation (approximately 70% stocks / 30% bonds, cash and other, according to Morningstar), it does have the most conservative asset allocation and the highest monthly payout rate of the three Vanguard payout funds. The fund’s primary objective is to balance preservation of principal with income that is appropriate for retirement. The moderate allocation may be a bit of a bumpy ride, in terms of volatility. for some investors but its performance record (averaging 4.31% annualized return for 5-year period as of June 30, 2013) and a diversified mix of Vanguard index funds is likely to attract many retirees already inclined to use Vanguard and/or index funds.

This fund is more conservative than the Vanguard Managed Payout Fund with a portfolio of underlying Fidelity mutual funds that, according to Fidelity, seeks to maintain a stable asset allocation strategy of approximately 14.6% in domestic equity funds, 5.4% in international equity funds, 35% in investment-grade fixed-income funds, 5% in high yield fixed-income funds, and 40% in short-term funds.

FFFAX is one of the oldest retirement income funds and boasts an impressive 15-year average annualized return of 4.33%, as of June 30, 2013. There have no doubt been short-term periods of declines in value but this performance was accomplished during a time frame that includes two of the worst recessions in history.

Of course past performance is no guarantee of future results but when you can reduce or eliminate drags on performance, such as loads, fees, and high expenses, you can at least give your retirement income a greater chance of lasting longer than you.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.