Residual Income (RI) Formula

Post on: 16 Март, 2015 No Comment

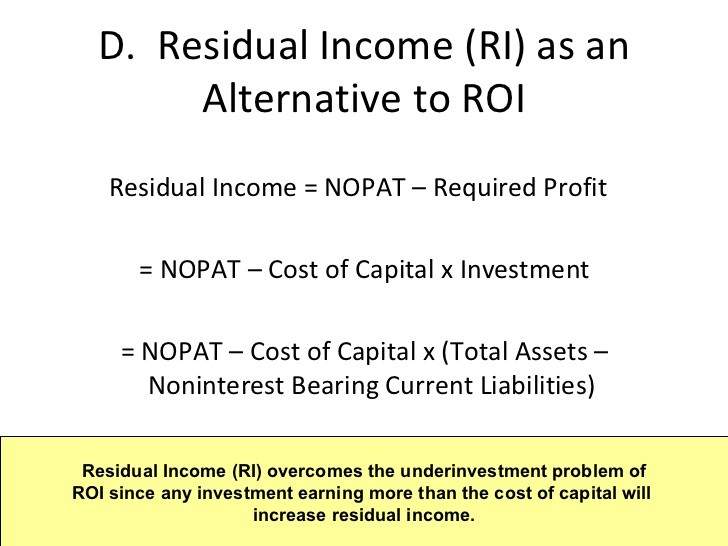

In the context of management accounting, residual income is a metric used to measure performance of a department. It measures the return earned by the department which is in excess of the minimum required return.

Formula

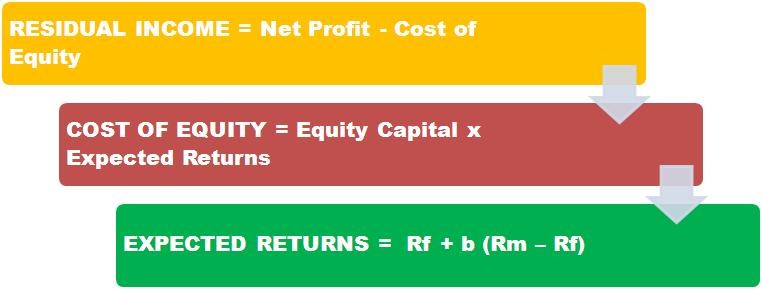

Residual Income (RI) = A (B C)

In the above formula,

A = Department’s net operating income;

B = Minimum required return on assets; and

C = Average operating assets of the department

Department’s net operating income is the department’s revenue minus all expenses for which the department manager is responsible.

The minimum required return on assets is the opportunity cost of the funds for the company which means it is the percentage return which the company expects to earn on alternate projects.

Average operating assets of the department represent the asset base of the department.

The main advantage of the residual income metric is that it measures excess return earned by a department in absolute terms. A positive residual income means that the department has met the minimum return requirement while a negative residual income means that the department has failed to meet it. Return on investment (ROI) is another metric which measures return in relative terms.

Example

CP Inc. is a company engaged in production and distribution of computers and printers. It has two main operating departments: department C specializes in design, production and marketing of computers and Department P deals in printers.

Department C has earned net operating profit of $300 million for the FY 2011 while department P has earned operating profit of $130 million for the same period. Department C had opening operating assets of $1 billion and its closing operating assets are $1.1 billion while department P had opening operating assets of $0.5 billion while its closing operating assets are $0.7 million.

The company’s weighted average cost of capital is 12% and it can use all the assets on a new project that earns a return of 15%.

Solution

Since the company can earn 15% on alternate projects, it is treated as the minimum required return.

Department C’s average operating assets are $1.05 billion on which the minimum required return is $157.5 million. Its residual income is hence $142.5 million ($300 million minus $157.5 million).

Department P’s average operating assets are $0.6 billion on which the minimum required return is $90 million. Its residual income is hence $40 million ($130 million minus $90 million).

Department C has earned $142.5 million residual income as compared to $40 million earned by department P. Residual income allows us to compare the dollar amount of residual income earned by different departments. Since the residual income in both cases is positive, we conclude that both have met the minimum return requirements. However, with residual income is not easy to compare performance.

Return on investment (ROI) calculates total return in percentage terms and is a better measure of relative performance. In this example, department C has a return on investment (ROI) of 28.6% ($300 million/$1,050 million) while department P has return on investment (ROI) of 18.6% ($130 million/$700 million).