Renewable energy might revive charities portfolios

Post on: 16 Март, 2015 No Comment

25 March 2014 by John Hildebrand, Be the First to Comment

The UK has made a commitment to increase the proportion of energy it uses from renewable sources — so could wind farms and solar plantations offer an attractive investment option?

John Hildebrand says investing in renewable energy could help charities gain exposure to infrastructure funds

For several years charities have been investors in the infrastructure sector. They have invested in this area for the attractive income streams it produces and the strong provenance of those streams (because, ultimately, government has to provide these services). Some might also have viewed this as a way of supporting the fabric of society, such as its courts, schools and hospitals.

Hence the investments have been attractive not just to charities but also to a range of clients, including pension funds. These investments have served charities well, but their strong performance means that many of them are no longer cheap. This makes it difficult to add to holdings in this area.

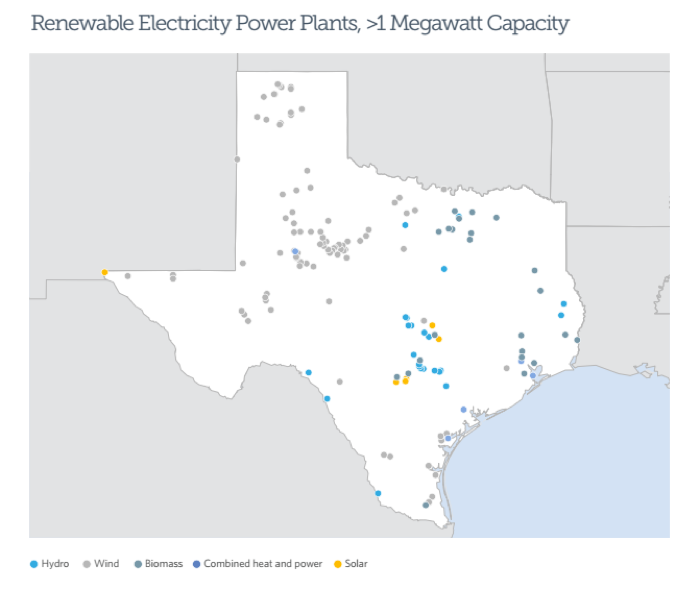

This leaves a gap that is now being filled by a raft of funds that generate their income through renewable energy. They are also based on what they think is a safe flow of income that rises in line with inflation. However, the money is being invested in solar plantations and wind farms — a relatively new area of investment and one where income flow depends to an extent on the price of energy, in that a 40 per cent fall in the wholesale price of energy could lead to them having to cut their dividends. This means one needs to understand them fully and form one’s own view on their attractions and weaknesses.

The UK has made a commitment to raise the proportion of energy it uses that comes from renewable energy from 5 per cent to 15 per cent by 2020. The energy suppliers are required to achieve this — they have to produce renewable obligation certificates and, in order to do this, they are entering into power purchase agreements with the owners of wind farms and solar plantations. They agree to take their energy and they guarantee a minimum price for it. In addition, if the energy price rises — as it well could once coal power plants come to the end of their lives — the producers benefit. So these vehicles are a slightly geared play on the energy generation market.

For several years charities have been investors in the infrastructure sector. In theory, the utilities could develop these new energy sources themselves, but they could not take on the levels of debt necessary to finance them — hence the need for others to supply the capital and their willingness to take their output and resell it to their consumers.

Uncertainty about prices

On the negative side, the current government and the opposition have both indicated that they do not want electricity prices for the consumer to increase. The government might overestimate its ability to stop this happening, but this does add some uncertainty to future energy prices. And although more efficient panels would help the existing solar plantations, there is always the danger that other fields can be set up at a lower cost. However, most agreements are for several years, so companies should be able to improve their fields and remain competitive; consequently, improved technology is as likely to be a benefit as a hindrance to these investments.

Overall, charities should stick to the basic rules of investing. If other institutions are investing in these new areas, they should consider them as well. The fact that they might be of benefit to all of us in the long term is an added bonus, but should not be the main driver of the investment. As with many investments, charities might wish to see how they settle down before investing, but renewable energy infrastructure funds could end up being a cheaper way of gaining exposure to infrastructure funds.