Real Estate investment portfolio

Post on: 11 Апрель, 2015 No Comment

Any ethical professional will insist that the first rule of investing is to diversify your portfolio. Generally no more than 30% of available investment funds should be allocated to any one category. Stocks, bonds and other savings instruments usually form one leg of a many pronged platform. Direct commodity investing is a highly risky venture, usually safe only for the savvy investor who has time to closely monitor the market. Options, commodity oriented mutual funds and other indirect investments are less risky, but still far from wise for the average person.

So what else is there? For many, real estate investment is an essential part of a well-rounded portfolio.

If you want to include paper in your investment scheme, real estate offers several opportunities. REITs (Real Estate Investment Trusts), options, property oriented mutual funds. and other mortgage backed securities are available in a dizzying array.

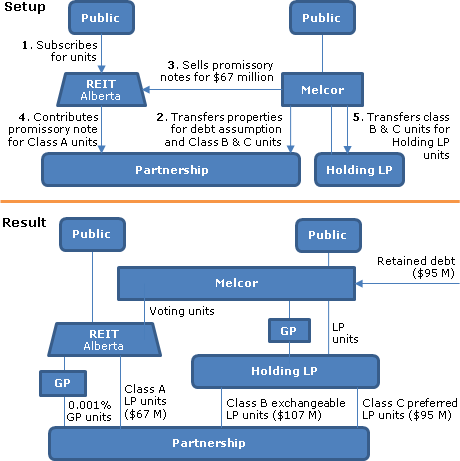

REITs are entities that invest in real estate related assets. such as shopping centers, office buildings, hotels, and mortgages secured by real estate. REITs fall into one of three categories. Equity REITs, which invest in or own real estate and make money for investors from the rents they collect. Mortgage REITs which lend money to owners and developers or invest in financial instruments secured by mortgages on real estate and Hybrid REITs which are a combination of the two. To qualify, a company has to pay 90% of its taxable income to shareholders every year and invest at least 75% of its assets in real estate and generate 75% or more of its gross income from investments in or mortgages on real property.

Options are an alternative form of offer. A potential buyer offers a sum, an option consideration, in order to effectively take a property off the market for a period of time. Option offers generally run anywhere from a few hundred to a few thousand dollars, but higher or lower amounts are possible. Some options bind one party only, some are called bilateral, requiring each to adhere to contractually specified conditions. Conditions involve contingencies around inspections, financing, and always have a time limit.

Every deal is a little different and, of course, if the option isn’t exercised by the specified time limit, the optionee — the potential buyer — forfeits the money. Risky, but potentially rewarding, since you’ve effectively eliminated alternative bidders. One advantage to the optioner is the time to find a buyer for the property itself, then selling the option. This eliminates the need to pay for transactions costs, keeps debt low, etc. Do your homework, first.

To fill out the other part of your portfolio, nothing beats the real in real estate. Historically, buying and selling real property. or even long-term owning, has proven one of the most profitable, least risky investments available. Observe carefully the words least risky. That doesn’t mean zero risk — there’s no such thing in investing. Prices can always go up or down, relative to other goods and investment channels.

Be willing to get educated about the market and the law. Make purchases while minimizing costs like agent fees, repairs, interest rates, etc. Have sufficient cash and other liquid assets to be able to hold until the time to sell is right. Follow these guidelines and you’ll never have any reason to regret making real estate investing a major portion of your portfolio.